EduInvesting.in | May 9, 2025

We all know that artificial intelligence (AI) is the buzzword of the decade. Whether it’s chatbots, self-driving cars, or predictive analytics, AI is everywhere. But the real question is: are AI stocks the next big investment opportunity, or are we just in the midst of a tech bubble?

With companies like NVIDIA, Alphabet (Google), and Microsoft leading the charge, AI is being positioned as the future of tech. But before you dive headfirst into AI stocks, let’s take a step back and ask some important questions. Are these stocks actually worth your hard-earned money, or are they simply benefiting from the hype machine?

Let’s break down the AI stock explosion and determine whether this is the next Tesla or just another overhyped trend.

🤖 What’s Driving the AI Boom?

There’s no denying that AI has exploded onto the scene, but why now? What’s changed?

1. Breakthrough Tech

AI isn’t new, but recent breakthroughs in machine learning and natural language processing (NLP) have pushed AI into the mainstream. Take OpenAI’s GPT models, for example — they’re changing how we think about chatbots and automation. AI has gone from science fiction to everyday reality, and investors are taking notice.

2. Unprecedented Investment

AI companies are raking in cash from both public and private investors. In 2024 alone, venture capital funding for AI startups soared to over $30 billion, a 50% increase from the previous year. Big tech companies are doubling down on AI, and even traditional automakers and financial institutions are betting big on the technology.

3. AI in Everything

From healthcare to finance, AI is infiltrating every industry. It’s optimizing operations, increasing productivity, and even driving the next wave of tech innovation. AI is not just about robots anymore; it’s about transforming industries.

🏦 Top AI Stocks — The Heavy Hitters

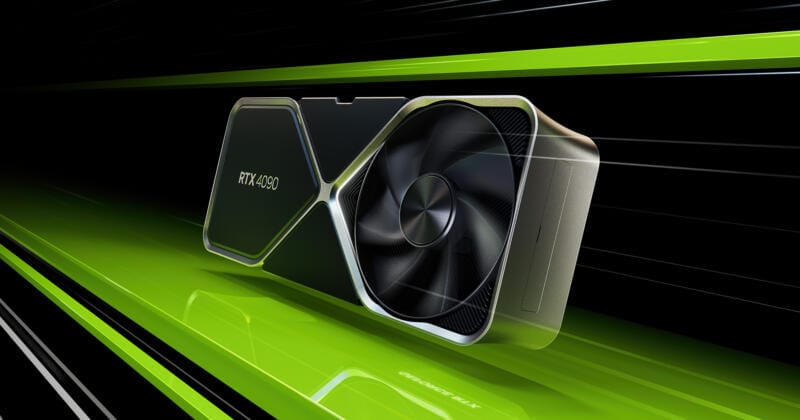

NVIDIA: The King of AI Chips

Let’s talk about NVIDIA. If there’s one company that’s synonymous with AI, it’s NVIDIA. The company is the leading producer of graphics processing units (GPUs), which are the backbone of AI computing. Whether it’s training deep learning models or running complex simulations, NVIDIA’s chips are at the heart of AI innovation.

What’s So Special About NVIDIA?

- Massive Market Share: NVIDIA controls 80% of the GPU market, which means its chips power the vast majority of AI systems.

- Diversification: Beyond gaming and GPUs, NVIDIA is investing in data centers and cloud computing, both of which are fueling the AI boom.

- Financials: NVIDIA’s stock price has skyrocketed over the past few years, and with AI adoption on the rise, its growth potential seems almost limitless.

But can NVIDIA keep up its momentum, or is the stock price too high already? Time will tell.

Alphabet (Google): AI Everywhere, All the Time

Next up, we have Alphabet (Google), which is using AI in everything from search to advertising to self-driving cars. In fact, Alphabet has one of the largest AI research teams in the world. With products like Google Assistant, Google Search, and Waymo (its self-driving car division), Alphabet