At a Glance

Venus Remedies Ltd (VRL), the injectable specialist with a flair for antibiotics and patents, just served a quarterly cocktail spiked with a 687% YoY profit growth. Q1 FY26 consolidated PAT came in at ₹9.6 Cr on revenues of ₹131.9 Cr, with OPM at a not-so-injectable-friendly 7.6%. The stock trades at ₹530 with a P/E of 15.4, far below its large-cap peers but nowhere near penny-stock cheap. Promoter holding is stable at 41.76%, but there’s a black cloud: a subsidiary with negative net worth (-₹2.95 Cr) screaming for restructuring. Investors now wonder – is this the start of a new growth chapter or just another antibiotic course that ends too soon?

Introduction

In the pharma world, giants like Sun Pharma and Cipla throw billions around like candy, while Venus Remedies quietly cooks up its own mix of antimicrobial resistance (AMR) drugs and meropenem injections. The company’s recent quarter feels like a phoenix moment: profits shot up from ₹1.2 Cr last year to ₹9.6 Cr now. Yet, margins shrank compared to peers, and earnings got a steroid boost from ₹8.7 Cr other income – not exactly recurring magic.

The share price has doubled in a year (+28%), riding on the narrative of debt reduction and focus on niche injectables. But, for every bullish investor, there’s a skeptic pointing at its volatile history and underperforming subsidiary.

Business Model (WTF Do They Even Do?)

Venus Remedies is a research-driven injectable pharmaceutical company, specializing in anti-infectives, oncology, and pain management. They hold 135+ patents and 1,040+ global marketing authorizations, making them a recognized AMR drug player. Their revenue comes from:

- Carbapenem antibiotics (meropenem, imipenem) – big market in hospital infections.

- Oncology injectables – cancer therapies, niche high-margin.

- Other therapeutics – neurology, pain, dermatology.

Exports play a huge role, with strong footprints in regulated and semi-regulated markets. Unlike generic mass producers, Venus focuses on high-value specialized drugs – a niche, but with limited pricing power against global giants.

Financials Overview

Q1 FY26 revenue was ₹131.9 Cr (down from ₹194.9 Cr in Q4 FY25, but up YoY), with Operating Profit of ₹10.1 Cr and OPM at 7.6%. PAT at ₹9.6 Cr is mostly supported by other income.

Annual FY25 saw sales of ₹640 Cr, PAT ₹45 Cr, and EPS ₹33.9. Revenue growth is modest, but profit jumped 64% on the back of debt reduction and cost control.

Key Observations:

- Sales CAGR (5Y) = 14% – not explosive but steady.

- PAT CAGR (5Y) = 69% – high because of a low base.

- Debt = negligible (₹2 Cr) – a big positive.

Commentary: Venus is like that quiet topper – doesn’t brag, but results show up. However, margins are still thinner than a pharma intern’s salary.

Valuation

1. P/E Method

- EPS (FY25) = ₹33.9

- CMP ₹530 → P/E = 15.6x

Peers trade at 18–30x. Venus is slightly undervalued.

2. EV/EBITDA

- FY25 EBITDA ≈ ₹64 Cr

- EV ≈ Market Cap ₹719 Cr + Debt ₹2 Cr – Cash ₹9 Cr ≈ ₹712 Cr

- EV/EBITDA ≈ 11x

3. DCF (Loose)

- Assume growth slows to 10%, discount 12%, terminal 3%.

- Fair Value Range: ₹480 – ₹600

Conclusion: Fairly priced, with limited margin of safety but scope for rerating if margins improve.

What’s Cooking – News, Triggers, Drama

- Subsidiary trouble: Negative net worth of -₹2.95 Cr, restructuring underway.

- AMR focus: Expanding AMR portfolio aligns with global push against superbugs.

- Debt-free status: Now almost debt-free, improving financial flexibility.

- Export markets: Regulatory approvals in new geographies could drive growth.

- Risks: Heavy reliance on hospital injectables, pricing pressures, and regulatory hurdles.

Balance Sheet (Standup Edition)

| Assets | ₹ Cr |

|---|---|

| Total Assets | 716 |

| Fixed Assets | 229 |

| CWIP | 26 |

| Investments | 84 |

| Other Assets | 376 |

| Liabilities | ₹ Cr |

|---|---|

| Borrowings | 2 |

| Other Liabilities | 153 |

| Net Worth | 561 |

Remark: Balance sheet is leaner than ever, debt is almost extinct – the CFO can finally sleep without nightmares.

Cash Flow – Sab Number Game Hai

| Year | Ops (₹ Cr) | Investing (₹ Cr) | Financing (₹ Cr) |

|---|---|---|---|

| FY23 | 37 | -58 | -1 |

| FY24 | 37 | -8 | -1 |

| FY25 | 86 | -77 | -1 |

Remark: Positive operating cash, but investing outflows suggest ongoing R&D and capacity expansions.

Ratios – Sexy or Stressy?

| Metric | Value |

|---|---|

| ROE | 7.2% |

| ROCE | 11.1% |

| P/E | 15.4x |

| PAT Margin | 7% |

| D/E | 0.0x |

Remark: Debt-free is sexy, but low ROE is a mood killer.

P&L Breakdown – Show Me the Money

| Year | Revenue ₹ Cr | EBITDA ₹ Cr | PAT ₹ Cr |

|---|---|---|---|

| FY23 | 552 | 60 | 27 |

| FY24 | 596 | 64 | 28 |

| FY25 | 640 | 64 | 45 |

| TTM | 671 | 62 | 54 |

Remark: Slow revenue growth, but PAT is catching up – efficiency at work.

Peer Comparison

| Company | Rev (₹ Cr) | PAT (₹ Cr) | P/E |

|---|---|---|---|

| Sun Pharma | 53,777 | 11,463 | 34x |

| Dr. Reddy’s | 33,520 | 5,656 | 18x |

| Cipla | 27,811 | 5,379 | 22x |

| Venus Remedies | 671 | 54 | 15x |

Remark: Venus is David in a world of Goliaths – niche player, smaller base, cheaper multiple.

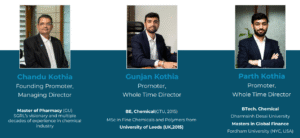

Miscellaneous – Shareholding, Promoters

- Promoters: 41.76% (stable – they’re not running away)

- FIIs: 2.25% (slightly up)

- DIIs: 0.11% (basically absent)

- Public: 55.9% (retail-driven)

EduInvesting Verdict™

Venus Remedies is like that underdog medical student – not the top ranker, but quietly building a strong portfolio. The company has cleaned up its debt, expanded patents, and maintained a strong promoter grip. However, margin compression and subsidiary losses act as speed breakers.

SWOT

- Strengths: Debt-free, strong patent portfolio, AMR focus, export reach.

- Weaknesses: Low ROE, dependency on few product categories, subsidiary drag.

- Opportunities: AMR drugs could be the next big thing globally.

- Threats: Regulatory risks, pricing pressure from global generics.

Final Word:

Venus Remedies offers a steady, niche pharma play. It’s not a multibagger rocket, but neither is it a value trap. Investors looking for low-debt, patent-rich small-cap pharma might find this stock worth watching – just keep an eye on subsidiary restructuring and margin trends.

Written by EduInvesting Team | 01 Aug 2025

SEO Tags

Venus Remedies, Pharma Small Cap, AMR Drugs, Injectables, Q1 FY26 Results Analysis