At a Glance

L.G. Balakrishnan & Bros Ltd (LGB) just revved its Q1 FY26 engine, but instead of racing ahead, it kind of cruised. Net Profit came in at ₹67 Cr (flat YoY), revenue ₹592 Cr (slight dip from last quarter), and OPM steady at 16%. The auto components giant also dropped a spicy update: a $10M Mexico plant is live, with Vietnam and Thailand expansions on the radar. P/E is a modest 14.7, and the stock trades at 2.1× book, making it the budget cousin in an industry where others sport Gucci P/Es.

Introduction

This isn’t your average nuts-and-bolts manufacturer. LGB is the OG of motorcycle chains and sprockets, commanding respect in India’s two-wheeler universe. For decades, they’ve been supplying Hero, Honda, and the whole biker gang. But in FY26, the company is trying to go global—literally setting up shop in Mexico and eyeing Vietnam and Thailand.

The stock has corrected 12% in a year, proving the market isn’t impressed by steady but slow growth. So is this a hidden gem or just a chain with rusting links?

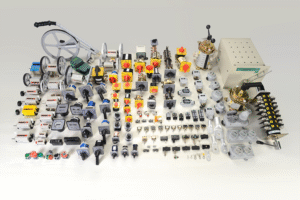

Business Model (WTF Do They Even Do?)

LGB operates across three main segments:

- Transmission (79% revenue) – motorcycle chains, sprockets, tensioners. Basically, if your bike moves, thank them.

- Metal Forming – precision metal parts for auto OEMs.

- Others – belts, brake shoes, and other small bits.

Strength: Established OEM relationships and 50+ years of expertise.

Weakness: High dependence on the two-wheeler market and limited diversification beyond auto.

Financials Overview

- Q1 FY26 Revenue: ₹592 Cr (↓2% QoQ)

- Q1 Net Profit: ₹67 Cr (flat YoY)

- Q1 OPM: 16%

- TTM Revenue: ₹2,445 Cr

- TTM PAT: ₹290 Cr

- EPS (TTM): ₹91.0

Commentary: The quarter was stable but uninspiring. Margins held, but topline barely moved. The Mexico plant is the real story here—it could open new markets and boost export revenue.

Valuation

- CMP: ₹1,260

- Book Value: ₹586

- P/B: 2.15

- TTM EPS: ₹91.0

- P/E: 14.7

Fair Value Range

- P/E Method: Sector P/E ~25×

- Fair Value = 25 × 91 = ₹2,275

- EV/EBITDA:

- EV ≈ ₹4,015 Cr (mcap) + ₹114 Cr (debt) – negligible cash

- EBITDA TTM: ₹409 Cr

- EV/EBITDA ≈ 10×; fair 12× → ₹1,500–₹1,700

- DCF: Using 7% growth, fair value ≈ ₹1,400–₹1,600

Verdict: Fair value ₹1,400–₹1,700. CMP ₹1,260 offers moderate upside.

What’s Cooking – News, Triggers, Drama

- Mexico plant operational – direct access to US auto market.

- Vietnam & Thailand expansion – diversification in ASEAN.

- Stable margins despite raw material cost swings.

- Global auto slowdown remains a risk.

Balance Sheet

| (₹ Cr) | FY25 |

|---|---|

| Assets | 2,462 |

| Liabilities | 593 |

| Net Worth | 1,870 |

| Borrowings | 114 |

Remarks: Debt minimal, net worth solid. Balance sheet stronger than most OEM suppliers.

Cash Flow – Sab Number Game Hai

| (₹ Cr) | FY23 | FY24 | FY25 |

|---|---|---|---|

| Operating | 300 | 346 | 296 |

| Investing | -291 | -305 | -285 |

| Financing | -58 | -43 | -9 |

Remarks: Cash from ops healthy, but investing cash flows consistently negative due to capex—this time for the Mexico plant.

Ratios – Sexy or Stressy?

| Metric | FY25 |

|---|---|

| ROE | 15.7% |

| ROCE | 20.3% |

| P/E | 14.7 |

| PAT Margin | 12% |

| D/E | 0.06 |

Remarks: Ratios are sexy for a small-cap auto supplier—high returns, low debt.

P&L Breakdown – Show Me the Money

| (₹ Cr) | FY23 | FY24 | FY25 |

|---|---|---|---|

| Revenue | 2,086 | 2,231 | 2,391 |

| EBITDA | 370 | 387 | 407 |

| PAT | 248 | 270 | 291 |

Remarks: Revenue growth is slow but steady. Profits creeping up, but no fireworks.

Peer Comparison

| Company | Revenue | PAT | P/E |

|---|---|---|---|

| Bosch | ₹18,087 Cr | ₹2,012 Cr | 59.1 |

| Schaeffler India | ₹8,547 Cr | ₹1,058 Cr | 60.9 |

| Uno Minda | ₹16,775 Cr | ₹934 Cr | 64.0 |

| L.G. Balakrishnan | ₹2,445 Cr | ₹291 Cr | 14.7 |

Remarks: LGB trades at a deep discount to peers despite strong fundamentals.

Miscellaneous – Shareholding, Promoters

- Promoter Holding: 34.8% (low, but stable)

- FIIs: 5.96%

- DIIs: 13.74%

- Public: 45.5%

Promoter Bio: The Balakrishnan family—masters of chains, literally.

EduInvesting Verdict™

LGB is a fundamentally solid small-cap with global aspirations. The Mexico plant is a strategic game-changer, and ASEAN expansion could further diversify revenues. However, growth remains modest, and promoter holding is low—raising governance eyebrows.

SWOT Analysis

- Strengths: Debt-free, strong OEM ties, global expansion.

- Weaknesses: Low promoter stake, sluggish sales growth.

- Opportunities: Entry into US & ASEAN markets.

- Threats: Global auto slowdown, currency risks.

Final Word: LGB is like that reliable motorcycle—it won’t win a race, but it won’t break down either. For investors, it’s a steady compounder with upside potential if global expansions pay off.

Written by EduInvesting Team | 31 July 2025

SEO Tags: L.G. Balakrishnan, Auto Components, Q1 FY26 Results, Mexico Plant Expansion, Small Cap Stocks