The broader market, as evidenced by the SPDR S&P 500 ETF Trust (SPY) , has shown little in the way of price action that would suggest an end to the current wave of market resilience.

Every other day, it seems a new all-time high is made, and chartists go back to the drawing board to pinpoint new upside price targets. And then there can be an abrupt reversal, leading doomsayers to come out of the woodwork.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

We’re all just one headline away from another sharp market move, either up or down.

Incoming news and its riptides can be overwhelming, to say the least, leaving many an investor scratching their head about what comes next.

So, how is an investor able to tell which way markets are likely to move next?

Different schools of thought on market outlook

One school of thought focuses on the economic fundamentals, such as interest rates, inflation, growth, and jobs, to develop an outlook for what to expect.

This all sounds good until you try to apply it to the real markets, where things can get more complicated.

Take, for instance, the current economic environment, where interest rates are widely expected to fall in coming months and quarters.

On the one hand, prospects of lower rates are typically a positive for market sentiment and consequently stock prices. That thought line relies on lower rates stimulating borrowing demand, generating job creation, increasing consumer spending, and enhancing corporate profitability.

And all of that is supposed to come back to propel the economy ahead, and with it, stocks. That’s the optimistic outlook and argues for still higher stock prices, all-time highs be damned.

Related: Stock market gets ‘kick in the pants’ from startling inflation report

But there’s always that other hand, which casts doubt on many of those assumptions.

The other hand points to signs of weakness in the labor market (July’s disastrous jobs report), sticky inflation (Aug. 14 July CPI & PPI), and tariff uncertainty (President Donald Trump), among other factors, to justify a steady, wait-and-see attitude.

This position argues that the Fed is likely easing because of economic uncertainty and weakness, which would tend to augur poorly for the stock market outlook.

And then there are those who also correctly point to policy uncertainty itself as being another headwind. But that can be modeled away, as the Fed will make a decision one way or the other come Sept. 18.

Apart from tariffs, then, much market uncertainty will be resolved in a few weeks.

It leaves us in a conundrum (that helps explain the back-and-forth of the market in recent weeks) about which way markets will eventually move.

Prices (usually) never lie when predicting market movement

Then there’s a second school of thought that could not care less what inflation is doing or whether jobs are being added or subtracted.

It’s only concerned with what past price movements are saying about potential future price movements.

This position is known as technical analysis, and it relies on past prices to predict the future, which, as we all know, is not guaranteed.

One can use technical analysis in many ways to identify key price points that are potential triggers to future gains or declines, including trendlines and channels.

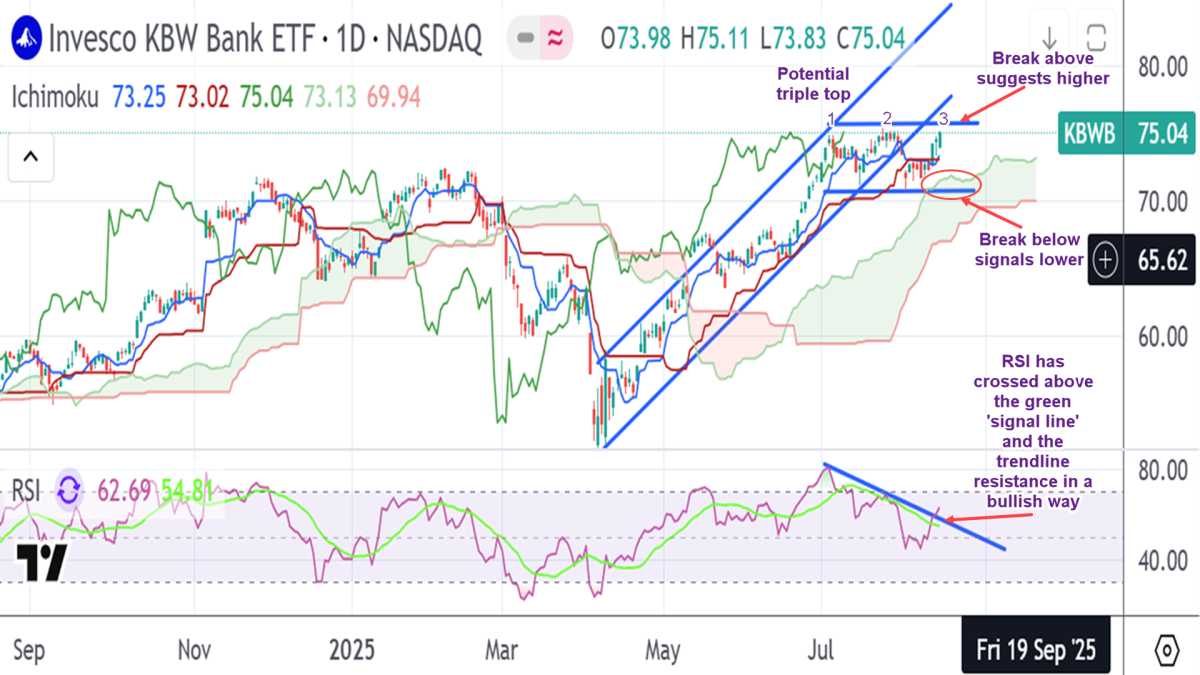

Technical indicators such as the RSI (shown on the chart below) can aid in estimating the strength of a market move and suggest potential outcomes.

Then there are chart patterns that have routinely formed in the past and frequently have quantifiable price targets, a discipline known as “pattern recognition.”

The chart below combines all of these elements and more and highlights the key price points to watch.

Source: TradingView/TheStreet.com/Brian Dolan

Spotting market trends: what to look for

Let’s begin by noting that price has broken down out of the major up-channel dating back to the April 2025 lows, potentially suggesting an end to the uptrend.

Also look at the potential triple top forming, a major reversal pattern, denoted by the 1,2,3 above the current price. That triple top happens to be forming around the $75.00 to $75.50 area, which is more than just a nice, big, round number.

It also happens to be the post-pandemic highs of 2022 (not shown), which (KBWB) has yet to surpass.

For comparison’s sake, the S&P 500 already blew through those highs back in Jan. of 2024! Hence, it was earlier noted that bank stocks are lagging the overall market.

More investing:

- Potential Fed chair pick makes boldest call yet on S&P 500 rally

- Highest tariffs since the Great Depression: What it means for stocks

- What may happen to stocks, markets next

Price has since established a sideways range over the past few weeks between recent highs just above $75.00 and below $71.00. It is this range, along with the daily Ichimoku cloud top (currently at $71.40 and set to move sideways for several days), that defines the key price levels for KBWB.

Lastly, it’s worth noting that the Relative Strength Index (RSI), seen in the bottom panel of the chart, has turned up again and made a bullish crossover of both trendline resistance and the green “signal” line, potentially setting the stage for a break higher.

Ultimately, events on the fundamental front will dictate which way prices move, but at least we have identified the likely key price points to a break in either direction.

To recap, a move higher may unfold if price closes above $75.50 on a daily basis. A move lower may develop on daily close weakness below the Ichimoku cloud top at $71.40 or below recent lows at 70.60, leaving the $70.60 to $71.40 area as the key support zone.

We’ll have to see which way the current conundrum unfolds. The $75.00 to $75.50 area could be a major reversal top and hold, or a break above could signal fresh gains ahead.

Maybe third time’s the charm and banks finally catch up with the rest of the market?

Related: Lower rates may unleash massive dealmaking wave for investment banks