1.At a Glance

Bombay Burmah Trading Corporation Ltd (BBTCL) is like that old-money uncle who’s been around since the British Raj and now casually owns plantations, biscuit factories, healthcare units, and a property portfolio. With₹18,676 crore TTM revenue,₹2,225 crore TTM profit, and a rock-solidROCE of 35.5%, it trades at a modestP/E of 11.6– a rare “value” tag in FMCG-land. But before you grab the kettle, note: the sales growth over the past 5 years is only 9% CAGR, and profits swing like a pendulum thanks to exceptional items.

2.Introduction

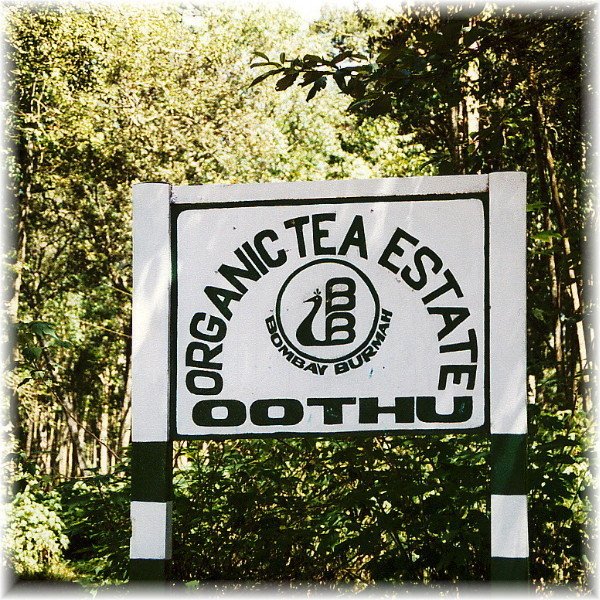

Founded in 1863 (yes, when Lincoln was still alive), BBTCL began as a teak trader before moving into tea plantations in 1913. Today, it’s a flagship of theWadia Group, rubbing shoulders with Britannia, GoAir (RIP), and Bombay Dyeing.

The company is the definition of diversification – tea, coffee, biscuits, dairy, healthcare devices, auto electricals, weighing products, and even horticulture. It’s like they built a corporate version of a general store. The portfolio stability comes from this spread, but it also means growth is more “steady cruise” than “rocket launch”.

3.Business Model (WTF Do They Even Do?)

BBTCL’s model is essentially:

- Plantations– Tea, coffee, and other crops.

- FMCG– Britannia (through holding), dairy products, biscuits.

- Healthcare– Dental, orthopedic, ophthalmic products.

- Industrial– Auto-electrical components, weighing scales.

- Others– Horticulture, real estate.

It’s part operator, part holding company – a hybrid where some revenue comes directly, and some through stakes in subsidiaries like Britannia.

4.Financials Overview

- TTM Revenue:₹18,676 Cr

- TTM Net Profit:₹2,225 Cr

- EBITDA Margin:~17%

- ROCE:35.5% |ROE:21.9%

- P/E:11.6 |Book Value:₹807 (CMP/BV ≈ 2.31x)

Recalculating P/E using Q1 FY26 annualised EPS:

- Q1 EPS = ₹34.5 → Annualised = ₹138 → P/E ≈ 13.5 (still reasonable given FMCG peers trade at 30–60x).

5.Valuation – Fair Value RANGE

| Method | Basis | FV Range (₹) |

|---|---|---|

| P/E Multiple | Sector avg ~25x on EPS ₹138 | 3,100 – 3,500 |

| EV/EBITDA | Sector avg 15x on EBITDA ₹3,124 Cr | 2,800 – 3,200 |

| SOTP (Holding Co. adj.) | Britannia stake + core ops | 2,900 – 3,400 |

Fair Value Range:₹2,800 – ₹3,500This FV range is for educational purposes only and is not investment advice.

6.What’s Cooking – News, Triggers, Drama

- Q1 FY26 Profit ₹497.7 Cr– boosted by asset sale gains.

- MSTC tie-up– to act as selling agent for property e-auctions.

- Debt reduction– borrowings down from ₹2,161 Cr (FY24) to ₹1,574 Cr (FY25).