📜 Disclaimer (Read This Before You YOLO)

This EduInvesting Premium Report is not a stock tip, not a buy/sell/hold call, and definitely not your financial planner’s cousin’s advice.

We’re a financial content platform — not SEBI-registered investment advisors. This research is for educational and informational purposes only.

We use public data, company filings, and meme-grade analysis to highlight interesting businesses. We may express strong views, but they’re just that — views, not recommendations.

Stock markets involve risk. Past performance means jack about the future.

DYOR = Do Your Own Research.

Invest responsibly, or don’t. But don’t blame us if your SIP cries.

If you make gains — tell your friends.

If you make losses — tell your therapist, not us.

“Consult a SEBI-registered adviser before acting.”

📄 Page 1: Why This Stock?

Alpex Solar ☀️ — From Contract Manufacturer to Green Hydrogen Hero?

Most solar stocks are already sitting on P/E ratios hotter than the Rajasthan sun.

But Alpex? Still under the radar. Still scaling. Still hungry. But who thought we can print money from the sun?

Here’s the thesis 👇

🔍 1. Solar’s Mini-Tata in the Making

- Alpex started off as a humble solar panel contract manufacturer for brands like Tata Power, Luminous, Jakson.

- Now? It’s going D2C + EPC + B2G + Green Hydrogen.

- They’ve shipped over 10,000 solar water pumps, bagged large state tenders (Jharkhand, Haryana), and are scaling with subsidiaries in hydrogen and EPC.

🔋 2. From 850 MW to 2.4 GW — That’s Not a Typo

- Existing solar module capacity: 850 MW

- By FY26: Target capacity = 2.4 GW (including new 7-acre Mathura plant)

- This is nearly 3x scale-up, self-funded via IPO + internal accruals.

- They’re building for the future, while most peers are still waiting for the PLI cheque.

💸 3. Financials That Actually Charge

📊 Alpex Solar – Key Financials (FY23–FY25)

| Metric | FY23 | FY24 | FY25 | Growth (FY23 → FY25) |

|---|---|---|---|---|

| 📈 Revenue (₹ Cr) | 195 | 413 | 780 | +300% |

| 💰 EBITDA (₹ Cr) | 12 | 37 | 125 | +941% |

| 💵 PAT (₹ Cr) | 4 | 27 | 83 | +1,975% |

| 📊 EBITDA Margin (%) | 6.2% | 9.0% | 16.0% | Expansion = 🔥 |

| 📉 Debt/Equity | 1.1 | 0.3 | 0.3 | Low – leverage |

| 🚀 ROCE (%) | 14.0% | 27.0% | 51.8% | Capital efficiency doubled |

| 🧮 EPS (₹) | 6.5 | 10.9 | 34.1 | +425% |

| 📈 P/E | 96.0x | 60.6x | 29.3x | Valuation cooling 😎 |

🧩 4. Backward Integration = Margin Weapon

- Alpex is now making aluminium frames and junction boxes in-house.

- These aren’t minor accessories — they’re 10–12% of BoM costs.

- By bringing them in-house, Alpex expects ~10% cost savings, better supply chain control, and faster deliveries.

🌱 5. Green Hydrogen + Solar Pumps = Tailwinds Galore

- Formed Alpex GH2 Pvt Ltd to ride the hydrogen wave

- Focused play on solar-powered irrigation and state-backed EPC tenders

- Strong government tailwinds: India aims for 300 GW of solar by 2030

- Approved vendor to biggies like NTPC, NHDC, CREDA, PEDA

🚩 So What’s the Catch?

- Trades at 23.9x FY24 EPS — not cheap, but justifiable if growth continues

- Execution risk on new capacity

- Still early in D2C/brand building journey

✅ Why This Stock Deserves coverage

Alpex checks all the EduPremium boxes:

- ✅ Sectoral tailwinds

- ✅ Undiscovered by most retail

- ✅ Hyper-growth mode with margin lift

- ✅ Skin in the game (68.76% promoter holding)

- ✅ Real cash flows, real capex, no nonsense

“FY25 paints a breakout picture — triple-digit revenue growth, PAT exploding nearly 20x in two years, and ROCE scaling past 50%. This isn’t hype. It’s execution.”

