1. At a Glance

Kwality Pharmaceuticals (KPL) isn’t just another pill-maker — it’s a pharma buffet serving 3,000+ formulations in over 25 therapeutic areas. If there’s a molecule that can be injected, swallowed, or smeared, chances are they’ve made it. Q1 FY26 numbers? Revenue up 39% YoY, PAT up 43%, OPM steady at 22%. The company is now eyeing higher-margin biologics and complex injectables while juggling EU-GMP and ANVISA approvals like a pharma circus performer.

2. Introduction

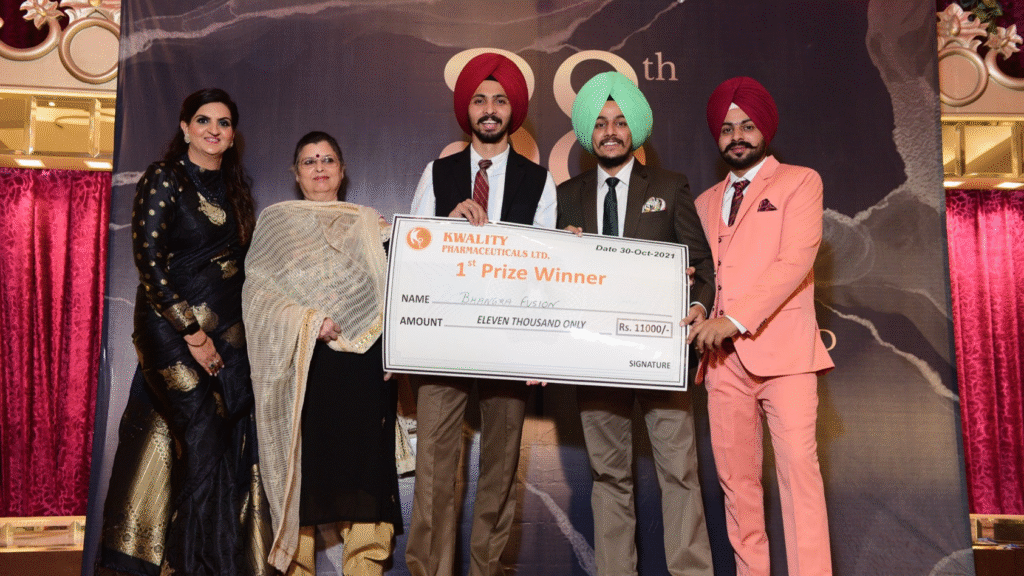

Born in 1983 in Amritsar, KPL started with basic formulations but has since morphed into a global exporter with regulatory credentials that open doors in the EU, Brazil, and 60+ other countries. They’re not chasing the high-street retail game — their focus is on high-barrier-to-entry markets and niche products like liposomal injectables, depot formulations, and biologics.

Domestic sales still account for 52% (FY23), but the export share is rising — especially with EU-GMP approvals in hand and Brazil recently opening up. The company’s future script reads like a growth thriller: two new plants (including one for prefilled syringes), biologics scaling, and entry into more regulated markets.

3. Business Model (WTF Do They Even Do?)

KPL’s business model revolves aroundmanufacturing + global distributionof:

- Generics & Antibiotics:Cephalosporins, beta-lactams.

- Oncology Products:High-potency injectables.

- Complex Formulations:Liposomal injectables, microsphere depot injections.

- Biologics:Erythropoietin, Alteplase, Etanercept.

They sell toinstitutional buyers, hospitals, and government tendersacross 60+ countries. Themargin gamecomes from regulatory approvals — once you’re in the EU-GMP/ANVISA club, the average selling price per dose can jump significantly.

4. Financials Overview

| Metric | Q1 FY26 | Q1 FY25 | Q4 FY25 | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue (₹ Cr) | 111 | 80 | 116 | 39.2% | -4.3% |

| EBITDA (₹ Cr) | 24 | 17 | 26 | 41.2% | -7.7% |

| PAT (₹ Cr) | 11.9 | 8.3 | 14 | 42.8% | -15.0% |

| EPS (₹) | 11.50 | 8.16 | 13.96 | 41.0% | -17.6% |

Commentary:Strong YoY growth driven by higher export realisations and volume uptick. QoQ softness is normal — seasonality plus product mix shifts. Margins holding at 22% show cost discipline despite expansion.

5. Valuation (Fair Value RANGE only)

- P/E Method:

- EPS (TTM): ₹41.8

- Industry P/E: 33.1

- FV Range (P/E 24–28): ₹1,003 – ₹1,170

- EV/EBITDA Method:

- TTM EBITDA: ₹87 Cr

- EV/EBITDA Range (12–15): ₹1,044 – ₹1,305 Cr → Per share ₹1,004 – ₹1,255

- DCF:Assume 18% earnings CAGR for 5 years, terminal growth 4%, discount 12% → ₹1,050 – ₹1,200

📌 FV Range:₹1,000 – ₹1,200(Educational purposes only, not investment advice.)

6. What’s Cooking – News, Triggers, Drama

- EU-GMP Audit Scheduled:Passing this for more units could unlock higher-value EU orders.

- Biologics Line:Erythropoietin launch in semi-regulated markets, two more molecules in pipeline.