ALL SECTIONS

Exploring AI’s influence on market dynamics

Once dominated by human intuition, gut feelings, and the occasional lucky guess, trading floors have now welcomed a new player: AI. But with AI-driven trading strategies becoming the norm, are they making investing smarter or just more unpredictable?

Featured | Forex and Brokerage | Markets

Author: Claire Millins, Features Writer

Top 5

- Top 5 female-fronted fintech firms

- Top 5 Latin American tech hubs

- Top 5 sustainability pioneers in Europe

- Top 5 keys to global economic recovery

- Top 5 WFH habits, according to the world’s most successful business leaders

- Top 5 pandemic-proof industries

- Top 5 countries to be world’s next manufacturing hubs

- Top 5 most influential and inspirational US economists

- Top 5 ways to boost employee engagement and commitment

- Top 5 financial services that are ripe for automation

- Top 5 ways that GDPR has impacted digital banking

- Top 5 emerging fintech hubs across the globe right now

- Top 5 ways that the finance industry can prepare for AI

- Top 5 economic risk factors that must be considered

- Top 5 tips for retailers looking to sell into Chinese market

Artificial Intelligence (AI) exploded into the mainstream in 2023, and its adoption is showing absolutely no signs of slowing down. From technology, health, and manufacturing to customer services, marketing, and even retail, AI is everywhere. And let’s face it, who hasn’t used Chat GPT (other LLMs are available) for a bit of inspiration or help sometimes.

But, AI itself is nothing new. It has been around since the 1950s, and the financial sector was an early adopter back in the early 1980s when James Simons founded quantitative investment firm Renaissance Technologies. Early financial use of AI included power trading and expert programmes, and as computing power has improved over the intervening years, so too has AI’s capabilities, shifting how markets operate from trading algorithms that execute within milliseconds to predictive analytics anticipating market shifts.

The role of AI in financial markets

From machine learning algorithms to natural language processing, AI technology is designed to mimic how the human brain thinks, understands, learns, and remembers, but with one valuable difference, which is especially useful when it comes to finance: it removes emotion. Analysing huge amounts of complex, unstructured datasets and real-time data in a fraction of the time it takes a human agent, AI can spot patterns that the human analyst may overlook, due to various biases, conscious or otherwise, detect data outliers and anomalies, and forecast market trends with pinpoint accuracy. Obviously, this means that this efficiency, speed and accuracy are a few of the key advantages of using AI in market analysis.

However, one of the standout features of AI is in its scalability to work equally as well with large datasets as it does with small, niche ones, making it suitable for both large-scale data analysis and the management of diverse investment portfolios. AI can also help to provide continuous monitoring of market movements, observing trading trends, and anomalies in trades, and flagging suspicious behaviour in real time, making it an efficient way to minimise risk and mitigate fraudulent activity.

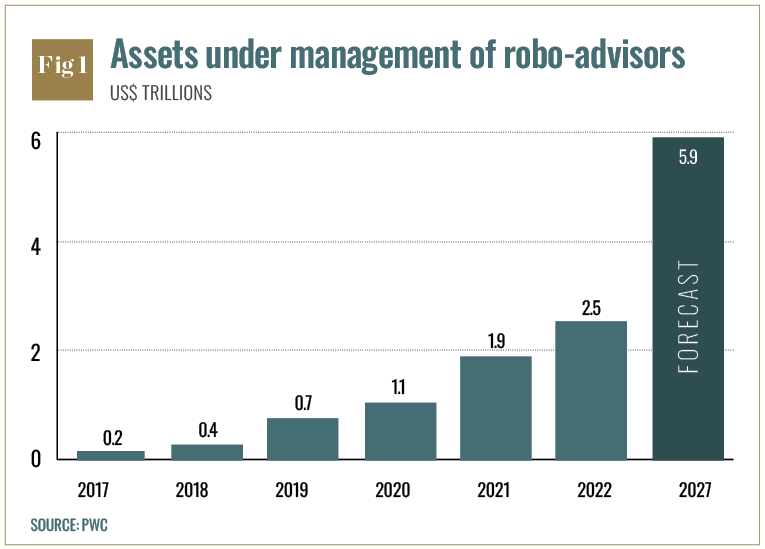

As AI’s capabilities have improved over recent years, it has become a significant tool in asset management, specifically generative AI (GenAI). AEIQ, launched in 2017, was the first public AI-driven fund, and many more funds have since also added AI tools and big data into their strategies. PwC’s 2023 ‘Global Asset and Wealth Management Survey’ predicted that the amount of assets managed by algorithm-driven, AI-enabled platforms will double to almost $6trn by 2027 (see Fig 1), while their 2024 survey revealed that 80 percent of asset and wealth management organisations say AI will fuel revenue growth, and those organisations adopting ‘tech-as-a-service’ could potentially see a 12 percent revenue boost by 2028. As an example, hedge fund start-up, Minotaur Capital, has replaced traditional analysts with AI and, since its launch in May 2024, has seen a 13.6 percent FYTD increase against a 2.03 percent 12-month increase of the global stock market (MSCI All-Country World Equity Index).

