At a Glance

RR Kabel lit up the earnings board in Q1 FY26 with revenue ₹2,058.6 Cr (+13.9% YoY) and PAT ₹89.8 Cr (+39.4% YoY). EBITDA surged 50% YoY to ₹143 Cr as wires & cables (W&C) segment rode on strong demand and better contribution margins. However, the FMEG (Fans, Switches, Lighting) business remains a problem child, still making losses though bleeding less than last year. Margins improved YoY but slipped sequentially. Stock trades at ~P/E 30, not cheap, but the growth narrative keeps it attractive.

Introduction

Once a humble wire maker, RR Kabel is now a diversified electricals player aiming to be the Havells-killer. Q1 numbers show the core W&C business flexing muscles with 16% revenue growth and expanding margins. The FMEG segment? Think of it as the cousin who always needs money – losses narrowed but it still drags. Working capital days improved (52 from 56), export share jumped to 29% from 24%, and capex is ramping up. Investors love the growth story, but FMEG must turn profitable to justify the steep multiples.

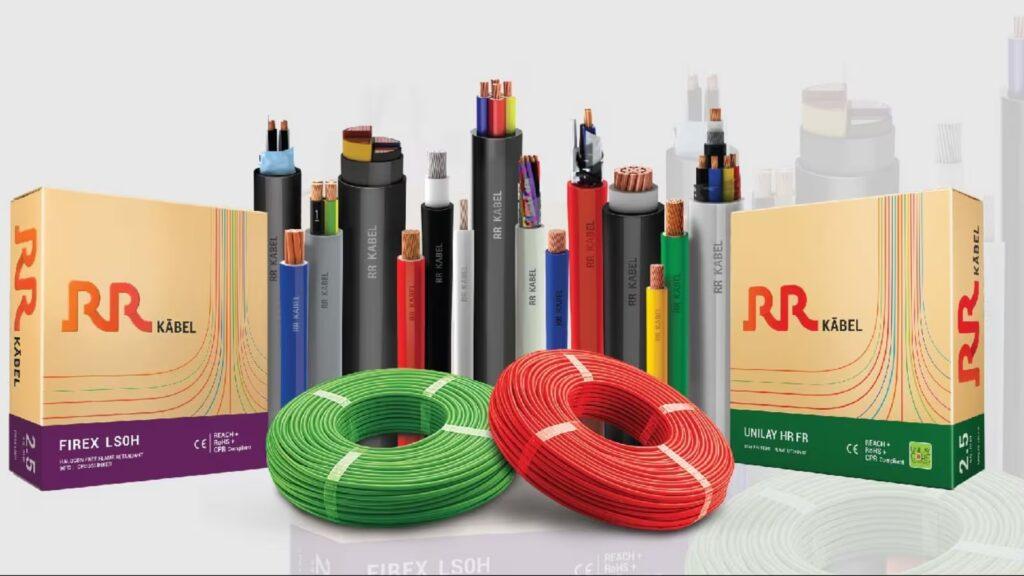

Business Model (WTF Do They Even Do?)

RR Kabel operates in two segments:

- Wires & Cables (89% of revenue) – House wires, power cables, specialty cables. High demand from housing, infra, and renewables.

- FMEG (11% revenue) – Fans, lighting, switches – a high-potential but currently loss-making vertical.

They focus on branding, distribution expansion, and exports (now ~30% of revenue). Think of them as the fast-growing challenger in the electrical space.

Financials Overview

Q1 FY26 Results

- Revenue: ₹2,058.6 Cr (+13.9% YoY, -7.2% QoQ)

- EBITDA: ₹143.1 Cr (+49.9% YoY, -26.9% QoQ)

- EBITDA Margin: 7.0% (vs 5.3% YoY)

- PAT: ₹89.8 Cr (+39.4% YoY, -30.5% QoQ)

- EPS: ₹7.8

Commentary: YoY growth impressive, but sequential margins dipped due to higher input costs and seasonal factors.

Valuation

- P/E Method

FY25 EPS ₹27 × fair P/E 25 = ₹675/share - EV/EBITDA Method

FY25 EBITDA ₹488 Cr × 15 = ₹7,320 Cr → per share ≈ ₹730 - Book Value

BV ₹380 × P/B 3 = ₹1,140

🎯 Fair Value Range: ₹675 – ₹1,140 (current levels moderately valued).

What’s Cooking – News, Triggers, Drama

- W&C demand strong, exports gaining share.

- FMEG losses narrowing but needs to flip to green.

- Working capital improving, cash reserves up.

- Capex to scale capacity, product launches in pipeline.

Balance Sheet

| Assets | ₹3,517 Cr |

|---|---|

| Liabilities | ₹1,364 Cr |

| Net Worth | ₹2,153 Cr |

| Borrowings | ₹222 Cr |

Auditor Roast: “Debt is low, equity rising. But inventory pile-up needs watching.”

Cash Flow – Sab Number Game Hai

| Year | Ops | Investing | Financing |

|---|---|---|---|

| FY23 | ₹454 Cr | -₹334 Cr | -₹102 Cr |

| FY24 | ₹339 Cr | -₹83 Cr | -₹205 Cr |

| FY25 | ₹494 Cr | -₹169 Cr | -₹191 Cr |

Commentary: Strong operational cash flows, reinvested back into expansion.

Ratios – Sexy or Stressy?

| Ratio | Value |

|---|---|

| ROE | 19.4% |

| ROCE | 15.6% |

| P/E | ~30 |

| PAT Margin | 4.4% |

| D/E | 0.1 |

Roast: “Returns decent, leverage low – but margins still too slim for the hype.”

P&L Breakdown – Show Me the Money

| Year | Revenue | EBITDA | PAT |

|---|---|---|---|

| FY23 | ₹6,595 Cr | ₹463 Cr | ₹298 Cr |

| FY24 | ₹7,618 Cr | ₹488 Cr | ₹312 Cr |

| Q1 FY26 (TTM run rate) | ₹8,200 Cr+ | ₹550 Cr+ | ₹360 Cr+ |

Commentary: Growth consistent; margins still thin.

Peer Comparison

| Company | Rev (₹Cr) | PAT (₹Cr) | P/E |

|---|---|---|---|

| Havells | 17,000 | 1,100 | 65 |

| Polycab | 16,000 | 1,500 | 45 |

| RR Kabel | 7,600 | 312 | 30 |

Commentary: RR Kabel trades cheaper than Havells but richer than legacy cable peers.

Miscellaneous – Shareholding, Promoters

- Promoters: ~62%

- FIIs: Rising (positive sign)

- DIIs: Stable

- Public: ~20%

Strong promoter skin in the game.

EduInvesting Verdict™

RR Kabel’s Q1 FY26 shows strong W&C growth, improving margins, and narrowing FMEG losses. Working capital discipline and cash flows are solid. However, thin PAT margins and sequential decline in profitability keep expectations in check.

SWOT Quickie

- Strengths: Fast growth, strong brand, export push.

- Weaknesses: Thin margins, FMEG losses.

- Opportunities: Domestic housing boom, exports, premium products.

- Threats: Raw material volatility, intense competition.

Final Word: RR Kabel remains a growth play in the electricals sector. Keep an eye on FMEG turnaround – it’s the joker that could turn this into an ace.

Written by EduInvesting Team | 31 July 2025SEO Tags: RR Kabel, Wires & Cables, FMEG, Financial Analysis