1. At a Glance

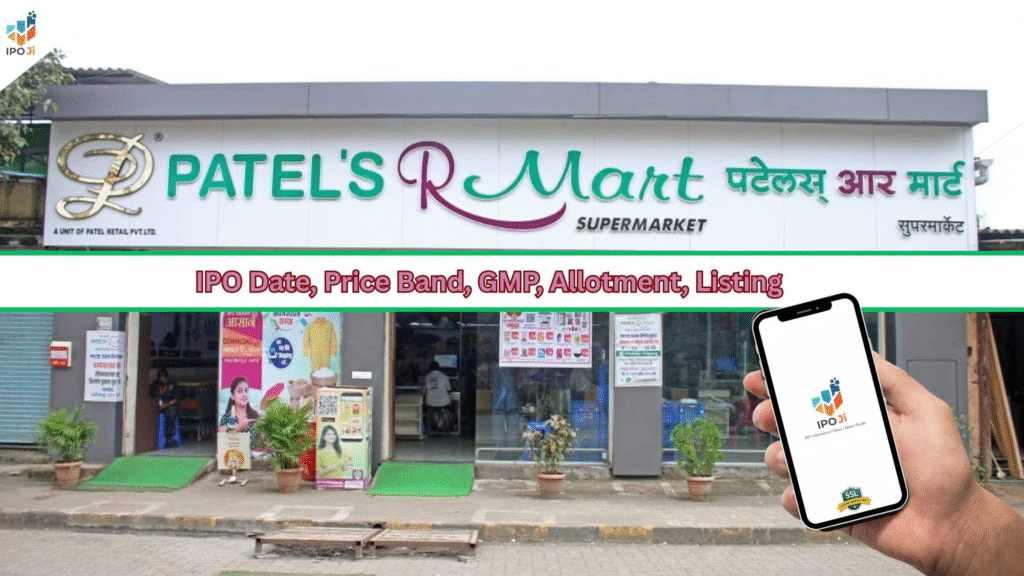

Patel Retail wants ₹242.76 crore from investors — with ₹217 Cr fresh issue (to pay debts and fill working capital) and a token ₹25 Cr OFS (because why not?). Price band ₹237–₹255 per share, market cap ~₹852 Cr. The company runs43 supermarkets under “Patel’s R Mart”in Tier-III towns of Maharashtra & Gujarat. Revenue is flat, PAT grew 12% in FY25, but margins are thinner than Amul butter spread in a hostel mess. Post-IPO P/E? A chunky34x. Retail business, pun intended, is looking expensive.

2. Introduction

Retail is sexy. D-Mart is a stock market cult, Reliance Retail is everyone’s neighborhood landlord, and even Avenue Supermarts’ founder Radhakishan Damani is practically worshipped by investors. Into this crowded mandir walksPatel Retail Ltd., waving its IPO prospectus like a prayer offering.

The story: Started in 2008 with one supermarket in Ambernath, Maharashtra. Now, 43 stores, ~1.8 lakh sq. ft. retail area, private label brands (“Patel Fresh”, “Indian Chaska”, “Blue Nation”, “Patel Essentials”), and three processing facilities — including anagri-cluster in Kutchwith cold storage, dry warehouse, and fruit pulp unit. So yes, they’re not just selling rice, dal, and masala — they’re also trying to become a mini FMCG producer.

But here’s the catch:Revenue in FY25 was ₹826 Cr vs ₹818 Cr last year— basically flat. PAT improved 12% (₹25 Cr vs ₹23 Cr), thanks to margin improvements. But debt is heavy (₹181 Cr) andDebt/Equity at 1.34is nothing to be proud of. They want IPO money to pay down ₹59 Cr of loans and add ₹115 Cr to working capital. Translation: “Fund our store shelves, please.”

The retail sector is brutally competitive. Kirana shops, Reliance Smart, D-Mart, Tata Star, even JioMart online — everyone wants your monthly grocery budget. Patel’s pitch? “Tier-III towns. Smaller cities. Hyper-local focus.” Noble strategy, but does it deserveD-Mart valuations? Spoiler: not really.

3. Business Model (WTF Do They Even Do?)

Patel Retail is aregional supermarket chainwith ambitions of becoming a hybrid of D-Mart + FMCG.

Core segments:

- Supermarkets: 43 outlets, mainly Thane & Raigad, Maharashtra.

- Private Labels: Patel Fresh (food), Indian Chaska (spices), Blue Nation (menswear), Patel Essentials (home goods). Private labels usually mean better margins.

- Processing Facilities:

- Ambernath + Kutch (pulses, spices, peanuts, fruit pulp, cold storage). This backward integration supports private labels.

- Rental Income: They even lease space inside stores to vendors (classic “sublet your real estate” trick).

So in theory, they’re not just retailers — they’re also mini-manufacturers, distributors, and landlords. In practice? Scale is too small to compete with national chains.

4. Financials Overview

| Metric | FY25 (Latest) | FY24 | FY23 | YoY % | 2Y CAGR % |

|---|---|---|---|---|---|

| Revenue | ₹826 Cr | ₹818 Cr | ₹1,020 Cr | +1% | -10% |

| EBITDA | ₹62.43 Cr | ₹55.84 Cr | ₹43.24 Cr | +12% | +20% |

| PAT | ₹25.28 Cr | ₹22.53 Cr | ₹16.38 Cr | +12% | +24% |

| EPS (₹) Pre | 10.16 | 9.07 | 6.60 | +12% | +24% |

| EPS (₹) Post | 7.57 | — | — | — | — |

👉Commentary: Revenue barely moved, but PAT rose. PAT margin 3%, EBITDA margin 7.6%. For comparison, D-Mart’s PAT margin is ~5%, EBITDA ~10%. Patel is half a D-Mart — but IPO asks you to pay almost D-Mart multiples.

5. Valuation (Fair Value Range Only)

- P/E Method:Post-issue EPS = ₹7.57.At ₹237–₹255 → P/E = 31.3x–33.7x.Peers like V-Mart trade 25–28x, D-Mart at ~60x. Patel in between, but scale is nowhere close.

- EV/EBITDA Method:EBITDA FY25 = ₹62 Cr.EV ≈ Market Cap ₹852 Cr + Debt ₹181 Cr ≈ ₹1,033 Cr.EV/EBITDA ≈ 16.5x. Peers 12–18x.

- DCF (Assume 12% growth, 12% WACC, 3% terminal)→ ~₹160–₹190/share.

🎯Fair Value Range (Educational only): ₹160–₹190/share.IPO band ₹237–₹255 is expensive.

6. What’s Cooking – News, Triggers, Drama

- Expansion Play: IPO