ALL SECTIONS

India rising: the world’s newest growth giant

As tensions between China and the US escalate during Trump’s second term, global investors are turning to India – not just as a backup, but as a rising star poised to lead the next wave of growth

Featured | Government policy | Strategy

Author: Antonia Di Lorenzo, Features Writer

Top 5

- Top 5 female-fronted fintech firms

- Top 5 Latin American tech hubs

- Top 5 sustainability pioneers in Europe

- Top 5 keys to global economic recovery

- Top 5 WFH habits, according to the world’s most successful business leaders

- Top 5 pandemic-proof industries

- Top 5 countries to be world’s next manufacturing hubs

- Top 5 most influential and inspirational US economists

- Top 5 ways to boost employee engagement and commitment

- Top 5 financial services that are ripe for automation

- Top 5 ways that GDPR has impacted digital banking

- Top 5 emerging fintech hubs across the globe right now

- Top 5 ways that the finance industry can prepare for AI

- Top 5 economic risk factors that must be considered

- Top 5 tips for retailers looking to sell into Chinese market

With the US doubling down on economic nationalism during President Trump’s second term, multinational corporations are accelerating their ‘China-plus-one’ strategies – and increasingly, that ‘plus-one’ is India. With its tech-savvy workforce, swelling middle class, and pro-business policy incentives, India is fast becoming more than a hedge against China: it is emerging as a standalone growth story. The shifting geopolitical winds, coupled with India’s demographic advantage, are redirecting global capital – and few relationships matter more in this transition than the one between Washington and New Delhi.

According to research by the German financial services multinational Allianz, India’s talent pool and demographic advantages, coupled with lower unit labour costs relative to its Asian neighbours, make it an attractive choice for re-shoring operations. Moreover, economic reforms and initiatives by the government to revitalise the manufacturing sector such as the Production Linked Incentive – a scheme that incentivises firms to increase domestic production – will be contributing factors for multinational firms to choose India to be China’s plus one. The share of high and medium skill-intensive manufacturing sectors out of the total was 64 percent in India in 2022, and grew by five percent from 2016, outpacing China, Malaysia, Indonesia, Thailand and Vietnam in terms of growth. Through knowledge spillovers, efficiency gains and innovation, high and medium skill-intensive manufacturers can further accelerate the manufacturing sector in India.

“India offers what investors seek in the post-globalisation world: scale, stability and strategic alignment with the West,” says Fei Chen, CEO of Intellectia AI, an AI-native investment platform based in Hong Kong. “The macro story is increasingly hard to ignore.”

The making of a strategic economic axis

The evolving bromance between President Trump and Indian Prime Minister Narendra Modi is reshaping economic flows and recalibrating alliances. In February 2025, Modi’s high-profile visit to Washington culminated in an ambitious joint target: to increase bilateral trade from $129bn in 2024 to $500bn by 2030. While recent US tariffs on Indian goods – most notably a proposed 26 percent levy – sparked brief tensions, the measure has been suspended until July, and both sides are actively negotiating a broader trade pact.

If China was once the ‘factory of the world,’ India is now vying to be the world’s innovation lab

“Modi and Trump are politically aligned in ways that make their economic partnership more durable,” says Robert King, CEO of the UK-based Acuity Knowledge Partners. “They are both strong leaders with nationalist platforms, and both recognise the value of deepening commercial ties.”

This alignment has opened the floodgates for foreign direct investment (FDI). In just the first nine months of FY2024, India attracted $41bn in FDI, a 27 percent year-over-year increase. US firms are at the forefront of this shift – part of a larger move to derisk supply chains and diversify manufacturing bases beyond China. Moreover, Indian companies are increasingly becoming exporters of capital themselves. In 2023, India invested $4.7bn in the US – about three percent of all US inbound FDI – with expectations of rapid growth ahead.

India’s tech-driven investment boom

If China was once the ‘factory of the world,’ India is now vying to be the world’s innovation lab and assembly line for the next era of global growth. The sectors attracting capital reflect not only India’s strategic ambitions but also investors’ desire for long-term scalability and resilience. Semiconductors sit at the heart of this ambition. India’s $10bn semiconductor mission is luring global chipmakers like Micron, AMD and Tower Semiconductor to set up shop with generous subsidies, land grants, and infrastructure support. Electric vehicles (EVs) and renewables are another fast-rising pillar. Tesla’s ongoing talks with the Indian government, including proposals for a local gigafactory and supply chain localisation, reflect the sector’s momentum. The Production-Linked Incentive (PLI) schemes are helping India compete with China in batteries, solar components, and other clean-tech hardware.

“India is becoming a magnet for clean energy hardware, and the PLI incentives are game-changers,” says Michael Ashley Schulman, Partner and Chief Investment Officer at a Southern California-based wealth management firm. “From EVs to solar, global firms are following policy tailwinds into the Indian market.” Pharmaceuticals and biotech are also rebounding, as companies seek alternatives to China’s dominance in active pharmaceutical ingredients. India, once known as the ‘pharmacy of the world,’ is seeing renewed investment in healthcare R&D and production.

Meanwhile, digital infrastructure and tech services remain a perennial draw. Global hyperscalers – Google, Amazon and Microsoft – are expanding data centres, AI labs and cloud investments. India’s robust SaaS ecosystem and deep engineering talent pool are helping position it as a global hub for next-generation technology services. Acuity Knowledge Partners, for example, has doubled its workforce in India over the past five years and recently added a new delivery centre. “We are not just investing in facilities – we are investing in India’s future as a knowledge economy,” says King.

