1. At a Glance

India’s second-largest wire & cable manufacturer with a growing presence in FMEG (fans, switches, appliances). FY25 revenue of ₹7,618 Cr, PAT ₹312 Cr. Stock trading at 51x earnings and a juicy capex pipeline of ₹1,450 Cr to scale by FY28.

2. Introduction with Hook

If Polycab is the captain of India’s cable ship, RR Kabel is the rogue pirate with a private equity compass, boardroom mutinies, and revenue currents that have doubled since FY21.

- Market Share: 40% in Indian cable space

- PAT Growth: 64% YoY in Q4 FY25

- 3-Year Sales CAGR: 20%

But with a recent CEO firing, tax raids, and litigation, this wire is anything but low resistance.

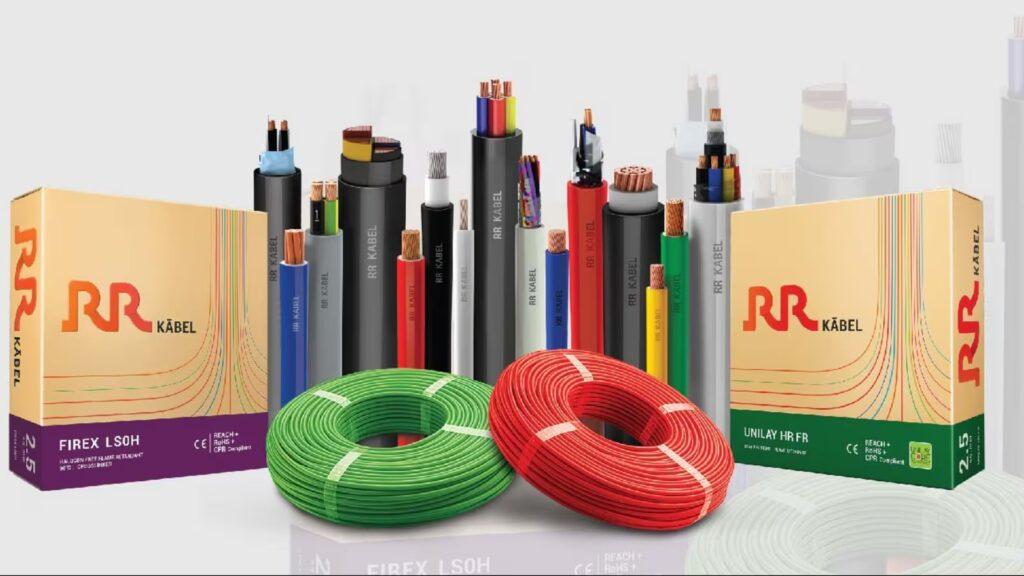

3. Business Model (WTF Do They Even Do?)

Two segments:

A) Wires & Cables (Main Dish):

- House wires, industrial & solar cables

- 80%+ of revenue

- Core manufacturing; high-volume, low-margin

B) FMEG (Fancy Dessert):

- Fans, lights, heaters, modular switches

- Still a sidekick, but growing

- High brand push (T20 tie-ups, influencer campaigns)

USP: Diverse SKUs, R&D investments, backward integration. Plus, global footprints in ~70 countries.

4. Financials Overview

| Metric | FY21 | FY22 | FY23 | FY24 | FY25 |

|---|---|---|---|---|---|

| Revenue (₹ Cr) | 2,724 | 4,386 | 5,599 | 6,595 | 7,618 |

| PAT (₹ Cr) | 135 | 214 | 190 | 298 | 312 |

| EPS (₹) | 56.6 | 89.4 | 19.8 | 26.4 | 27.6 |

| ROE (%) | 16 | 16 | 16 | 15 | 15.2 |

| OPM (%) | 9 | 7 | 6 | 7 | 6 |

Growth is electric, but margins are flickering like an old tubelight.

5. Valuation

Valuation models scream premium:

- Current P/E: 51x

- Peer Median P/E: ~36x

- EV/EBITDA: ~24x

Fair Value Range (12M):

- Base Case: ₹1,180

- Bull Case (FMEG scaling): ₹1,520

- Bear Case (litigation risk + margin pressure): ₹1,050

It’s trading at 7x Book Value. Cheap? Nah. Deserved? Maybe.

6. What’s Cooking – News, Triggers, Drama

- Boardroom Drama: CEO fired. Chairman resigned. Lawsuits flying like sparks during Diwali.