The power of automation

Traditional algorithmic, rule-based trading systems rely on static conditions and predefined rules, whereas algorithmic strategies underpinned by AI and machine learning can help institutional and retail traders adapt, refine, and improve their decision-making process in real-time in an effort to outwit the market. While they can help generate ideas, develop strategies, and even execute trades, they are, however, just tools, and should never be used to replace human judgment, but rather complement it to enhance performance. In general, trading models are built following a structured four-stage process: collecting and analysing market data to recognise patterns, identifying factors that filter out unnecessary noise, training the model with historical data so it learns how different market conditions impact trade volumes, and then testing in the live market and continually monitoring performance.

There is the ethical dilemma of whether AI should make high-stakes financial decisions without human oversight

High-frequency trading (HFT) is one trading method that takes algorithmic execution to the extreme. It uses complex algorithms for lightning-fast analysis of multiple markets and trades are executed in microseconds. And because speed is of the essence, AI and machine learning are vital to HFT success. The algorithms need to process enormous streams of real-time data, order books, price ticks, news feeds, and decide, in fractions of a second, whether to enter or exit positions. Reinforcement learning (RL) and neural networks are often used to optimise execution, manage risk exposure, and identify fleeting market inefficiencies faster than any human could.

Predictive analytics and sentiment

Using statistical and data analysis techniques, predictive analytics is used to forecast future market trends based on historical and current data. AI-driven models are still trained using historical data to identify patterns, relationships, and trends, but the big difference is that while traditional models required manual adjustments and pre-defined assumptions, the AI model continuously refines itself. Machine learning algorithms, deep learning networks, and natural language processing (NLP) work together to analyse and transform vast amounts of data into actionable insights, allowing investors to make better choices, limit risks, and optimise their portfolio.

Additionally, using real-time data sources from social media, news articles and internet sources, AI can measure the sentiment towards a stock, sector, or general market, and detect any movement; positive, negative, or neutral, signalling a potential movement in price, before others flag it. Using this ‘sentiment analysis,’ investors can take better advantage of market unpredictability and make smarter, more data-driven decisions, though it does have its drawbacks. AI-based sentiment analysis is volatile and unreliable for long-term investments: just look at what happened to the share price of GameStop in January 2021, after Reddit investors fuelled the fire. The share price doubled over two days from $4.99 on January 12 to $9.98 on January 14, before shooting up to a high of $120 on January 28 and crashing back down to $10 by February 19. Further fluctuations followed, but on average, the share price has been bumbling along around $20 since then. The other challenge AI-based sentiment analysis has is that it can’t distinguish whether online information is true or false. According to Forbes, 48 percent of all business-related messages contain false or irrelevant information; just because social media is buzzing about something, good or bad, this doesn’t always translate to movement in the stock price.

The uncharted territory of AI in trading

There is no doubt that AI is improving the ability to forecast market movements more accurately and trade quicker, but as systems become more advanced, is there a risk of AI being able to anticipate and reshape market behaviour, simulate entire economies, or even generate trading strategies with minimal human input?

As AI’s capabilities have improved over recent years, it has become a significant tool in asset management

Currently, technologies like RL and GenAI are increasingly being used in financial markets. Through RL, algorithms learn optimal behaviour through trial and error, adjusting strategy according to results, thus improving performance over time, while the possibility of using GenAI for risk assessment and strategic planning is also being investigated. Quantum computing has the potential to supercharge current AI capabilities and solve optimisation problems in seconds, opening new windows for predictive modelling and portfolio management. However, it is still at least a decade away from mainstream adoption. This all sounds wonderful, but by automating more and more of the financial decision-making process, will this create smarter markets, or make them more fragile?

With similar AI models trained on overlapping, or even the same, data, there is a distinct possibility that algorithms could amplify price swings, causing more ‘flash crashes’ than any government spending announcements or mini-budgets could make if the algorithms misinterpret signals or react at the same time. Not to mention, the complexity and speed of these systems also make it hard to predict how they will behave under stress.

Additionally, there is the ethical dilemma of whether AI should make high-stakes financial decisions without human oversight. When billions of trades are at stake, how do you audit a neural network’s decision path? These are the questions that need answering before travelling past the point of no return as they affect regulatory frameworks, risk management strategies, and even the very definition of understanding the market.

For retail and institutional investors, staying informed and adaptable is more important than ever. Moving forward, it may not be enough to understand technical analysis alone; there will probably be a need to understand algorithm ethics, data bias, and AI governance.

At the end of the day, as much as AI is shaping the financial markets, like every other sector, it is how we choose to use it that will shape the outcomes. But the million-dollar question is: will it ever guarantee to beat the market 100 percent of the time?

Post navigation

Previous article

How leadership can create a culture of success

Related:

- AI 2.0: The hype is over and it is time to monetise

- The rise and coming fall of Chinese manufacturing

- Digitalisation and financial literacy vital to Eurozone success

- The next phase of digital banking

- The future of digital corporate banking

- Pioneering innovation and sustainability in Dominican banking

- New pathways to trading success

- Harnessing the power of AI in asset management

- Responsibility in the age of AI

- The future of CFD trading: trends and perspectives