1. At a Glance

With a stock P/E hotter than a car’s hood in June and a book value that looks like a typo (₹5.50 vs stock at ₹583), Automotive Stampings (ASAL) is a sheet-metal supplier to Tata Motors—but trades like it’s printing Teslas. ROCE is zooming at 24.2%, but is that enough to justify a 106x book multiple?

2. Introduction with Hook

You know that kid in school who flunked half the time and then suddenly topped the class? Meet ASAL.

After years of crawling like a broken axle, ASAL went from loss-making zombie to a 2,300% ROE rocket. Yes, the number isn’t a typo. But with Q1 profits dropping 36% QoQ, the honeymoon phase might be over faster than your new EV’s battery.

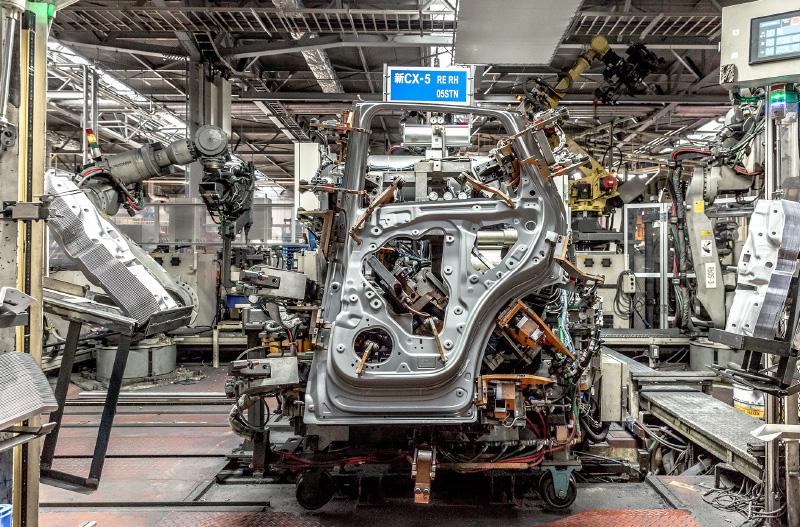

3. Business Model (WTF Do They Even Do?)

ASAL = “We stamp metal. Then weld it. Then bolt it onto Tata vehicles.”

In short:

- Sheet metal stampings

- Welded assemblies

- Chassis and structural parts

- Clients: Mostly Tata Motors (read: Tata AutoComp owns 75%)

Basically:

“We don’t make the car, but your car literally won’t hold together without us.”

Simple biz. Hardcore ops. No D2C drama. No app download needed.

4. Financials Overview

Q1 FY26

- Revenue: ₹173 Cr ↓ from ₹188 Cr QoQ

- EBITDA: ₹10.75 Cr

- Net Profit: ₹2.54 Cr ↓ 36% QoQ

- OPM: 6.21%

- EPS: ₹1.60

FY25 (TTM)

- Revenue: ₹756 Cr

- PAT: ₹15 Cr

- ROCE: 24%

- ROE: 2,332% (courtesy: near-zero equity)

Margins up from <3% in 2022 to >6% now. But profits slipping quarter-on-quarter? Investors might start un-stamping their excitement.

5. Valuation

Current Market Cap = ₹922 Cr

Book Value = ₹5.50

Stock Price = ₹583

P/E = 60x, P/B = 106x

Valuation Methods:

- P/E 25x on FY25 PAT of ₹15 Cr: Fair MCap = ₹375 Cr → FV = ₹237/share

- EV/EBITDA 15x on FY25 EBITDA ₹47 Cr: EV = ₹705 Cr → FV = ₹450–₹480/share

“If you think ₹583 is fair for ₹5.50 of book value, you probably also tip your Uber driver in dollars.”

6. What’s Cooking – News, Triggers, Drama

- Q1 FY26 Results (July 24): Profit dip sparks worry.

- CRISIL Rating (July 2025): Reaffirmed A- Stable.

