The last few years have been a test for every retailer worldwide. The challenges started before the pandemic with the rise of online retailers, forcing many beloved brick-and-mortar locations to close their doors.

Then, the pandemic happened and started taking physical stores one by one. Those who survived were severely weakened and are now dealing with a long set of new challenges: rising labor costs, inflation, tariff pressures, and changes in consumer behaviors.

Related: California grocer closes store after 24 years due to US tariffs

While some industries proved more resistant to the above-mentioned challenges, others have seen many closures and bankruptcies this year.

While we all need clothing just to leave home, not to mention for work, special occasions, and sports activities, the fashion industry has been shaken. This year, some very popular brands were forced to shut down.

Liberated Brands, the name behind brands like Volcom, Billabong, and Roxy, filed for Chapter 11 bankruptcy in February this year and confirmed the closure of its stores.

Then crafts and fabrics retailer Joann Inc. announced the closure of all 800 of its retail stores and the liquidation of its assets in going-out-of-business sales. A struggling plus-size clothing chain, Torrid, also closed 180 stores as part of a strategic shift toward online sales.

Liberated Brands, Joann, and Torrid are only a few of many fashion giants that made difficult decisions this year.

The newest one to join the group is a popular British fashion and lifestyle brand with an international digital presence.

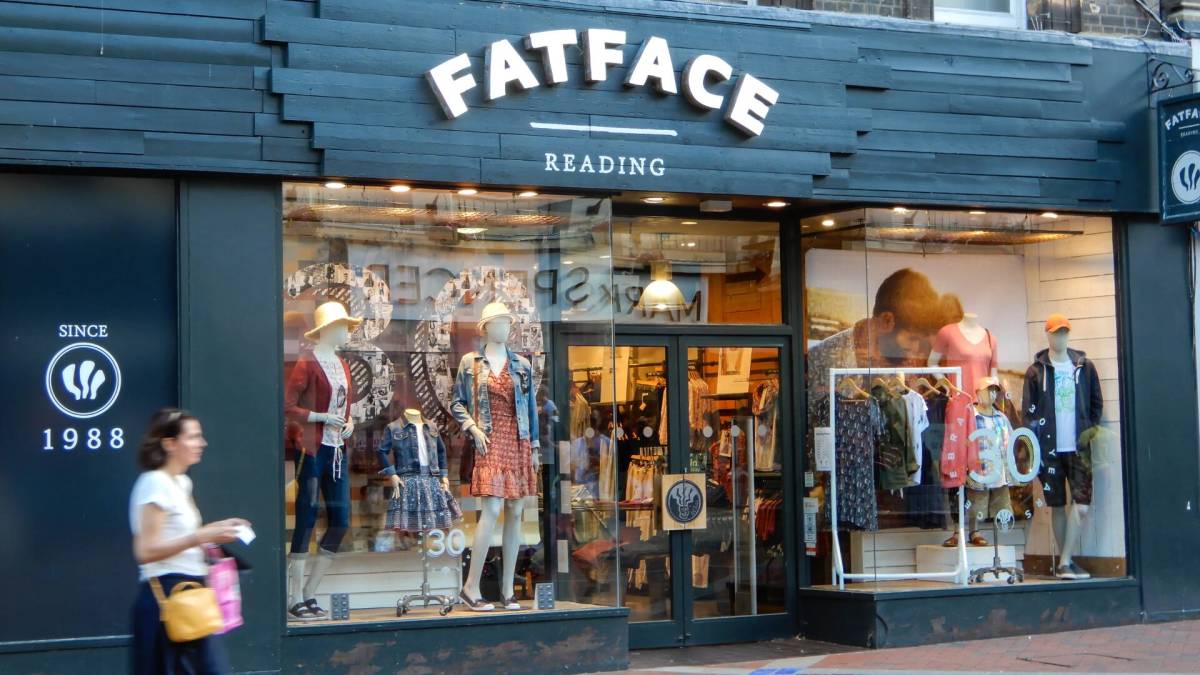

Image source: Roger Utting/Shutterstock

FatFace closing all stores across the U.S., shifting to online model

Popular multichannel retailer FatFace is closing all 23 of its U.S. stores and will continue operating exclusively online.

The brand’s story started back in 1988, when two friends, the company’s founders, Tim and Jules, who loved to ski, started having financial problems. To solve the money troubles, they came up with the idea to print some sweatshirts and t-shirts and sell them at night, continuing to do what they loved most during the day — skiing.

More Retail:

- 125-year-old supermarket chain closes over a dozen stores

- Amazon makes customer service change it knows people don’t like

- Huge travel brand closes stores, posts big profits

The name of the brand comes from La Face, their favorite World Cup downhill ski course in France, on Rocher de Bellevarde mountain in Val-d’Isère, Savoie.

What consumers love about FatFace is its stylish and practical clothing, as the brand focuses on quality and durability, while also being committed to sustainability. The brand’s core value is “Made for Life,” and according to comments from consumers on Reddit, the clothing quality is excellent.

Most of the consumers say the price matched the high quality and that the customer service is amazing.

“Love FatFace stuff. I have loads and it’s all really high-quality stuff. Often find their stuff in thrift stores and always feel great giving it a second home. Also still have the first FatFace thing I bought new in 2008, a hoodie that’s worn regularly and still going strong,” reads one comment from two years ago.

FatFace’s harsh decision comes amid rising costs and economic uncertainty

Despite its legacy, quality, and consumer satisfaction, FatFace has succumbed to ongoing economic uncertainty and rising costs. It made a hard decision to close all stores across the U.S., resulting in 145 job cuts, reported Retail Gazette.

Per the report, which cites sources close to the brand, FatFace plans to continue to invest in its stores across the United Kingdom, after already opening three new locations, renovating and updating 35 this year.

According to data from a February 2025 press release, FatFace operates 191 stores in the UK.

Related: Beloved Texas home décor shop closes after 40 years

“While with any digital migration it can take time, this move will give us additional digital capabilities to enhance the experience for our customers and more seamlessly manage our operations,” said FatFace CEO Will Crumbie as reported by Express.

According to the reports, FatFace posted a 21% decrease in pre-tax profit that dropped to £16.9 million (about $22.93 million) for the 52 weeks ending January 25. The company attributed the decline partly to its e-commerce operation’s transition to Next’s total platform.

While the 12-month pre-tax profit for the year ending January 25 declined, the first half of 2025 started stronger. The fashion retailer posted growth in pre-tax profit, backed by a 6.6% rise in full-price sales and a 3.4% increase in like-for-like store revenue.

Related: Popular travel brand files Chapter 11 bankruptcy amid lawsuits