2025 has been an interesting year for car buyers thanks to the U.S. trade war, which has resulted in 25% tariffs on autos and auto parts.

President Donald Trump has used his bully pulpit to pressure companies across the spectrum not to raise prices, and save for a few seasonal adjustments, most have not raised prices to reflect how much the tariffs are costing them.

Everyone from Ford to General Motors to Toyota has said that tariffs will cost them billions this year, but all have committed to keeping prices low.

Related: US car buyers should expect great summer deals, but there’s a catch

In June, the average new-vehicle price rose 0.2%, according to Kelley Blue Book.

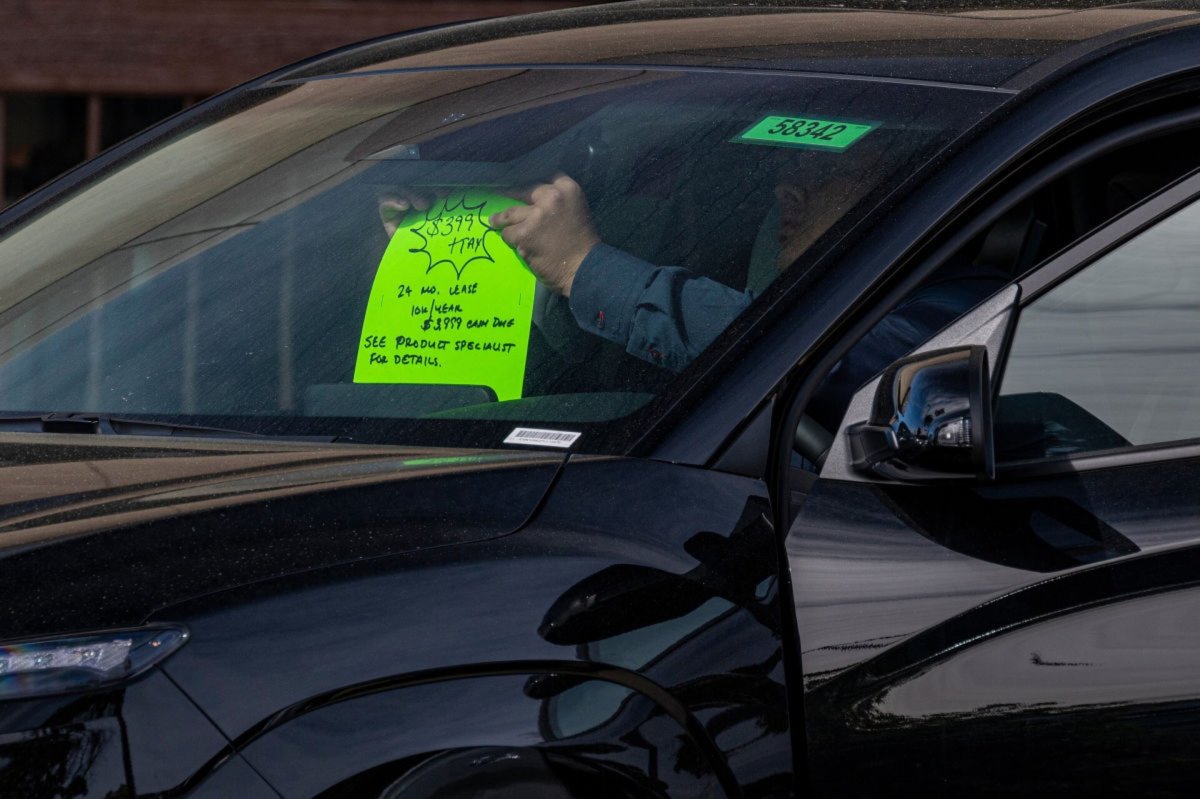

Additionally, companies have been spending on incentives to drive sales.

Ford used incentives and the fear of tariffs to become the top-selling brand in the U.S. during the first half of the year. Ford said total sales in the second quarter rose at a rate 7x that of the overall auto industry.

The 1.11 million units it sold (a 6.6% year-over-year increase) were largely due to the employee pricing and 0-0-0 incentive programs.

But incentives can only hold back the floodwaters for so long, and new data from Cox Automotive suggests that prices could rise soon.

July car prices remain flat, but signs are pointing to an increase

Carmakers actually increased their incentive spending last month to 7.3% of new vehicle average transaction prices (ATP) from 7% in June, according to Cox Automotive.

Automakers spent an average of $3,553 per vehicle to move their inventory in July, reaching the high point for incentive spending this year.

“Automakers are providing healthy incentives to keep sales flowing. Prices are trending higher, but just as we are seeing in the broader retail markets, there’s sufficient demand and generous incentives out there, and that’s driving the market,” said Cox Automotive Executive Analyst Erin Keating.

Related: 1 in 5 new car shoppers are committing a big financial blunder

Manufacturer Suggested Retail Prices (MSRP) were only slightly lower in July sequentially, but compared to last year, they are higher by 2.4%, which Cox says is a sign that manufacturer costs are increasing more than consumer retail prices.

Companies try not to make a habit of losing too much money on sales offers, so the time for incentive spending may end.

Wealthy buyers are propping up the auto market

The data suggests that wealthy buyers are the ones flocking to dealerships to buy ahead of tariffs impacting prices, and they are also getting the best deals.

“In the face of rising prices, it is becoming more evident that the new-vehicle market is being supported by pent-up demand driven largely by high-net-worth households,” Keating said.

Cox’s data shows that only about 7% of consumers financing new vehicle purchases are locking in a 0% annual percentage rate.

Meanwhile, the average new auto loan rate is above 9%. Even consumers with “very good” credit scores, above 760, were getting 5.4% rates in July. But that rate is still the lowest it has been since September 2022.

More automotive:

- Ford CEO Jim Farley supports US tariffs despite $2 billion cost

- EU and US automakers both lose big in latest tariff deal

- Tesla faces ‘unprecedented’ downturn in one key area

A recent Bank of America report notes that vehicle loan applications declined from their peak in April, “suggesting that ‘buying ahead’ has largely run its course.”

Like Cox, BofA expects lower-income and younger buyers to feel the most pain. Its data shows that median car payments have grown faster than new and used car prices since 2019.

Shockingly, of those households with a monthly car payment, 20% have a payment over $1,000.

Related: New car buyers are finally starting to feel the pain from tariffs