Many Americans are finding it increasingly difficult to contribute to their 401(k) plans as financial pressures mount.

Rising costs for housing, health care, and everyday expenses are forcing individuals to make tough choices between saving for retirement and managing immediate obligations.

At the same time, concerns about the future of Social Security are growing. With projections indicating potential benefit reductions in the coming decade, there is widespread uncertainty about whether Social Security will provide adequate income in retirement.

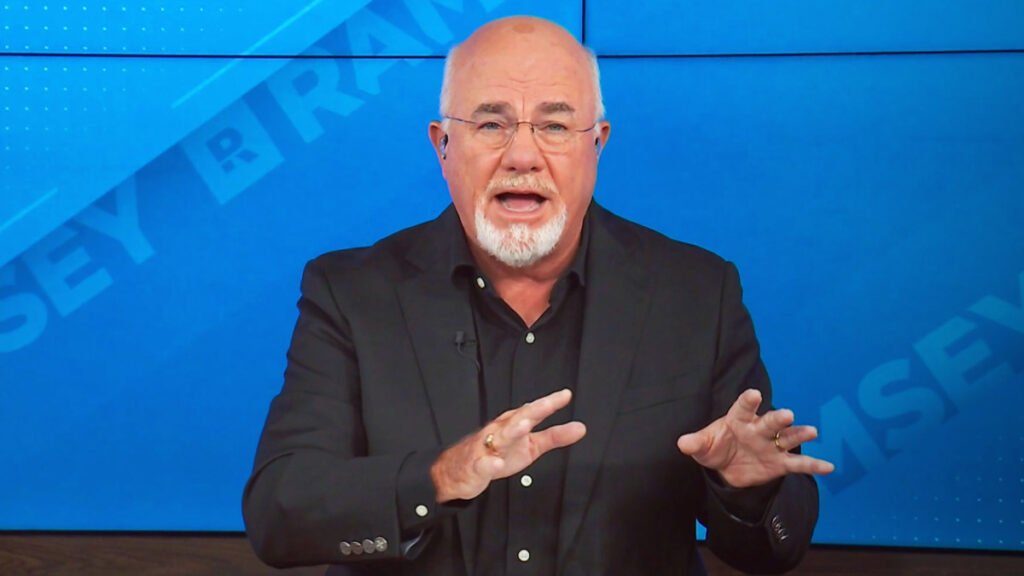

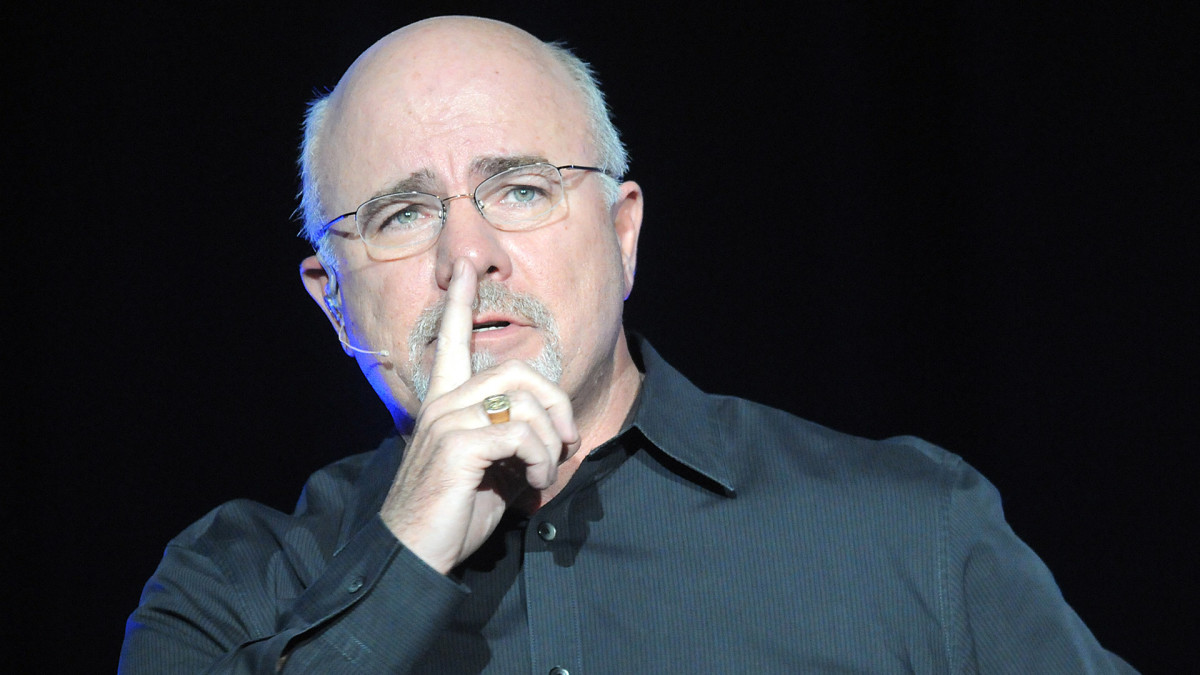

Dave Ramsey, radio host and bestselling personal finance author, offers his perspective on an important concern a number of people have about making contributions to their 401(k) plans.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰💵

For those carrying high-interest debt, the challenge is even greater. The decision to invest in a retirement account while juggling credit card payments, student loans, or personal debt can feel like a losing battle.

Ramsey’s advice is to pause 401(k) contributions while aggressively paying off debt. His approach offers a path for those seeking stability before growth.

Related: Dave Ramsey has blunt words for Americans on Medicare, Medicaid

Dave Ramsey has blunt words on Social Security

In a 2025 report, the Social Security Administration (SSA) states that, beginning in 2033, the Old-Age and Survivors Insurance (OASI) Trust Fund will become depleted.

At that point, the SSA explains, continuing program income will be sufficient to pay only 77 percent of total scheduled benefits. This will remain the reality unless legislative action is taken.

“Your financial security in retirement shouldn’t come from Social Security — it should come from what you’ve saved over your working lifetime,” Ramsey wrote. “You are the CEO of your retirement.”

As the baby boomer generation continues to retire, Ramsey clarifies the fact that the population of Americans aged 65 and older is projected to rise significantly — from around 61 million today to approximately 77 million by 2035.

This demographic shift will coincide with a shrinking workforce, meaning fewer active workers will be supporting a growing number of retirees. That imbalance is expected to place increasing pressure on the Social Security system.

Ramsey has emphasized that relying solely on government programs like Social Security is a risky strategy for retirement planning. His view is that individuals should take personal responsibility for their financial futures, rather than assuming Washington will provide adequate support in retirement.

