This live blog is no longer being updated. To find the latest Stock Market Today, click here.

Good afternoon. The market is closed. More on today below.

Update: 4:00 p.m. ET

Market Roundup: End of the Week

The market is closed for the week. Let’s just call it one strange week.

Today, the Dow (+0.08%) remained the sole index in the green, buoyed by UnitedHealth (UNH) , which had a fantastic day. It didn’t quite make a new record today, but there’s always next week.

The other three major indexes weren’t so lucky, on the other hand. The Russell 2000 (-0.47%), the Nasdaq (-0.40%), and S&P 500 (-0.29%) all fell.

Still, it was a great week for stocks, even in spite of a few off putting economic reports. Here’s how the week-over-week shook out when you zoom out a bit:

Update: 2:25 p.m. ET

Afternoon Headlines: Trump, Ad Nauseam

President Donald Trump just landed in Alaska, where he’s expected to meet with Russian President Vladimir Putin.

Long-foreshadowed, the meeting of the two global leaders might settle a key piece of geopolitical instability, especially in Europe. The two are expected to talk shop on the Russian-Ukraine conflict, hopefully opening the door to talks between the U.S., Russia, and Ukraine. However, that’s a big if. And if there isn’t a breakthrough, it’s hard telling how President Trump might respond (although, some have speculated the retaliation could be epic.)

It’s not his only touch point in the news today. The President said that semiconductor import tariffs are “coming soon”, with rates which can only be speculated to exceed 100%. The same might in the cards for pharmaceuticals and other key industries, which the President is seeking to reshore at any cost to businesses or consumers.

Last of all, Bloomberg reports that Trump aides have scored over 550 businesses on their support for the recently-passed Republican tax plan, assembling a “loyalty list.” The “One Big Beautiful Bill Act” has been poorly-received by Americans across public opinion polls run by Pew Research, Morning Consult, and YouGov. It remains to be seen how that information will be used by the administration.

Update: 1:15 p.m. ET

Mid-Day Movers: Solar and health move markets

Indexes might be down, but the same can’t be said for solar, biotech/pharma, and health insurance names. Today, they’re putting themselves in a class all their own.

Solar names like Sunrun (RUN) (+33%), health insurance giant UnitedHealth (UNH) (+11%), and pharma name Arrowhead Pharmaceuticals (ARWR) (+8%) are sitting atop the movers.

You can read the whole story here.

Update: 12:07 p.m. ET

Fed’s Goolsbee Adds Skepticism to September Rate Cut

Chicago Fed President and FOMC voter Austan Goolsbee has added caution to the conversation around the Fed’s September meeting, where investors widely anticipate a 25 basis point (0.25%) cut.

The September meeting has been complicated by confounding economic data. On one hand, the labor market seems to be seizing up. On the other hand, the risk of reaccelerating inflation seems increasingly real, as evidenced by the higher-than-anticipated Producer Price Index (PPI) report on Thursday.

Goolsbee told CNBC, “We’ve got to get some clarity from the numbers.”

Update: 10:42 a.m. ET

UnitedHealth Soars, Leading Dow Higher

While the broader market might be down, there’s one stock that’s really shaping the market around itself today: UnitedHealth (UNH) (+13%). It’s having such a big impact that it’s actually lifting the Dow today; it’s the sole index in the green on the day.

The worst-performing stock in the Dow — and among the worst in the S&P 500 — is soaring after it was revealed that institutional investors nabbed shares of the ailing insurer en masse last quarter.

Among them were Berkshire’s Warren Buffett and Michael Burry of Housing Crash stardom. You can read more about Berkshire’s big buy here.

Update: 10:08 a.m. ET

Data Drop: Michigan Consumer Sentiment; Business Inventories

Friday is usually a quiet one for earnings, but today, investors have had no shortage of economic data to pore over. Most of that has hit the wire now.

Rounding out some of the earlier day reports, we now have preliminary data from the Michigan Consumer Sentiment Survey. All figures are for August:

- Consumer Sentiment Prelim: 58.6 [Prev: 61.7] [Consensus: 62]

- Current Economic Conditions: 60.9 [Prev: 68.0] [Cons: 67.9]

- Index of Consumer Expectations: 57.2 [Prev: 57.7] [Cons: 58.5]

- Inflation Expectations: +4.9% [Prev: +4.5%]

- 5-Yr Expectations: +3.9% [Prev: +3.4%]

Inflation expectations rose month-over-month, while perceived consumer conditions (and future expectations) decayed in the preliminary count.

