1. At a Glance

If the Indian pharma world were a college reunion,FDC Ltdwould be that grand old alumnus who still shows up in sneakers, brags about “back in my day we invented ORS,” and then quietly admits he’s just survived a bad quarter.

At ₹447 per share and a market cap of ₹7,281 crore, this 1936-born pharmaceutical veteran might not be sprinting, but it’s still flexing some financial muscle — mostly debt-free (₹20.7 crore debt on ₹2,886 crore balance sheet, that’s practically zero), with an ROCE of 15.9% and ROE of 11.8%.

But hold your ORS packets — September 2025 results weren’t pretty. Revenue fell 7.9% QoQ to ₹473 crore, and profit after tax nosedived 60.6% to just ₹28 crore. If corporate India had a “before and after” meme, FDC’s June-to-September transition would win.

The company’s P/E is 32.3 — high enough to suggest that the market still believes FDC is sipping on its Electral. Yet, with PAT margins shrinking and R&D spend stuck at a modest 2–3% of turnover, this is a company caught between vintage wisdom and modern pharma hustle.

Will this ORS legend rehydrate its growth story? Or is the “fully integrated” tag now more nostalgia than narrative? Let’s unpack, unbox, and (politely) roast.

2. Introduction

In India’s pharma universe, FDC Ltd is that reliable uncle who’s been selling youElectralevery summer since childhood — literally keeping half the country from fainting during heatwaves. Founded before Independence (1936!), this company has seen more policy shifts than most politicians.

But longevity doesn’t guarantee excitement. Over the last decade, FDC’s compounded sales growth is a polite 9%, profits have grown just 7%, and stock returns over five years are around 6%. It’s the pharma equivalent of that kid who always scores 75% — never fails, never tops, just cruises through decades.

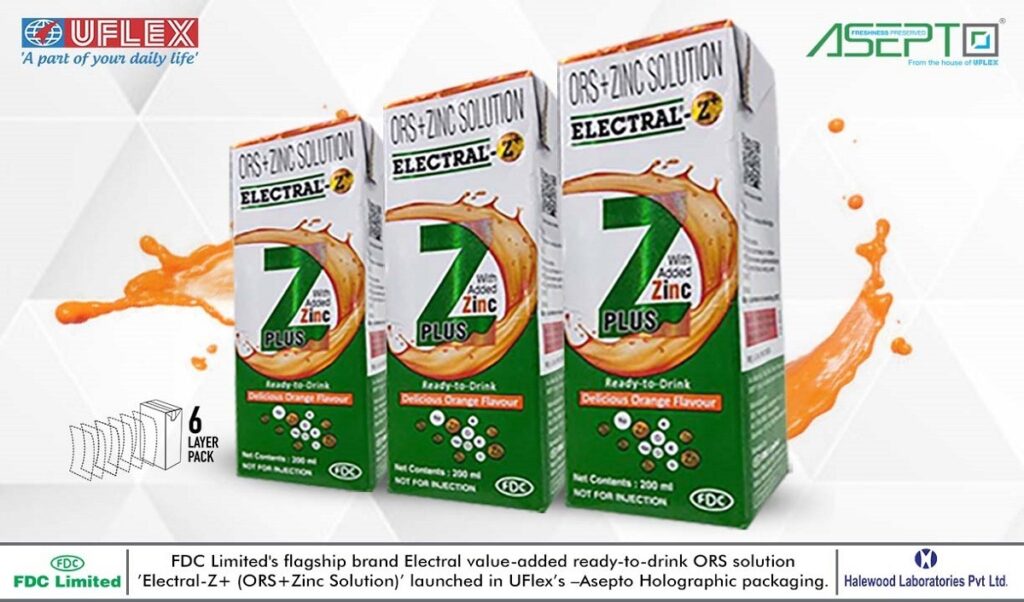

Yet, don’t dismiss it too quickly. This is a company withsevenmanufacturing facilities, zero pledges, and almost no debt. Its flagship brands —Zifi(anti-infective) andElectral(ORS) — dominate their categories with market shares of 24% and 72% respectively. You read that right: 72% market share in ORS, meaning if you’ve ever recovered from dehydration, FDC probably helped.

But lately, there’s been drama — CFO resignations, new US FDA approvals, and expansion plans worth ₹140 crore for its Sinnar plant. Mix in a 60% quarterly profit crash, and you have a company trying to juggle legacy, liquidity, and laboratory pipelines — all at once.

