1. At a Glance

RVNL is the Ministry of Railways’ in-house EPC contractor — doubling lines, electrifying tracks, building bridges, and occasionally trying not to derail budgets. On paper, the 10-year sales CAGR is a robust20%, but the recent TTM sales are actuallydown3%. Profitability? Slipping like a passenger on a wet platform — OPM has been stuck at5–6%for years. With a57.6xTTM P/E, it’s valued like a high-growth tech startup, but operates with PSU efficiency… which is to say, growth comes on its own schedule.

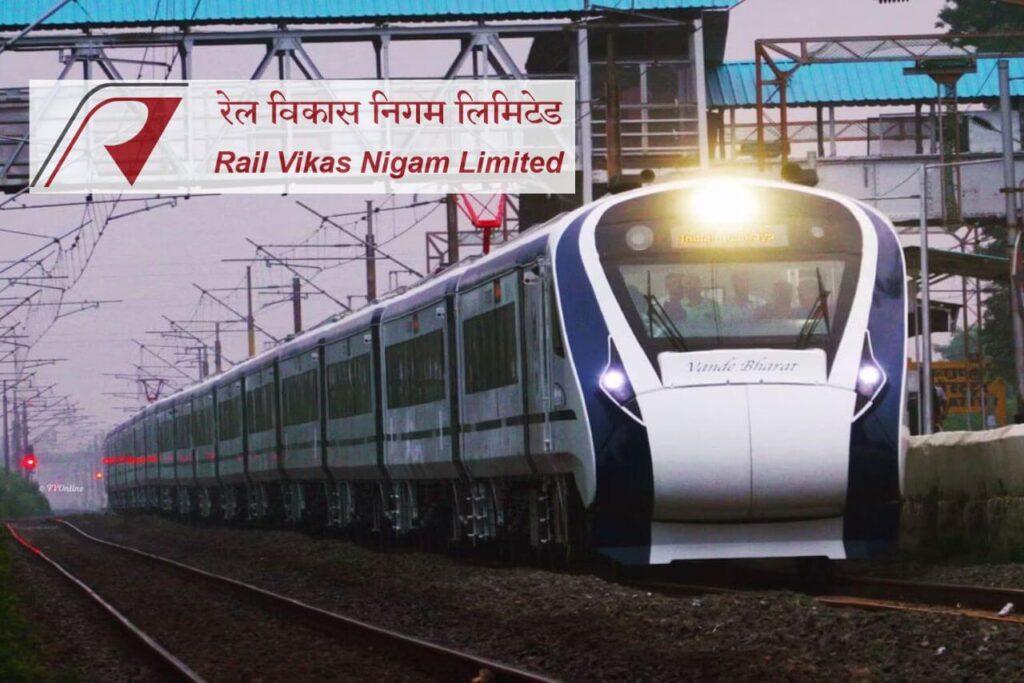

2. Introduction

Imagine if your boss was also your only client, and also the Ministry of Railways. That’s RVNL’s life. Incorporated in 2003, it was created to execute mega railway infrastructure projects the government didn’t trust anyone else with. The model is simple:

- MoR hands them a project.

- RVNL executes it (sometimes with subcontractors).

- They get reimbursed + margins.

That “margin” is where the romance dies — because 5–6% OPM means they’re essentially a break-even machine with a side hustle inother income.

Recent quarters haven’t been kind. Q1 FY26 saw revenue of ₹3,925 Cr (down ~4% YoY) and net profit of ₹128 Cr (down ~40% YoY). But the market doesn’t seem to care — PSU rail stocks are the poster boys of “nation building” trades, and traders are still boarding this train.

3. Business Model (WTF Do They Even Do?)

RVNL’s to-do list from the Ministry of Railways includes:

- Doubling & Gauge Conversion:Turning single tracks into multi-lane highways for trains.

- New Lines:Greenfield rail routes.

- Electrification:Taking lines off diesel.

- Major Bridges:Over rivers, valleys, and occasionally over political troubles.

- Workshops & Production Units:For rail stock upkeep and manufacturing.

- Freight Revenue Sharing:Per concession agreements — a nice little annuity stream.

Roast: They’re technically in “construction,” but since they only work for the Railways, it’s less “competitive bidding” and more “government’s

favourite child gets pocket money.”

4. Financials Overview

- Revenue (TTM):₹19,758 Cr (down from ₹21,879 Cr in FY24).

- EBITDA (TTM):₹981 Cr, margin ~5%.

- PAT (TTM):₹1,192 Cr (down from ₹1,551 Cr in FY24).

- Other Income (TTM):₹1,084 Cr (yes, almost equal to EBITDA — think about that).

- ROE:14%, ROCE: 14.7%.

- Debt:₹5,419 Cr — not scary for infra, but notable.

P/E Recalc:Q4 FY25 EPS = ₹2.20 → Annualised EPS = ₹8.80 → Forward P/E = ₹329 / ₹8.80 ≈37.4x(a lot saner than TTM 57.6x).

5. Valuation (Fair Value RANGE only)

| Method | Assumptions | FV |

|---|---|---|

| P/E | Forward EPS ₹8.80 × 25–35x | ₹220–₹308 |

| EV/EBITDA | EBITDA ₹981 Cr × 12–15x | ₹240–₹300 |

| DCF | 6% growth, 11% WACC | ₹230–₹310 |

FV Range:₹220 – ₹310

Disclaimer:This FV range is for educational purposes only and is not investment advice.

6. What’s Cooking – News, Triggers, Drama

- Q1 FY26 Results:Revenue ₹3,925 Cr, NP ₹128 Cr — margins crushed to1% OPMthis quarter.

- JV Shareholding Reshuffle:In Kinet Railway Solutions Pvt Ltd — RVNL now at 25%.

- Order Book:Robust, with multiple electrification and doubling projects in pipeline.

- Rail Capex Theme:Government still pumping money