Aside from the UM survey, we also scored some business inventory information:

- Business Inventories: +0.2% MoM [Prev: 0%] [Cons: +0.2%]

Thus far, the data that we have seen has sent stocks tumbling. It’s only the Dow (+0.10%) that’s up on the day now, while the other three indexes have reversed their earlier gains.

Update: 9:15 a.m. ET

Data Drop: Retail Sales, Export/Import Prices, Industrial Production

Stocks are stagnant after the first swath of economic data reports dropped. Here are the highlights from that:

- Retail Sales (Jul): +0.5% MoM; +3.9% YoY [Prev: +0.6% MoM; +3.9% YoY] [Consensus: +0.5%]

- Export Prices (Jul): +0.1% MoM; +2.2% YoY [Prev: +0.5% MoM; +2.6% YoY]

- Import Prices (Jul): +0.4% MoM; -0.2% YoY [Prev: -0.1% MoM; -0.5% YoY]

- NY Empire State Manufacturing Index: 11.9 [Prev: 5.5]

- Industrial Production (Jul): -0.1% MoM; +1.4% YoY [Prev: +0.4% MoM, +0.8% YoY]

- Manufacturing Production (Jul): UNCH MoM; +1.4% YoY [Prev: +0.3% MoM; +0.8% YoY]

Retail sales rose for a second consecutive month.

More economic data is incoming. We will provide these updates as they arrive.

Update: 7:33 a.m. ET

Earnings Today: Pandora, Foot Locker, Sphere Entertainment

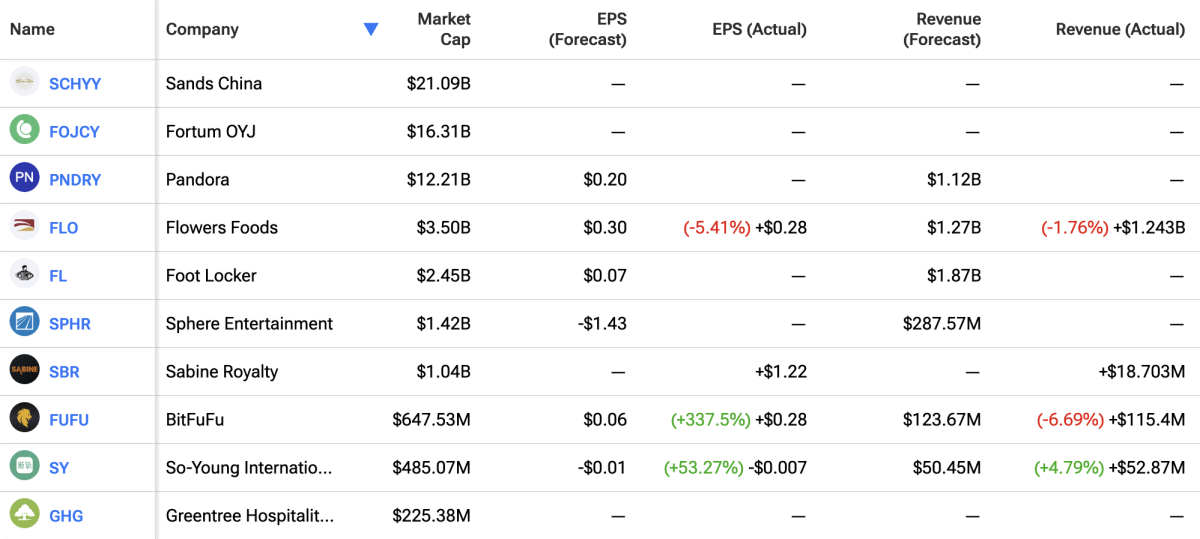

Bookend days are generally quiet for earnings. Today’s no difference. There are 13 earnings reports today. Here are the top ten, sorted by market cap, sourced from TipRanks:

Economic Data

In roughly an hour, investors will get slammed with the most important economic reports of the day. Per data from TE, here are the ones to watch:

8:30 a.m. ET

- Retail Sales [Prev: +0.6% MoM; +3.9% YoY] [Consensus: +0.5%]

- Export / Import Prices

9:15 a.m. ET

- Industrial Production [Prev: +0.3%] [Consensus: 0%]

10:00 a.m. ET

- Michigan Consumer Sentiment Preliminary for August [Prev: 61.7] [Consensus: 62]

- Michigan Inflation Expectations [Prev: 4.5%]

- Michigan 5-Yr Inflation Expectations [Prev: 3.4%]

- Business Inventories [Prev: UNCH] [Consensus: +0.2%)]

4:00 p.m. ET

- Net Long-Term TIC Flows [Prev: $259.4 billion]

- Foreign Bond Investment [Prev: $146.3 billion]

- Overall Net Capital Flows [Prev: $311.1 billion]