1. At a Glance

Ingersoll-Rand India is basically the “lungs” of Indian industry—manufacturing air compressors that keep everything from auto factories to pharma plants breathing. FY25 numbers?Revenue ₹1,375 Cr, Profit ₹268 Cr, with a delicious19.5% PAT margin.Q1 FY26 clocked ₹315 Cr topline, ₹59 Cr PAT—meaning even in a “meh” quarter, they print cash. With45% market share in centrifugal compressorsand a newSanand mega plantgoing live in Oct ’25, this company is literally compressing air into profits.

2. Introduction

If Reliance is India’s oil king, and Infosys is its IT darling, then Ingersoll-Rand India is the nerdy cousin making sure machines don’t suffocate. The company’s main job? Selling compressors and pretending air is worth paying crores for. And it works.

Their parent (global giant Ingersoll Rand Inc.) gives them tech, branding, and customers, while the Indian subsidiary executes with Swiss-watch precision. 76% of sales are domestic, 24% exports—meaning they’re big enough at home but still have global legs.

Fun fact: one customer alone (Ingersoll-Rand USA) gives them ~18% of revenue. Imagine billing your own parent for homework. That’s Ingersoll for you.

3. Business Model (WTF Do They Even Do?)

The revenue mix is industrially boring but financially beautiful:

- Sale of Goods (92%): Air compressors (the cash cow).

- Services (5%): Installation, maintenance, AMC (the annuity stream).

- Other (3%): Freight, insurance recovery, etc. (a.k.a. “miscellaneous jugaad”).

Industries Served:Auto, metals, pharma, textiles—basically anyone with machines.

Geography:

- 76% India.

- 24% exports (US, Europe, South Asia).

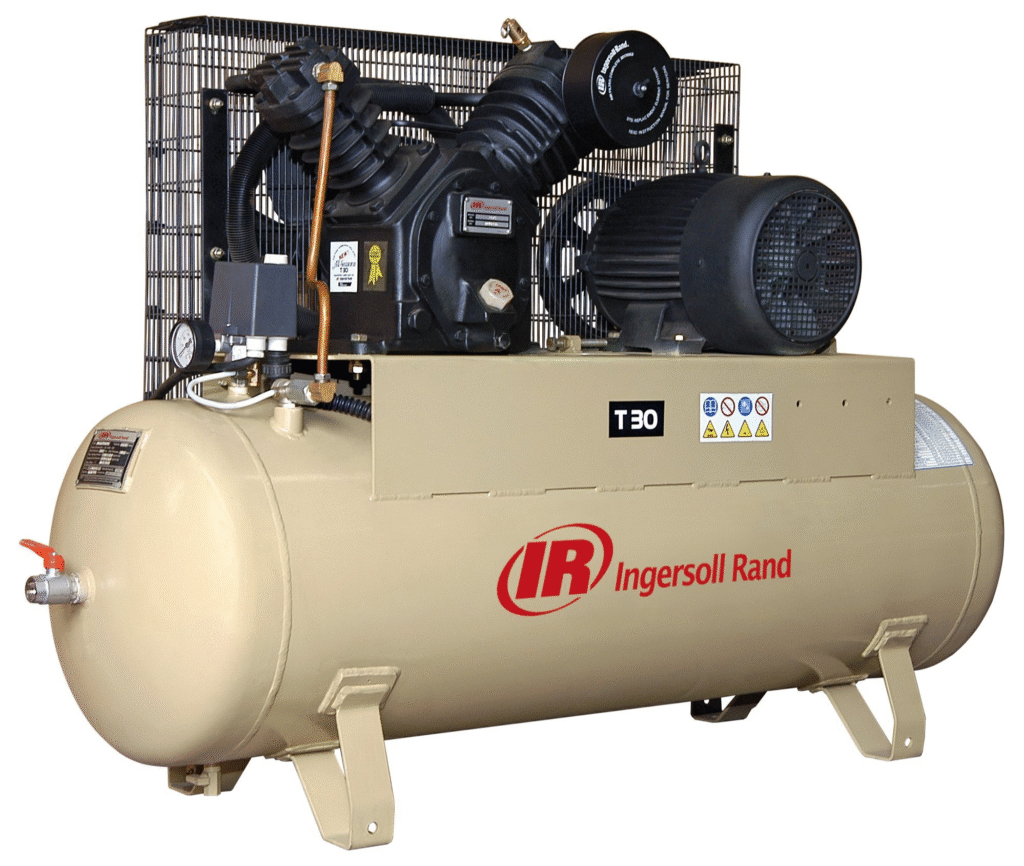

Key Brands in Portfolio:Ingersoll Rand, Gardner Denver, CompAir, NASH, Milton Roy, Thomas, ARO. If it blows, pumps, or compresses, chances are one of these logos is on it.

Moat:A cool 45% share in centrifugal compressors—industry equivalent of having monopoly on oxygen.

4. Financials Overview

Q1 FY26 vs Q1 FY25 vs Q4 FY25

| Metric | Jun ’25 | Jun ’24 | Mar ’25 | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | ₹315 Cr | ₹283 Cr | ₹347 Cr | +11.3% | -9.2% |

| EBITDA | ₹88 Cr | ₹77 Cr | ₹95 Cr | +14.3% | -7.4% |

| PAT | ₹59 Cr | ₹49 Cr | ₹66 Cr | +20.4% | -10.6% |

| EPS (₹) | 18.7 | 15.5 | 21.0 | +20.6% | -11% |

Annualised EPS (Jun ’25 run rate) ≈ ₹74.8.

5. Valuation (Fair Value Range Only)

- P/E Method:EPS ~₹74.8. Apply 28–35× = FV ₹2,095 – ₹2,620.

- EV/EBITDA:EV ~₹6,500 Cr / EBITDA ~₹350 Cr ≈ 18.6×. Peers trade 18–24× → FV = ₹2,000 – ₹2,800.

- DCF Lite:Assuming 12% growth, 10% discount → FV = ₹2,100 – ₹2,400.

📌Educational FV Range:₹2,000 – ₹2,600.(Not investment advice, only for academic fun.)

6. What’s Cooking – News, Triggers, Drama

- Sanand Plant:₹170 Cr capex, 5,000 compressors/month capacity. Trial run Sep ’25, full ops Oct ’25. Translation: bigger lungs for India Inc.

- Dividend Happy:AGM in Aug ’25 declared ₹25 final dividend. Healthy payout history.

- Parent Leverage:Tech and brand support from Ingersoll Rand Inc. plus captive global sourcing.

- Sustainability Focus:Pushing energy-efficient compressors for