If you want to find out where AI money’s heading, Wedbush’s Dan Ives just handed you a map.

The veteran tech analyst just refreshed the Dan Ives AI 30 list, essentially Wedbush’s cherry-picked list of the best AI stocks that could potentially define where AI is going next.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

Nvidia’s (NVDA) is the usual suspect on the list, but some new names may surprise you.

Also, a fair few big names got booted off the list, which makes things even more interesting. Ives’ selections are far from just a list, representing more of a snapshot of where the tech industry might be five years from now.

Best AI stocks 2025: from market titans to sub-$10 speculations

When it comes to investing in AI stocks, the conversation typically starts with the biggest names.

The best AI stocks to buy are essentially the platform leaders controlling compute, data, and distribution. Nvidia, a no-brainer pick, usually dominates accelerators and AI software ecosystems, while Microsoft and Amazon sit at the top of cloud AI adoption.

Google continues to push through with its search prowess and generative AI integration, while chipmakers and AI infrastructure players like Broadcom and AMD remain critical suppliers powering the space.

Also, for those with a long-term investing mindset, Meta and Taiwan Semiconductor are in the mix.

Related: Billionaire fund manager doubles down on Nvidia, partner in AI stack shift

And what about Elon Musk’s AI play? His company, xAI, behind the potent Grok chatbot, remains private, but Tesla acts as the public proxy. From the powerful Dojo supercomputer to Robotaxi ambitions and even humanoid robots, Tesla embodies Musk’s AI vision in a listed form.

Of course, not everyone is looking at mega-caps.

Some investors will want to scoop up AI stocks under $10 with moonshot potential. That’s a space where there’s a ton of speculation, but opportunities exist as well.

Over the past few years, companies such as BigBear.ai, SoundHound AI, and Guardforce AI typically show up in this range. They’re volatile, but often provide healthy exposure to smaller, fast-moving bets on the AI trend.

Risk management matters are as important as stock picking, which is where the 7% rule comes in.

It’s a simple philosophy, too, in that if a stock falls 7% to 8% below your purchase price, you sell. The idea is to efficiently prevent major losses that can drag down performance while letting winners run.

The playbook remains clear, where the goal is to anchor portfolios in durable AI platforms and selectively use sub-$10 names for upside, while sticking to the 7% rule for discipline.

Nvidia still leads as Wedbush refreshes Dan Ives’ AI 30 list

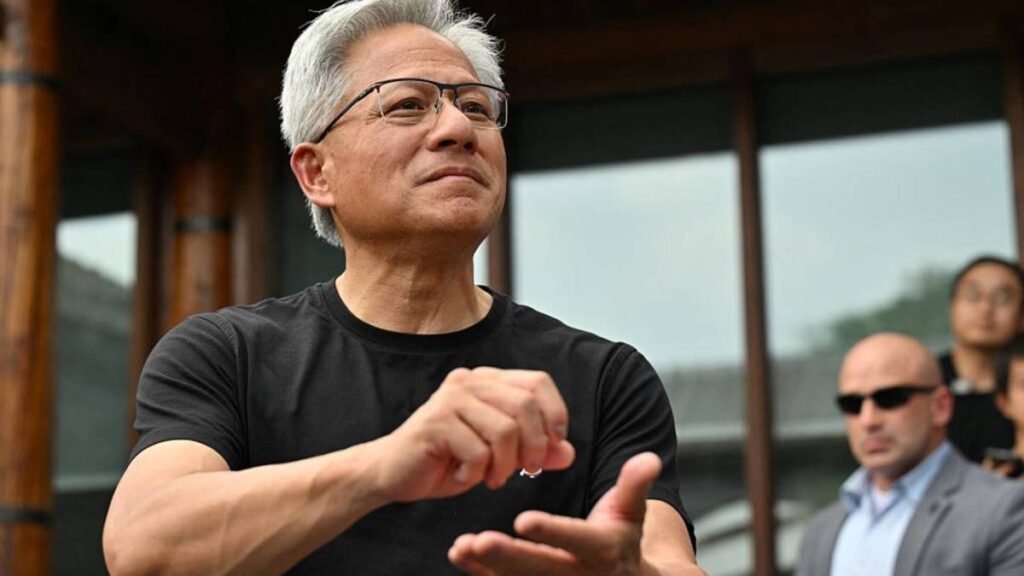

Nvidia sits at the top of Wedbush’s Dan Ives’ AI 30 list, and it’s not hard to see why.

The chip giant is clearly the backbone of the AI revolution, powering everything from ChatGPT to enterprise machine learning models. Wedbush views Nvidia as a critical engine of this multi-trillion-dollar shift.

Related: Cathie Wood buys $13.4 million of surprising tech stock

For perspective, the global data‑center electricity demand is forecasted to jump more than double by 2030, to roughly 945 TWh. That’s equivalent to the entire electricity consumption of Japan today, and AI is the key driver behind this surge.

But Nvidia’s not the only name that warrants attention.

Before going any deeper, though, here’s the list of notable additions and removals:

Additions to the AI 30 list:

- CrowdStrike

- Roblox

- GE Vernova

- Nebius

Removals from the AI 30 list:

- Adobe

- C3.ai

- CyberArk

- Elastic

In its latest shake-up, Wedbush added CrowdStrike, Roblox, GE Vernova, and Nebius to its illustrious group of 30 AI-driven businesses.

Ives said these businesses are well-positioned to capitalize on the AI revolution, backed by healthy fundamentals and emerging momentum.

CrowdStrike is part of the list for its surging demand in cybersecurity and AI-powered protection, with Ives touting the success of its Charlotte AI platform.

Roblox earned its place through robust developer incentives and smarter content discovery.

More News:

- Billionaire George Soros supercharges Nvidia stake, loads up on AI plays

- Tesla just got its biggest break yet in the robotaxi wars with a key permit

- Bank of America drops shocking price target on hot weight-loss stock post-earnings

AI is playing a critical role in driving user growth and monetization, potentially paying dividends in the upcoming quarters.

GE Vernova benefits from the hyperscaler boom.

With the expansion in data centers, demand for power and grid tools grows along with it. Nebius, meanwhile, is growing fast as it looks to meet red-hot demand for its AI infrastructure, with demand still outpacing supply.

Additionally, Apple, Alibaba, and Baidu are already part of this elite list, and the new entrants show just how fast the AI race is evolving.

Wedbush cuts Adobe, C3.ai, CyberArk, and Elastic from AI 30

With the addition of some fresh names, four tech businesses just lost their spot on the AI 30 list.

Foremost, we have Adobe, which was dropped on the back of a slower AI start than Ives had hoped for. That sluggishness is resulting in slower growth and could significantly hurt its free cash flow haul.

CyberArk is being scooped up by Palo Alto Networks, which is already featured in the AI 30 list. That deal, which is worth $25 billion, was a big reason for the switch, which Wedbush deemed a “home-run M&A deal.”

C3.ai was also removed from the list on the back of a messy sales reorganization and its CEO Thomas Siebel’s resignation. The leadership shakeup raised some major questions for analysts, pointing to near-term speed bumps.

Elastic also got the boot, despite boasting strong federal contracts under its repertoire. Though Ives remains bullish, the axe was perhaps more about other tech names now pulling ahead.

Related: Veteran analyst drops blunt 7-word take on AMD’s China deal