🎭 Previously on “As the BSE Turns”…

Once upon a time (okay, 1992), a textile company called Overseas Synthetics was born. By 2019, it was basically a sleepy relic—until one Mr. Vijay N. Dhawangale stepped in and said, “Let’s not sell cloth anymore. Let’s save lives.” Enter: corporate makeover.

The company got a new name (One Global Service Provider), a new identity (healthcare!), and by 2025, a new obsession: merging with a private diagnostics player called Plus Care. Plot twist: it wasn’t just a merger—it was a reverse merger. Think of it as Plus Care jumping into a listed company’s body like it’s a Bollywood body-swap movie.

🎬 The Real Story – No Boardroom Buzzwords, Just Facts (and Fun)

💉 Who is Plus Care?

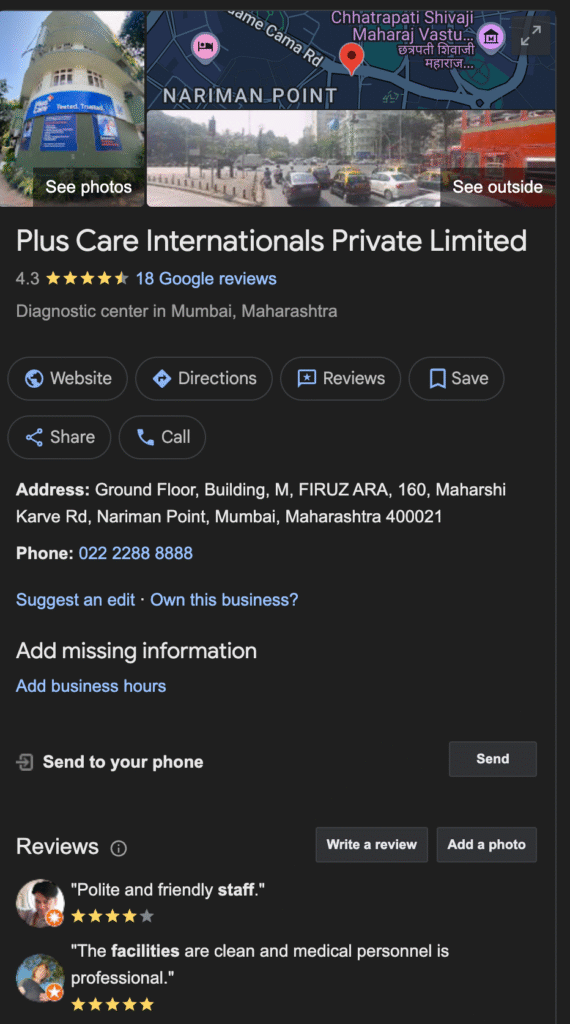

An unlisted diagnostics firm from Maharashtra with fancy NABL-accredited labs and government healthcare projects under its belt. Started in 2018, wanted to scale big, but IPOs are expensive and boring.

👔 Who is One Global?

Formerly a textile firm, now a healthcare cosplayer with a BSE listing. Perfect vehicle for a reverse merger.

💍 The Merger Proposal: A Reverse Wedding

In Feb 2023, One Global said, “We’ll marry you, Plus Care—but no cash, only shares.” They agreed to issue:

1,202 shares of One Global for every 1 share of Plus Care.

Why such a huge number? Because Plus Care had only ~10,000 shares. So they ended up issuing 1.24 crore fresh shares to the Plus Care gang.

End Result: Plus Care became the controlling shareholder of One Global. It’s like moving into someone’s house and then owning 65% of it by dinner time.

🧾 The Legal Checklist (because India loves its paperwork)

- ✅ Board nod: Both boards approved the scheme by March 2023.

- ✅ SEBI & BSE blessings: No objections. (Translation: “We saw nothing wrong, carry on.”)

- ✅ NCLT Showdown: March 2024 – Tribunal approved the plan but said “hold shareholder and creditor meetings just to be polite.”

- ✅ Meetings Held: May 9, 2024 – Creditors and shareholders gave their thumbs up on Zoom.

- ✅ Final Order: NCLT Mumbai approved the whole shaadi by April 2025.

- ✅ Share Allotment: 4 July 2025 – The shares were officially handed over. Plus Care now lives inside One Global’s body.

🧠 Why Did This Even Happen?

Official Version:

“To create a bigger, stronger healthcare platform and maximize shareholder value.”

Real Version:

- Plus Care got public market access without the IPO headache.

- One Global got a real business to justify its stock price.

- The market got a fresh narrative: Healthcare turnaround story!

📉 Stock Drama 101

- 2020: Stock was at ₹1.72 — cheaper than a samosa.

- 2025: Touched ₹407 — more expensive than your Netflix plan.

- After merger shares were issued? Fell to ~₹240. Why? Because dilution is real, folks.

👑 Who Controls the Throne Now?

- AVD Trust (linked to old promoter Vijay Dhawangale) got gifted 14.5% stake just before merger closed.

- Plus Care founders (via the newly issued shares) now own the lion’s share—over 60%.

- Together: The diagnostics mafia runs the show now.

💰 Financial Flex Time

- Deal valued Plus Care at ₹42 crore.

- Post-merger One Global market cap: ₹477 crore (mid-2025).

- One Global’s Q4 FY25 Profit: ₹11 crore. Translation: “Hey look, real money!”

Also, they gave out a dividend. Which in smallcap land is like spotting a unicorn.

🎤 Final Thoughts – Drama. Strategy. Transformation.

This isn’t just a merger. It’s a Netflix-worthy corporate glow-up. A struggling old textile firm gave a piggyback ride to a private diagnostics company, which then took over the wheel and made it a legit healthcare player. Everyone got what they wanted:

- Plus Care: Listing + control

- One Global shareholders: A real business

- SEBI & BSE: No rule-breaking detected

- Stock Market: A new midcap “healthcare” play

We’re waiting for Q1 results, and then we’ll drop the proper Eduinvesting Value Article, so stay tuned