✅ At a Glance

| Metric | FY25 (Standalone) |

|---|---|

| 🧾 Revenue from Operations | ₹1,733.5 Cr |

| 💰 Total Income | ₹1,758.2 Cr |

| 🧨 Net Profit (PAT) | ₹867.7 Cr (BOOM) |

| 🧮 EPS (Basic & Diluted) | ₹84.50+ est. |

| 🚀 CMP (20 May 2025) | ₹2,795 🔼 +20% today |

| 🔮 FV (Edu Estimate) | ₹1,350–1,600 |

| 📦 Segment | Power Equipment |

EPS ka inverter blast ho gaya — this is not a silent genset anymore, it’s a screaming powerhorse. But wait… there’s a twist.

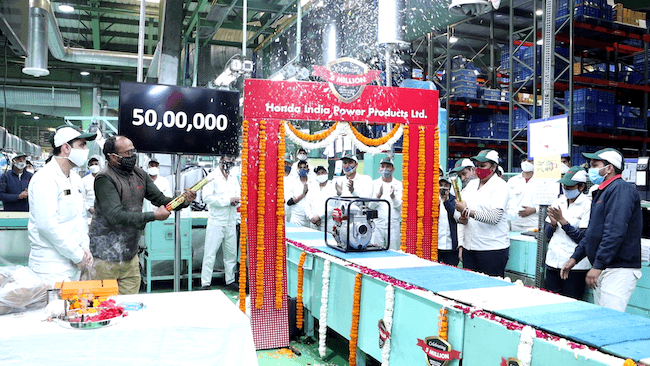

🏭 About the Company

Honda India Power Products Ltd. makes:

- 🧯 Portable Gensets

- 💧 Water Pumps

- 🔨 Engines

- 🧊 Industrial and agri-use power equipment

It’s a subsidiary of Honda Motor Co., Japan, with a global export footprint and rural + defence + infra customer base.

📊 FY25 Financial Breakdown

| Line Item | FY25 (₹ Cr) |

|---|---|

| Revenue from Operations | ₹1,733.5 Cr |

| Other Income | ₹24.7 Cr |

| Total Expenses | ₹1,494.5 Cr |

| Profit Before Tax (Pre-Exceptional) | ₹263.7 Cr |

| Exceptional Income | ₹604 Cr 🚨 |

| Profit Before Tax (Total) | ₹867.7 Cr |

| Estimated EPS | ₹84.50 |

💥 Key Note:

That ₹604 Cr jump is from exceptional items — probably sale of land, old factory, or asset rejig.

So actual operations = decent

But FY25 PAT = one-time sugar rush

🧮 Edu Fair Value Calculation

Let’s assume normalised EPS = ₹22 (without exceptional item)

And fair P/E = 20x (for

To Read Full 16 Point ArticleBecome a member

To Read Full 16 Point ArticleBecome a member