Interest rates in the U.S. are set to decline dramatically in coming quarters, according to futures pricing data (FedWatch – CME Group) and overriding market sentiment.

Markets are pricing in a virtual 100% probability of a quarter-point reduction to a new target range of 4% to 4.25% at the Sept. 17-18 Fed meeting (the current target rate is 4.25% to 4.50%).

Probabilities of a second quarter-point rate cut at the Oct. 29 meeting have increased and currently stand at about 70%. At the same time, prospects for a third 0.25% reduction at the Dec. 10 meeting are growing and stand at about 60%, according to current futures data.

Related: White House pitches jumbo Fed interest rate cuts starting in September

And to spice things up further, U.S. Treasury Secretary Scott Bessent recently suggested a 0.50% rate cut may be in order at the September meeting.

Regardless, looking further out on the curve, one-year expectations for the Fed Funds Target Rate are centered on the 3.0 to 3.5% area, suggesting rates will be at least a full percentage point lower in a year’s time.

By lowering borrowing costs, the Fed hopes to stimulate the economy by making mortgages more affordable, increasing corporate profitability, and stimulating job creation.

Banks may do well with lower interest rates, but not all banks are created equal

The banking sector usually does well in lower-interest-rate environments due to the potential for increased borrowing, among other factors. But not all banks behave equally.

The main difference is seen between retail banks, which rely on customer deposits for lending, and investment banks that cater to Mergers and Acquisitions (M&A), Initial Public Offerings (IPOs), and trading.

More financial news:

- Surprising CPI report sparks mixed Fed interest rate cut forecasts

- Jim Cramer sounds off on tariffs, hot economy, and interest rate pressures

- Warren Buffett’s Berkshire Hathaway predicts major mortgage rate changes for 2026

Retail-focused banks, such as Bank of America (BAC) , Citibank (C) , and Wells Fargo (WFC) , may tend to lag other banking stocks in a falling interest rate environment.

That’s due to an effect known as “interest rate compression,” which narrows the difference, or spread, between the rate that banks pay depositors and the rate at which they can lend. This, in turn, reduces interest income, overall profitability, and potentially the stock price.

Investment banks may be the way to go when interest rates fall

On the other hand, investment banks like Goldman Sachs (GS) and Morgan Stanley (MS) tend to thrive in a period of falling rates. That’s because lower rates can lead to more borrowing for potential M&A transactions.

Additionally, with the stock market as buoyant as it is, the environment for IPOs is nothing less than stellar. And this comes on the heels of the SPAC-led surge in M&A and IPO-related revenues in 2024.

Heightened market volatility can also be good for trading desks at investment banks, giving them more opportunities and wider spreads to deal with and potentially profit from.

Those are the three key pillars of investment banking: M&A, IPOs, and trading.

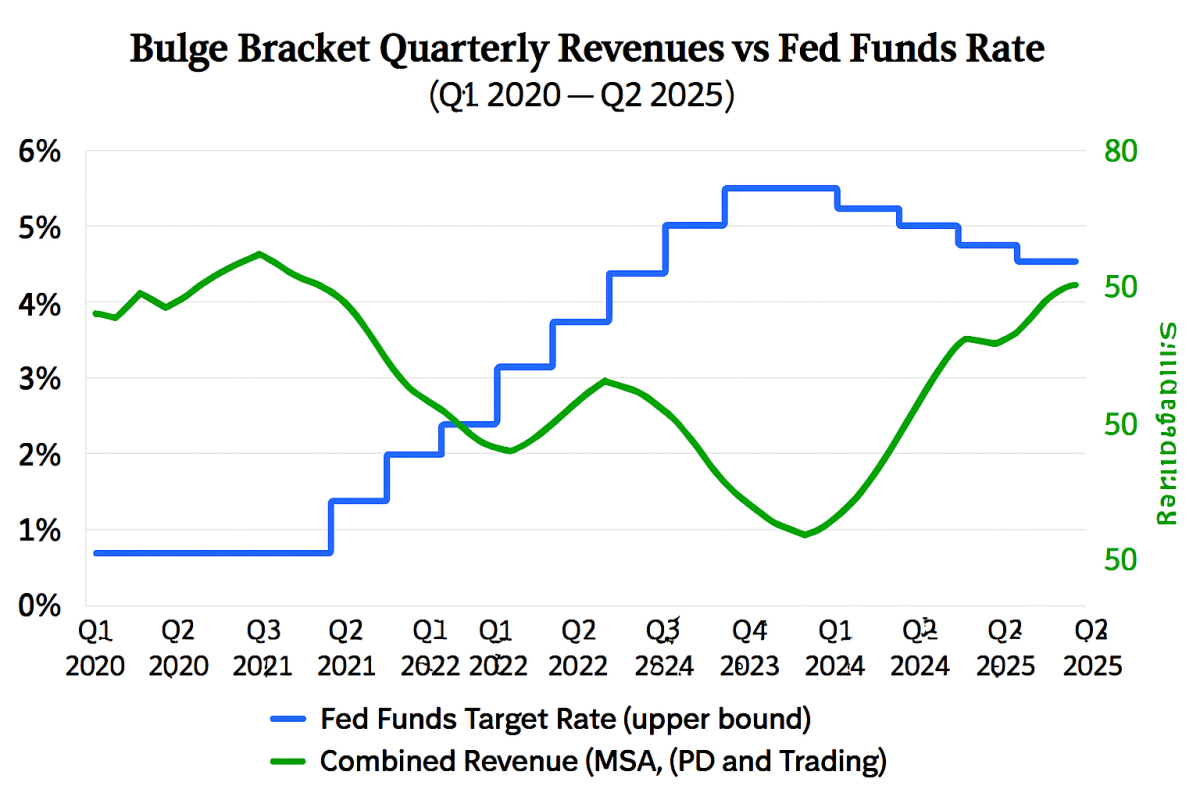

To illustrate the inverse relationship between interest rates and the combined revenue of those investment banking pillars, the chart below shows a clear negative relationship between the two.

Fed/company filings/TheStreet.com/Brian Dolan

The left side of the chart shows that as interest rates rise, investment banking revenues decline. And the right side of the chart shows the opposite: As interest rates begin to decline, investment banking revenue gains.

The relationship is clear and intuitive.

If we examine the chart more closely, we can discern a potential relative magnitude of revenue change according to interest rate levels.

Taking into account the one-off circumstances of Special Purpose Acquisition Company (SPAC)-generated activity in the early part of the easing cycle in 2024 (which led to an abrupt surge in revenues beyond the historical relationship), it still leaves the potential for additional revenue growth as interest rates are set to decline further.

In short, bulge bracket investment banking firms such as GS, MS, JPM, UBS, and C may see enhanced revenue prospects and higher share prices in coming quarters thanks to lower rates.

That could translate into a stock-based way to take advantage of the prevailing lower interest rate scenario.

Related: Highest tariffs since the Great Depression: What it means for stocks