1. At a Glance

John Cockerill India (earlier CMI FPE) is the cousin who brags about living abroad but quietly borrows money back home. With amarket cap of ₹2,261 Cr, CMP at a royal₹4,578, and yetROCE of -2.21%, this is the corporate version of wearing Louis Vuitton with a bank loan. Sales? Barely ₹307 Cr TTM. Profits? Negative. Investors? Still optimistic because, hey, “Belgium parent hai yaar.”

2. Introduction

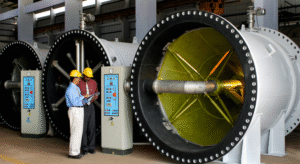

Founded in 1986, headquartered in Mumbai, but mentally always in Belgium, John Cockerill India builds the big boys’ toys of the metal world — cold rolling mills, galvanizing lines, color coating lines, pickling lines — basically, all the machines that make Tata Steel and ArcelorMittal shine.

The company has two units in Maharashtra — Taloja and Hedavali. Sounds industrial, but if you peep at the P&L, half the time it looks like they are running a coaching class for losses.

They got a₹1,000 Cr order from ArcelorMittal Nippon Steel in 2022(biggest in history) and a₹270 Cr furnace order in Aug 2025. Great news. But here’s the twist: execution timelines run till2027, which means investors will keep chewing their nails while management sips Belgian beer.

And yes, they just appointedFrederic Martin as MD(₹6 Cr annual salary). Let’s hope his bonus isn’t tied to “net profit growth” or he’ll be eating Maggi instead.

3. Business Model (WTF Do They Even Do?)

Imagine you’re building a factory. You need machines to roll steel, galvanize sheets, coat them pretty, pickle them (not achar-style, industrial acid bath style), and burn stuff in giant furnaces. That’s where John Cockerill walks in with engineering, design, commissioning, and after-sales services.

Key products:

- Cold Rolling Mills (17% FY22 mix)

- Continuous Annealing Lines (37%)

- Continuous Galvanizing Lines (21%)

- Color Coating Lines (10%)

- Chemical & Furnace Equipment

Services: EPC-style installation, commissioning, consultancy.

Translation: They don’t make steel, they make the machines that make the steel. Or in Indian parenting language — they are the tuition teacher, not the actual exam writer.

4. Financials Overview

Quarterly Comparison (₹ Cr)

| Metric | Q1 FY26 (Jun’25) | Q1 FY25 (Jun’24) | Q4 FY25 (Mar’25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 82.1 | 93.3 | 76.4 | -12.0% | 7.4% |

| EBITDA | 1.9 | 0.6 | -0.4 | +232% | NA |

| PAT | 1.7 | -0.03 | -0.75 | Huge | NA |

| EPS (₹) | 3.48 | -0.06 | -1.52 | NA | NA |

Annual EPS:-16.2. Translation: “P/E not meaningful” (unless negative P/E becomes a thing).

Commentary: Revenues swing like Sensex on budget day. Margins are thin, losses common, but occasional positive quarter keeps investors hopeful — like that one Sharma uncle who hits a six after 20 dot balls.

5. Valuation (Fair Value Range Only)

a) P/E Method

EPS TTM = -16.2. Negative = P/E comedy show.

b) EV/EBITDA

EV = ₹2,142 Cr.EBITDA TTM = -₹8 Cr.EV/EBITDA =meaningless (negative).

c) DCF

Sales growth last 3 years: 25%. But TTM = -55%. Assume normalized 10% growth with 3–5% margins. DCF says value =₹2,000 – ₹2,800 Cr market cap, i.e.₹4,000 – ₹5,600/share.

FV Range (educational only): ₹4,000 – ₹5,600.(Current CMP ₹4,578 sits in the middle of this circus tent.)

6. What’s Cooking – News, Triggers, Drama

- Aug 2025: Won ₹270 Cr order for tunnel furnace, execution till 2027.

- Aug 2025: MD change — Frederic Martin in, Michael Kotas out. (New MD = new PowerPoint deck = new hope cycle.)

- FY22: Largest ever ₹1,000 Cr ArcelorMittal Nippon Steel order. Still ongoing.

Triggers:

- Big steel capacity expansions = more orders.

- Parent group’s “One