- Tata EV Demand: ASAL could benefit—if margins don’t melt first.

- Shareholder Base Growing: Retail is in. Let’s just hope they read the P&L too.

No frauds. No IPOs. No reality TV drama. Just the regular metal-bending grind.

7. Balance Sheet

| Metric | FY25 |

|---|---|

| Equity | ₹16 Cr |

| Reserves | -₹7 Cr (still negative, lol) |

| Borrowings | ₹149 Cr |

| Total Liabilities | ₹294 Cr |

| Fixed Assets | ₹118 Cr |

| Cash | Barely there |

Highlights:

- Net Worth is basically… your good vibes.

- Debt has ballooned back up to pre-2019 levels.

- Negative reserves = haunted legacy from pre-2022 losses.

“Balance sheet is leaner than a crash diet, but still not exactly gym-ready.”

8. Cash Flow – Sab Number Game Hai

| Year | Ops CF | Inv CF | Fin CF | Net CF |

|---|---|---|---|---|

| FY23 | ₹25 Cr | -₹14 Cr | -₹12 Cr | -₹1 Cr |

| FY24 | ₹31 Cr | -₹12 Cr | -₹20 Cr | -₹1 Cr |

| FY25 | -₹7 Cr | -₹16 Cr | ₹25 Cr | ₹3 Cr |

Key insight:

“Free Cash Flow? Ha! That’s just a mythical creature here.”

9. Ratios – Sexy or Stressy?

| Ratio | Value |

|---|---|

| ROCE | 24.2% |

| ROE | 2,332% (Not a typo) |

| P/E | 60x |

| OPM | 6.2% |

| D/E | ~9.3x (savage) |

So yes, it’s profitable… but also kinda heavily geared.

“If leverage was a cricket match, ASAL just hit a six with a borrowed bat.”

10. P&L Breakdown – Show Me the Money

| Year | Revenue (Cr) | EBITDA (Cr) | PAT (Cr) |

|---|---|---|---|

| FY23 | ₹828 | ₹33 | ₹8 |

| FY24 | ₹880 | ₹51 | ₹20 |

| FY25 | ₹775 | ₹48 | ₹17 |

Solid improvement post-FY22 resurrection, but FY25 saw a dip in revenue and profit. Time to hit the welding gun harder?

11. Peer Comparison

| Company | Rev (TTM) | PAT | P/E | ROE |

|---|---|---|---|---|

| Bosch | ₹18,087 Cr | ₹2,012 Cr | 55.6x | 15.6% |

| Uno Minda | ₹16,775 Cr | ₹934 Cr | 66.5x | 17.5% |

| Endurance Tech | ₹11,561 Cr | ₹782 Cr | 47.4x | 14.6% |

| Automotive Stamp | ₹756 Cr | ₹15 Cr | 60.1x | 2,332%* |

*Low base. Don’t get excited unless you also invest in penny stocks that moon once a decade.

“Looks like a gully boy at a corporate party.”

12. Miscellaneous – Shareholding, Promoters

| Holder | % |

|---|---|

| Promoters (Tata AutoComp) | 75.00% |

| Public | 25.00% |

| FIIs | 0.00% |

| DIIs | 0.01% |

Shareholders count: From 30K to 36K+ in a year

Retail entering like it’s the buffet at a wedding.

No pledge. No dilution. No BS. Just Tata legacy backing.

13. EduInvesting Verdict™

ASAL has turned itself around dramatically—like a Bollywood hero coming out of rehab. From years of losses to now flaunting operating profits and improving margins, the company’s trajectory is commendable. But let’s not forget:

Negative reserves

Leverage is high

P/B is from outer space

Q1 FY26 saw a profit drop

“A solid turnaround machine—now let’s see if it can stay in the fast lane without running out of gas.”

Metadata:

Written by EduInvesting Team | 24 July 2025

Tags: Automotive Stampings, Tata Group, Auto Components, EduInvesting Premium