“Do you really want to put your retirement dreams in the hands of the government?” Ramsey asked. “Heck no!”

Image source: Jackson Laizure/Getty

Dave Ramsey clarifies pausing 401(k) contributions while paying off debt

Ramsey advises Americans to halt all retirement contributions while focusing on eliminating debt, including opting out of 401(k) plans that offer employer matching.

“This makes a lot of people nervous, and I understand that. I’m a math nerd, and I know that getting a 100-percent match on your contributions is a sweet deal,” Ramsey wrote in his book “Dave Ramsey’s Complete Guide to Money.”

More on personal finance:

- Scott Galloway has bold words for Americans on Social Security

- Tony Robbins sends warning message to Americans on IRAs, 401(k)s

- Dave Ramsey has blunt words for Americans on Medicare, Medicaid

A strategic way to speed up debt repayment is to pause retirement contributions — including 401(k) plans with employer matches — for around 18 months, Ramsey explains.

This temporary shift frees up cash flow, helping people tackle debt more aggressively and with greater urgency.

Once the debt is cleared, Ramsey says, they can resume investing with confidence, no longer weighed down by monthly payments.

For those facing more complex financial issues, the pause may need to be longer. Still, this approach lays a solid foundation for long-term financial health and improved savings potential, according to Ramsey.

Related: Tony Robbins sends warning message to Americans on IRAs, 401(k)s

Dave Ramsey’s approach on 401(k)s and debt offers clarity

Ramsey’s advocacy for a strict, step-by-step financial plan that prioritizes debt elimination before contributing to a 401(k) plan is part of a larger philosophy.

His method begins with establishing a small emergency fund, followed by using a debt snowball technique to pay off all debt. Only after becoming entirely debt-free (with the exception of a mortgage payment because home ownership creates equity) does he recommend contributing to retirement accounts.

Some financial advice encourages individuals to contribute to their 401(k)s consistently — even while managing debt — especially when employer matching is available.

For many, Ramsey’s approach offers clarity and discipline in a financial landscape that often feels overwhelming.

The psychological relief of eliminating debt, combined with the improved monthly cash flow, can provide a strong foundation for future investing.

While delaying retirement contributions may result in missed opportunities for growth, Ramsey’s method appeals to those who value financial control and simplicity.

Related: Shark Tank’s Kevin O’Leary bluntly speaks on Americans’ 401(k)s