Will the new CFO Vishal Shah steady the ship? Or is FDC’s rehydration therapy limited to its customers and not its balance sheet?

3. Business Model – WTF Do They Even Do?

So what exactly does FDC do when it’s not being the brand ambassador for electrolyte balance?

Simply put, it manufactures and markets pharmaceutical formulations across therapeutic areas like anti-infectives, gastro-intestinal, vitamins, ophthalmology, and dermatology. If you’ve had a sore throat, tummy ache, fungal infection, or hangover dehydration — chances are, FDC was in your medicine cabinet.

The revenue cocktail looks like this:

- Anti-infectives:42%

- Gastro-intestinal:24%

- Cardiac:7%

- Vitamins & minerals:7%

- Ophthalmology:6%

- Dermatology:4%

- Others:11%

It’s like a buffet — not Michelin-star fancy, but solid enough to keep customers returning.

Internationally, the company exports to50+ countries, with theUSAcontributing52% of export revenue. FDC’s subsidiaries in the US and UK — FDC Inc. and FDC International Ltd — manage global ops, while its 49%-owned JV in South Africa (Fair Deal Corp Pharmaceutical) covers Africa.

What makes FDC stand out? Asset-light marketing with full manufacturing control. Seven plants across Waluj, Baddi, Roha, Sinnar, and Goa churn out everything from tablets to eye drops to ORS sachets.

What’s missing? R&D intensity. Indian peers spend 8–13% of revenue on R&D; FDC spends just2–3%. That’s like showing up to a Formula 1 race on a Hero Splendor — brave, but underpowered.

4. Financials Overview

| Metric | Latest Qtr (Sep 2025) | YoY Qtr (Sep 2024) | Prev Qtr (Jun 2025) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | ₹473 Cr | ₹514 Cr | ₹648 Cr | -8.0% | -27.0% |

| EBITDA | ₹34 Cr | ₹70 Cr | ₹140 Cr | -51.4% | -75.7% |

| PAT | ₹28 Cr | ₹72 Cr | ₹121 Cr | -61.1% | -76.9% |

| EPS (₹) | 1.74 | 4.42 | 7.45 | -60.6% | -76.6% |

Commentary:That’s not a slowdown — that’s a clinical trial gone wrong. PAT collapsed from ₹121 crore to ₹28 crore in just three months. Operating margins slipped to 7%, half the long-term average. Maybe it’s one-off; maybe it’s operational dehydration.

Annualised EPS stands at ₹6.96, putting P/E near64xbased on the latest quarter’s trend — so “not meaningful” in analyst language, or “ouch” in investor language.

5. Valuation Discussion – Fair Value Range

Let’s run through the numbers like a tired pharma intern:

a) P/E Method:TTM EPS = ₹13.85Industry P/E ≈ 33xSo, fair value = ₹13.85 × (25x–35x) = ₹346 – ₹485 per share

b) EV/EBITDA Method:EV/EBITDA = 19.9x (as per screener)EBITDA (TTM) = ₹275 CrEV = 19.9 × ₹275 = ₹5,472 CrSubtract debt (₹21 Cr), add cash (~₹300 Cr+ est. from balance sheet liquidity) ⇒Fair Equity Value ≈ ₹5,750 CrPer share = ₹5,750 / 16.3 Cr = ₹353

c) DCF (Educational Estimate):Assume 7% CAGR in free cash flow (steady pharma) and 10% discount rate.Intrinsic range = ₹350–₹480

🎯 Educational Fair Value Range:₹350–₹480

📜Disclaimer:This fair value range is for educational purposes only and not investment advice.

6. What’s Cooking – News, Triggers, Drama

You thought pharma was boring? Welcome to FDC Ltd’s 2025 highlight reel:

- CFO Exit, CFO Entry:On Oct 17, 2025, CFO Vijay Bhatt resigned, replaced swiftly by Vishal Shah (effective Oct 24). Classic corporate handover — like changing the driver mid-flight.

- US FDA Greenlights:On Oct 4, 2025, FDC gotANDA approvalforPilocarpine ophthalmic solution(1%, 2%, 4%) — its ticket to ophthalmic expansion in the US. Earlier, in Dec 2024, it got approval forCefixime 400 mg Tablets.

- No 483s, No Tears:Both theBaddiandRohaplants passed US FDA inspections with zero observations — a rare badge of honour in pharma land.

- Capex for Growth:In April