- Capex Plan: ₹1,450 Cr to expand cable capacity by 42,000 MT by FY28.

- Litigation: Ex-CEO suing for ₹25 Cr. Income tax raids. Insider trading report filed.

- Marketing Push: IPL partnerships, Firex LS0H launch, branding blitz across switches & lighting.

So yes, a LOT is cooking — just not sure if it’s biryani or bombay firewire.

7. Balance Sheet

| Metric (₹ Cr) | FY21 | FY22 | FY23 | FY24 | FY25 |

|---|---|---|---|---|---|

| Equity | 24 | 24 | 48 | 56 | 57 |

| Reserves | 1,023 | 1,226 | 1,372 | 1,772 | 2,096 |

| Borrowings | 507 | 533 | 580 | 360 | 290 |

| Total Liabilities | 1,715 | 2,051 | 2,634 | 2,869 | 3,517 |

| Fixed Assets + CWIP | 406 | 441 | 561 | 699 | 1,004 |

Key Takeaway: Capex-heavy, but funded through internal accruals + modest debt. Balance sheet = lean but scaling.

8. Cash Flow – Sab Number Game Hai

| ₹ Cr | FY21 | FY22 | FY23 | FY24 | FY25 |

|---|---|---|---|---|---|

| CFO | -71 | 98 | 454 | 339 | 494 |

| CFI | -6 | -63 | -334 | -84 | -169 |

| CFF | 74 | -32 | -102 | -205 | -191 |

| Net Cash | -3 | 4 | 19 | 50 | 134 |

Cash whispers: Business is throwing off cash like a pro, and reinvesting wisely. No frivolous dividend boosts.

9. Ratios – Sexy or Stressy?

| Metric | FY21 | FY22 | FY23 | FY24 | FY25 |

|---|---|---|---|---|---|

| ROCE (%) | 15 | 18 | 16 | 22 | 20 |

| ROE (%) | 16 | 16 | 16 | 15 | 15.2 |

| Debtor Days | 56 | 43 | 39 | 35 | 39 |

| CCC (Days) | 128 | 98 | 72 | 67 | 54 |

Efficiency metrics are clean. Payables increasing, inventory efficient — finance team deserves halwa.

10. P&L Breakdown – Show Me the Money

| Metric (₹ Cr) | FY21 | FY22 | FY23 | FY24 | FY25 |

|---|---|---|---|---|---|

| Sales | 2,724 | 4,386 | 5,599 | 6,595 | 7,618 |

| EBITDA | 232 | 304 | 323 | 462 | 487 |

| EBITDA Margin (%) | 9% | 7% | 6% | 7% | 6% |

| PAT | 135 | 214 | 190 | 298 | 312 |

| EPS (₹) | 56.6 | 89.4 | 19.8 | 26.4 | 27.6 |

Margins: Under pressure, but steady growth keeps the wires humming.

11. Peer Comparison

| Company | Sales (₹ Cr) | PAT (₹ Cr) | ROCE (%) | P/E | CMP/BV |

|---|---|---|---|---|---|

| Polycab | 22,408 | 1,931 | 29.7 | 52 | 10.4 |

| KEI Industries | 9,735 | 695 | 21.3 | 51 | 6.2 |

| RR Kabel | 7,618 | 312 | 19.8 | 51 | 7.2 |

| Finolex | 5,319 | 701 | 17.6 | 20 | 2.6 |

Conclusion: RR Kabel is the flashy middle child — growing, branded, but not cheap.

12. Miscellaneous – Shareholding, Promoters

- Promoter Holding: Stable at ~61.8%

- FIIs: 7.17% (rising)

- DIIs: 14.75% (very bullish)

- Public: Shrinking exposure — down to 16.27%

- No. of Shareholders: 1.46 lakh

Red Flag: Insider trading probe + ex-CEO litigation could ruffle governance feathers.

13. EduInvesting Verdict™

RR Kabel is a power-play stock — backed by brand, growth, and infra tailwinds. But the ongoing boardroom drama, valuation heat, and FMEG scaling risk mean it’s not a slam dunk. Keep this one on a “surge protector” — powerful but unpredictable. Plug in wisely.

Metadata

Written by EduInvesting Team | July 15, 2025

Tags: Wires, Cables, FMEG, Capex, Governance, Infra, Midcap Mania