At a Glance

Lloyds Engineering Works Ltd is on a rollercoaster – Q1 FY26 PAT dropped 17% YoY to ₹17.6 Cr while sales declined 28% to ₹174 Cr. Despite this, the stock holds strong at ₹73.2, because retail loves a “defence order” buzzword. With a P/E of 106x, this stock is priced as if it’s building the next aircraft carrier, not just fabricating components. Promoter holding fell to 49.3%, adding a bit of spice to the drama.

Introduction

Once a steel equipment maker struggling with legacy issues, Lloyds Engineering has rebranded itself as a niche player in defence, naval propulsion, and high-tech fabrication. The transformation story has fueled a 5-year profit CAGR of 109%, but investors are now asking – is the hype justified or is this just another overvalued microcap with a shiny order book?

Business Model (WTF Do They Even Do?)

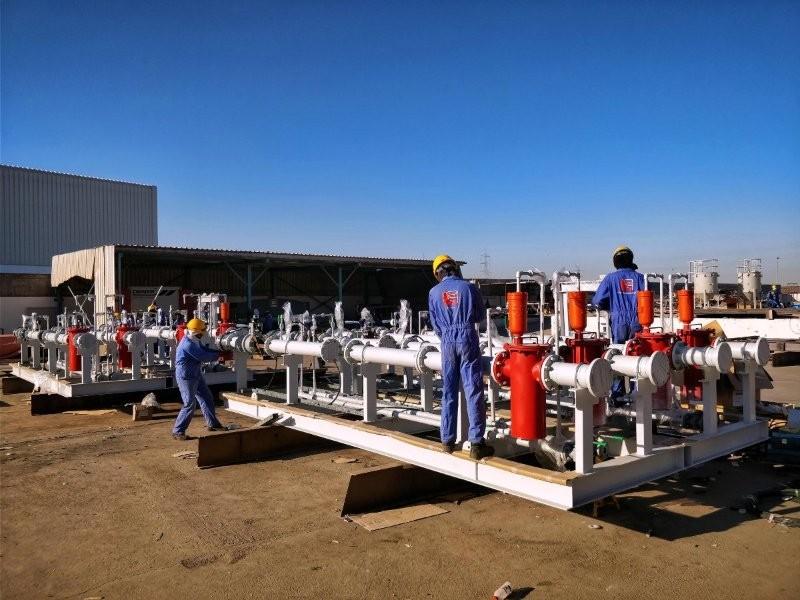

Lloyds designs and manufactures heavy equipment & turnkey systems for hydrocarbons, oil & gas, power, nuclear, and naval projects. Recently, it entered defence naval propulsion systems with Italian major Fincantieri. Its revenue mix is:

- Hydrocarbon & Steel Plant Equipment – Old bread-and-butter.

- Defence & Naval Orders – New growth driver.

- Turnkey Projects – High-margin, high-risk contracts.

Roast: Great at getting orders, not always great at executing them on time without margin erosion.

Financials Overview

- Revenue: ₹174 Cr (↓29% YoY)

- EBITDA: ₹24 Cr (margin 14%)

- PAT: ₹17.6 Cr (↓17% YoY)

- EPS: ₹0.12

Commentary: Margins are steady, but order execution timing killed revenue growth this quarter.

Valuation

- CMP: ₹73.2

- P/E: 106x (sky-high)

- Book Value: ₹4.38 (P/B 16.7x)

- ROE: 18.9%

- ROCE: 23.2%

Fair Value Range: ₹45 – ₹60. The current valuation is priced for perfection.

What’s Cooking – News, Triggers, Drama

- Rights Issue: ₹1,050 Cr rights issue at ₹32 to fund expansion.

- Acquisitions: 76% stake in Metalfab Hightech and 11% in TIPL to boost fabrication capabilities.

- Defence Orders: Partnership with Fincantieri for indigenous naval propulsion.

- Orders: Recent ₹20.7 Cr contract from Cochin Shipyard and a quirky ₹15.3 Cr order for a cricket museum at Wankhede Stadium.

Balance Sheet

| (₹ Cr) | Mar 2025 |

|---|---|

| Total Assets | 888 |

| Total Liabilities | 888 |

| Net Worth | 645 |

| Borrowings | 45 |

Remarks: Low debt but high equity dilution risk due to frequent rights issues.

Cash Flow – Sab Number Game Hai

| (₹ Cr) | FY23 | FY24 | FY25 |

|---|---|---|---|

| Operating | -3 | -45 | 165 |

| Investing | -54 | -97 | -106 |

| Financing | 46 | 142 | -55 |

Remarks: Operating cash finally turned positive in FY25, but investing cash outflow continues due to acquisitions.

Ratios – Sexy or Stressy?

| Metric | Value |

|---|---|

| ROE | 18.9% |

| ROCE | 23.2% |

| P/E | 106x |

| PAT Margin | 10% |

| D/E | 0.05 |

Remarks: Strong returns but valuation is stretched beyond logic.

P&L Breakdown – Show Me the Money

| (₹ Cr) | FY23 | FY24 | FY25 |

|---|---|---|---|

| Revenue | 313 | 624 | 756 |

| EBITDA | 53 | 101 | 123 |

| PAT | 37 | 80 | 96 |

Remarks: Tremendous growth, but Q1 FY26 is a speed bump.

Peer Comparison

| Company | Revenue (₹ Cr) | PAT (₹ Cr) | P/E |

|---|---|---|---|

| Kaynes Tech | 2,722 | 293 | 127 |

| Jyoti CNC | 1,818 | 323 | 73 |

| Tega Inds | 1,639 | 200 | 62 |

| Lloyds Engg | 795 | 96 | 106 |

Remarks: Lloyds trades at a higher P/E than peers with much larger scale – risky.

Miscellaneous – Shareholding, Promoters

- Promoter Holding: 49.3% (fell 7% QoQ)

- FIIs: 2.2%

- Public: 48.3%

Comment: Falling promoter stake raises eyebrows.

EduInvesting Verdict™

Past Performance

Lloyds has gone from near-obscurity to a ₹10,000 Cr market cap darling in 3 years. Its defence pivot is promising, but investor euphoria is running ahead of fundamentals.

SWOT Analysis

- Strengths: High ROE/ROCE, strong order book, defence entry.

- Weaknesses: Overvaluation, promoter stake dilution, execution risk.

- Opportunities: Defence sector growth, Make-in-India push.

- Threats: Order delays, rising competition, macro slowdown.

Final Word

Lloyds Engineering is like that student who topped the last exam and now thinks they’re IIT material – the market is rewarding it for its transformation, but one bad quarter could trigger a harsh reality check. For now, it’s a high-beta bet on defence manufacturing with a price tag that assumes everything will go right.

Written by EduInvesting Team | 29 July 2025SEO Tags: Lloyds Engineering, Defence Manufacturing, Q1 FY26 Results