1. At a Glance

Q1FY26 and ITI Ltd’s scoreboard reads:Loss ₹63.32 Cr, OPM-1%, revenue down4.23% YoY. For a company that once made half the country’s telecom hardware, it’s now mostly running on government projects, revival plans, and hope. Book value is ₹16.4, CMP ₹303 — yes, that’s an 18.5x P/B. ITI has effectively rebranded “patient capital” into “patient investor”.

2. Introduction

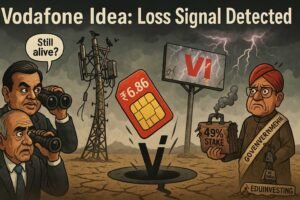

Founded in 1948, ITI was India’s first PSU in telecom manufacturing. It’s seen rotary phones, push buttons, landlines, and the slow death of copper cables. Today, it’s hanging on via turnkey projects like BharatNet, ASCON, FTTH rollouts, and e-governance, mostly courtesy of government orders. But with 403 debtor days and a history of negative ROE, it’s not exactly a quick-return machine.

3. Business Model (WTF Do They Even Do?)

- Turnkey Projects (~78% of revenue)– Govt-backed infrastructure (BharatNet, ASCON, Net for Spectrum).

- Manufacturing & Trading– Telecom gear, optical fibre cables, network equipment.

- Service & Maintenance– Ancillary services, mostly contract-based.

In short: Bid for large government telecom infra projects, execute (eventually), wait a year (or two) to get paid.

4. Financials Overview

Q1 FY26 (₹ Cr)

| Metric | Latest Qtr (Jun’25) | YoY Qtr (Jun’24) | Prev Qtr (Mar’25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 498 | 520 | 1,046 | -4.2% | -52.4% |

| EBITDA | -7 | -13 | -28 | — | — |

| PAT | -63.3 | -91.0 | -5.0 | — | — |

| EPS (₹) | -0.66 | -0.95 | -0.05 | — | — |

Commentary: Loss narrowed YoY but widened QoQ. Margins stuck in negative; other

income is a major lifeline.

5. Valuation (Fair Value RANGE only)

Method 1 – P/B

- Book value: ₹16.4; Applying 3x–5x for revival-story PSUs → FV ₹49 – ₹82.

Method 2 – EV/Sales

- Sales (TTM): ₹3,594 Cr, EV ≈ ₹29,120 Cr → EV/Sales ~8.1x; fair telecom infra range 2x–4x → FV ₹75 – ₹150.

Method 3 – Loss-making DCF

- Not meaningful until sustained positive FCF appears.

Educational FV Range (not advice): ₹50 – ₹150. CMP way above.

6. What’s Cooking – News, Triggers, Drama

- Q1FY26 loss₹63.3 Cr; audit disclaimer continues.

- Govt-backed revival planin place; recent ₹59 Cr equity infusion by the President of India.

- AI-driven road safety pilotlaunched in UP – diversification beyond telecom.

- Order bookstill fed by big government contracts; private sector traction negligible.