1.At a Glance

If Bollywood had a Marvel-style multiverse, Prime Focus Ltd (PFL) would be the studio behind the CGI explosions, perfectly timed slow-motion rain shots, and the 2.4 million minutes of subtitles telling youexactlywhat you already guessed. It’s a global post-production giant – running Oscar-winning VFX through its DNEG brand – yet somehow its financial plotlines include enough twists to rival a Christopher Nolan script. The company is now juggling Hollywood glory, Abu Dhabi expansion, AI content dreams, and the small matter of ₹4,800+ crore in borrowings.

2.Introduction

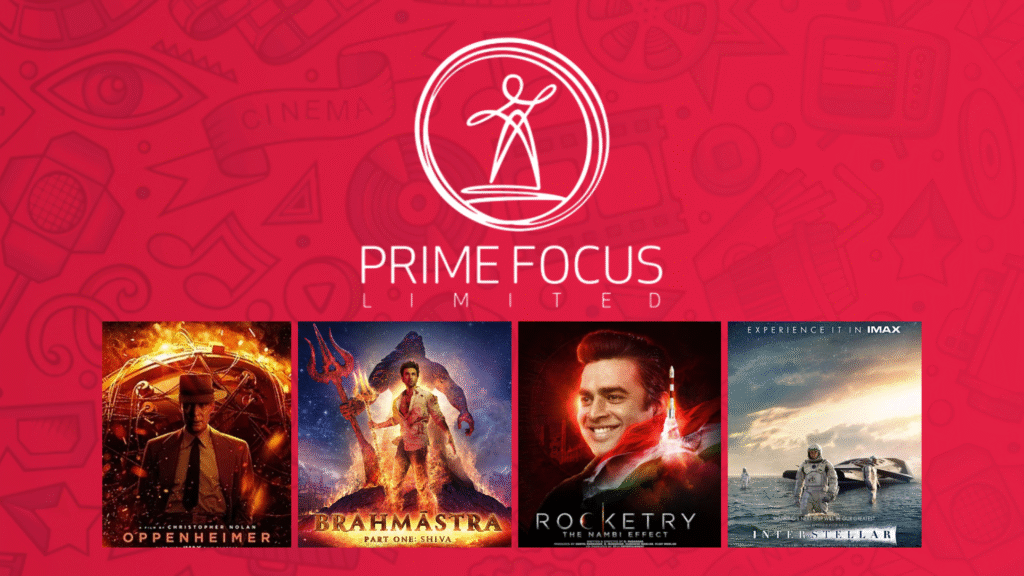

Picture this: a Mumbai-born post-production shop in 1997, started by Namit Malhotra, now with studios from London to LA, Toronto to Sydney, and even Barcelona for those art-house European vibes. Prime Focus has evolved into an entertainment-tech beast, mixing creative wizardry (VFX, 3D conversion, color grading) with tech-enabled media automation (subtitling, dubbing, digital delivery).

Through its DNEG arm, PFL has handled visual effects forOppenheimer,Dune: Part Two(Oscar for Best VFX 2025),The Last of Us, and more popcorn-scented blockbusters than you can count. In India, it’s touched nearly every big-ticket release fromFightertoGadar 2, meaning if you’ve cried, laughed, or facepalmed in a theatre, there’s a chance Prime Focus was involved.

But it’s not all red carpets and golden statuettes. FY24 margins took a nosedive to 6% thanks to Hollywood strikes, before bouncing back to 17% in 9MFY25. Debt remains the supporting villain, and a ₹4,000 crore rights issue is the sequel nobody really asked for but everyone knew was coming.

3.Business Model (WTF Do They Even Do?)

Think of PFL as thebackend of your movie-watching life:

- Creative Services (90% of FY24 revenue):High-end VFX, stereo 3D, animation, editing, grading, equipment rentals. TheDNEGbrand is their crown jewel – winner of 7 Academy Awards for VFX.

- Tech-Enabled Services (10%):Through Prime Focus Technologies (PFT) – now tucked under DNEG – they run the CLEAR® platform for content workflow automation, AI-based compliance, mastering, and delivery to OTTs and broadcasters.

Global

Delivery Machine:

- India hubs: Mumbai HQ + 11 more cities.

- Global: 10 international locations from LA to London to Singapore.

- Client list includes Disney, Marvel, Netflix, Warner Bros, Sony, ICC, BCCI.

Content Output FY24:

- 2.4M+ minutes subtitled.

- 15,000+ hours dubbed.

- 20,000+ assets delivered to 300+ brands.

Basically, they run an industrial-scale creative sausage factory where the raw meat is footage and the output is polished, award-winning screen magic.

4.Financials Overview

| Metric | Latest Qtr (Jun’25) | YoY Qtr (Jun’24) | Prev Qtr (Mar’25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue (₹ Cr) | 1,023 | 813 | 979 | 25.8% | 4.5% |

| EBITDA (₹ Cr) | 244 | 75 | 232 | 225% | 5.2% |

| PAT (₹ Cr) | 110 | -158 | -252 | NA | NA |

| EPS (₹) | 2.00 | -3.98 | -7.70 | NA | NA |

Commentary:This quarter’s comeback story is so dramatic it could be a Netflix docu-series – “From Loss to Oscars: The Prime Focus Redemption”. Revenues up, EBITDA surging, and PAT back in the black after two quarters of blood-red losses.

5.Valuation (Fair Value RANGE only)

Method 1 – P/E:

- Annualised EPS = ₹2 × 4 = ₹8.

- Assign industry-ish P/E range: 25x–35x → FV = ₹200–₹280.

Method 2 – EV/EBITDA:

- TTM EBITDA ~ ₹955 Cr.

- Net Debt ~ ₹4,879 Cr – Cash ~ negligible.

- EV = Mcap (₹4,925 Cr) + Debt (₹4,879 Cr) ≈ ₹9,804 Cr.

- EV/EBITDA = 10.2x. Sector fair range