According to McKinsey Global Institute, the business and economics research arm of McKinsey, India is the fastest-growing e-commerce market in the world, with its size going from $3.9bn in 2009 to $200bn in 2024, driven by smartphone penetration and the use of digital payments. Online retail represents around 25 percent of India’s total retail market. This is expected to grow to 37 percent by 2030. India also has a strong cohort of local players such as Flipkart (acquired by Walmart) and Meesho, as well as global companies like Amazon and Rakuten.

India’s information technology (IT) industry, valued at around $250bn, already serves many of the world’s leading companies, and its market for AI services is growing rapidly. Moreover, India has an abundance of IT talent, and given the shortage of AI talent globally, this wealth of expertise could be a significant competitive advantage in a market for AI services that could reach $4.6trn globally by 2040.

Further, major Indian companies are diving in. For example, Reliance Industries has launched AI initiatives in high-potential sectors such as energy and telecommunications, and Tata Consultancy Services has announced a $1.5bn investment in its Generative AI project pipeline.

Can India sustain the hype?

While the macro story is compelling, the micro often frustrates. India’s bureaucratic hurdles, regulatory unpredictability, and fragmented federal system can slow even the best-laid business plans. Despite years of reforms, state-by-state inconsistencies in labour laws, tax policy and infrastructure quality persist.

Once seen as just a backup to China, India is now becoming the market others must hedge against

“There is a tendency to weaponise regulations retroactively,” warns Schulman. “Global tech firms have had to navigate everything from sudden data localisation mandates to retrospective tax disputes. That unpredictability adds friction.”

India’s geopolitical positioning, while generally favourable, is also complex. Its strategic alignment with the US coexists uneasily with longstanding relationships with Russia and Iran – and a tense, if economically intertwined, relationship with China.

That said, the broader economic indicators are actually quite promising. Inflation is cooling (projected at four percent in FY2026), the fiscal deficit is narrowing (down to 4.4 percent), and the current account deficit remains modest at 1.1 percent. India’s exports hit a record $820bn in FY2025, and its dependence on exports (only 22 percent of GDP) makes it relatively resilient to global trade shocks. “The fundamentals are solid,” says King. “What investors need is patience and precision – it’s a long game.”

Fei Chen argues that the India pivot is no longer just about derisking from China – it is about embracing India as a standalone growth story. “Investors aren’t expecting frictionless returns,” he says. “They are betting that India’s digital momentum, demographic edge, and policy frameworks will pay off over the next decade.”

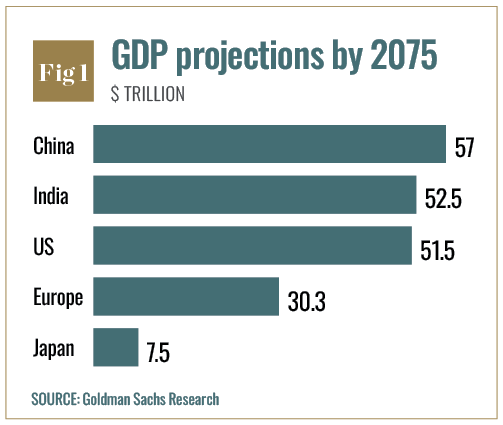

Indeed, with a median age of 28, an expanding digital consumer base, and deepening capital markets, India is one of the few large economies with long-term, endogenous growth drivers. Initiatives like ‘Make in India,’ coupled with newer schemes like the Design-Linked Incentive (DLI) for innovation, are helping create a more compelling and beneficial ecosystem for start-ups and multinationals alike. Still, challenges remain. Infrastructure development, while improving, lags behind China’s in scale and execution speed. Inter-state coordination on industrial policy can be clunky. And the lingering perception of ‘policy risk’ continues to spook some long-term investors. Yet, optimism endures. Goldman Sachs forecasts that India will become the world’s second-largest economy by 2075, with a projected GDP of $52.5trn (see Fig 1). That may feel distant, but it is a signal of just how expansive the India bet really is.

India’s investment moment has arrived

Once seen as just a backup to China, India is now becoming the market others must hedge against. The world isn’t just betting big – it is betting forward. The convergence of geopolitical realignment, structural reforms, and digital dynamism has created a moment of genuine opportunity. Whether India can fully seize that moment depends on its ability to translate promise into execution – and maintain the investor goodwill it has worked so hard to earn.

However, Schulman highlights that “corruption is not as endemic as it once was, but navigating bureaucracy still requires local savvy and strong partnerships…and while geopolitical alignment with the US is strengthening, India’s relationships with Russia and Iran, plus its balancing act with China, complicate the narrative,” he said.

In short, India isn’t just a plug-and-play growth story – but rather it is a strategic allocation that requires patience, persistence, precision and a bit of luck.

Post navigation

Previous article

Exploring AI’s influence on market dynamics

Related:

- AI 2.0: The hype is over and it is time to monetise

- Can India become a developed economy by mid-century?

- The economic impact of de-globalisation

- The great big tech break-up

- The rise and coming fall of Chinese manufacturing

- Can Bretton Woods adapt to a changing world?

- Tradition to transformation within the luxury market

- India’s economic ascendancy

- The difficult art of rebranding

- The appeal of Hong Kong