📄 Page 2: TL;DR Thesis + EduFair Valuation (2 Methods)

🎯 TL;DR Snapshot: Alpex Solar at a Glance

| 🧠 Metric | 📊 Value |

|---|---|

| 💵 Stock Price | ₹999 (as of June 20, 2025) |

| 🧱 Market Cap | ₹2,444 Cr |

| 📈 Revenue FY25 | ₹780 Cr (+89% YoY) |

| 💰 Net Profit FY25 | ₹83 Cr |

| 🧮 EPS FY25 | ₹34.11 |

| 🔢 P/E (TTM) | 29.3x |

| 🚀 ROCE | 51.8% |

| 🏗️ Capacity Target FY26 | 2.4 GW |

🧠 Method 1: EduFair™ P/E Valuation

📊 Step-by-Step:

- EPS FY25: ₹34.11

- P/E Range: 25x (conservative) to 30x (bullish)

- Fair Value:

- ✅ Base Case: ₹34.11 × 25 = ₹853

- ✅ Bull Case: ₹34.11 × 30 = ₹1,023

🔎 Justification: Sectoral median P/E is 44x — we remain conservative due to working capital intensity and early-stage EPC volatility.

🎯 EduFair™ Valuation Range: ₹850 – ₹1,020

🧮 Method 2: CashFlowLite™ DCF

Let’s model future Free Cash Flow (FCF) with the following assumptions:

| Variable | Value |

|---|---|

| FY25 FCF | ₹50 Cr (est. from EBITDA – capex) |

| Growth (FY26–30) | 25% CAGR (driven by capacity scale-up) |

| Terminal growth | 5% |

| Discount rate (Ke) | 14% |

| Terminal Year | FY30 |

📉 DCF Valuation (simplified):

Using standard DCF formula (NPV of 5 years + terminal value)

- Estimated DCF value ≈ ₹2,450 Cr

- Per Share Value (DCF) = ₹2,450 Cr / 2.44 Cr shares = ₹1,004

🎯 CashFlowLite™ Valuation: ₹950 – ₹1,050 range

✅ Verdict:

| Method | FV Range |

|---|---|

| EduFair™ (P/E) | ₹850 – ₹1,020 |

| CashFlowLite™ (DCF) | ₹950 – ₹1,050 |

📌 EduPremium Fair Value Consensus Range:

₹875 – ₹1,025 ✅

Stock at ₹999 is now fully valued on FY25. Future upside hinges on margin expansion, exports, and Green H2 execution.

📄 Page 3: Business Breakdown – What Does Alpex Actually Do?

Alpex Solar isn’t your rooftop solar uncle’s company. It’s an integrated B2B solar machine that manufactures, assembles, sells, and even installs — across multiple verticals.

Let’s decode the solar chakravyuh 👇

🔧 1. Solar PV Module Manufacturing (Core Biz)

- Alpex builds monocrystalline, polycrystalline, bifacial, Mono PERC, and half-cut panels.

- Product lines include:

- Nikko Topcon MBB (N-Type bifacial 560–590W)

- Nikko MBB Series (Mono PERC 440–555W)

- Diamond Series (Crystalline 150–400W)

- Operates via:

- Contract manufacturing (Tata Power, Jakson, Luminous)

- Own-brand supply (to EPC players like Solarworld, BVG India)

✅ Revenue driver, high-volume, low-margin

🚀 Margin kicker will come from backward integration

💧 2. Solar Water Pumps (AC/DC)

- Installed 15,000+ pumps across India

- Offers both Surface and Submersible categories

- Focused on State tenders (B2G) — recent wins include:

- ₹12 Cr order from Jharkhand

- ₹44 Cr order from Haryana

🤝 Subsidiary set up specifically to scale this vertical

📈 High-volume biz with potential for branding and annuity EPC deals

🏗️ 3. EPC Projects (Engineering, Procurement, Construction)

- End-to-end execution for solar water pumping + solar power plants

- Focused on North Indian state agencies — CREDA, HAREDA, NHDC

- Entry barrier: Tender qualification, local execution bandwidth

⚠️ EPC = lumpy revenues + execution risk

✅ But they already have past tender experience and installed base

🏗️ 4. Backward Integration Products

- Aluminium Frames:

- Protect and mount panels

- High input cost component, now being made in-house

- Junction Boxes:

- Electrical connection hub behind every panel

- In-house = better supply chain control + 10% cost saving

🎯 Margin expansion is the big story here

This turns Alpex from “assembler” to “integrator”

🧪 5. New Bet: Green Hydrogen (Alpex GH2 Pvt Ltd)

- Subsidiary launched for Green H2 push

- No major orders yet, but aligns with govt’s ₹20,000 Cr National Green Hydrogen Mission

- Long shot bet, but may attract attention if policy picks up

🚨 Early-stage, don’t price it into the core thesis yet

🌱 Optionality with real upside

🌍 6. Legacy + Miscellaneous Trades

- Also trades in:

- Air purifiers, circular knitting needles, yarn

- (Yes, you read that right. Very SME.)

- Likely legacy verticals or channel margin fillers

- Not material to core story, but worth keeping an eye on if expanded

🧠 Summary:

| Segment | % Revenue (Est.) | Margin Profile | Outlook |

|---|---|---|---|

| PV Modules | ~65% | Medium | Scaling fast |

| Solar Pumps (EPC) | ~25% | Medium | Growing via tenders |

| Frames + J-Boxes | ~5–8% | High | Early stage, margin lever |

| Green H2 | <1% | N/A | Optionality |

| Others (Legacy trade) | <1% | Low | Ignore for now |

📦 Alpex isn’t just “making panels.”

They’re going full-stack solar — and stacking the odds in their favour.

📄 Page 4: Financial Trends – 5-Year Revenue, Margin & Return Trajectory

From underdog to overachiever — Alpex Solar’s financials look like a J-curve printed on steroids.

Let’s break it down by the numbers 👇

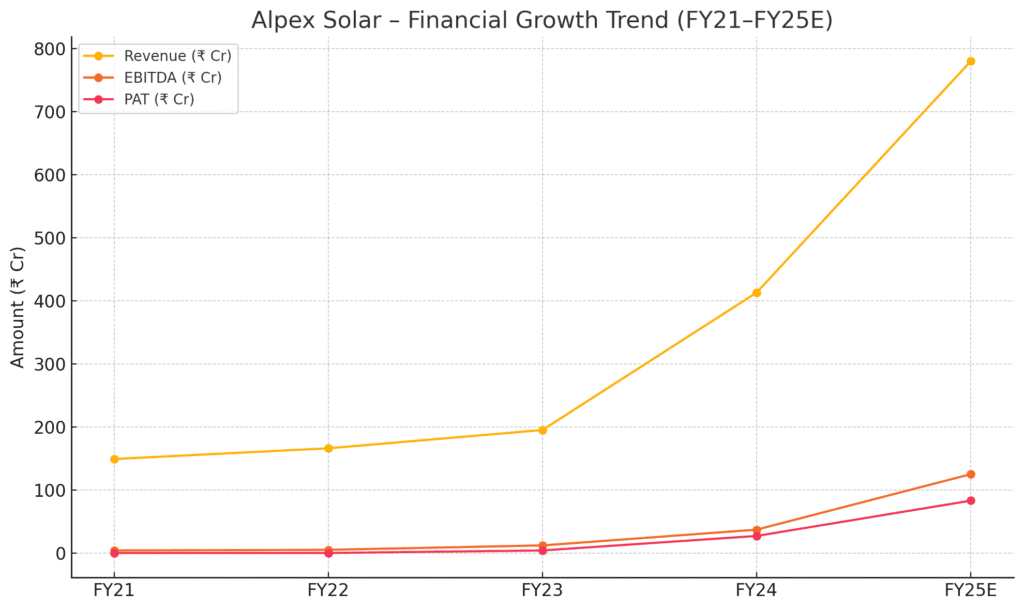

📈 1. Revenue Growth:

| Year | Revenue (₹ Cr) | YoY Growth |

|---|---|---|

| FY21 | 149 | – |

| FY22 | 166 | +11% |

| FY23 | 195 | +17% |

| FY24 | 413 | +112% |

| FY25 | 780 | +89% |

🔥 Revenue CAGR (FY21–FY25): 49%

Alpex doubled sales last year and is set to nearly double again. That’s not compounding. That’s combustion.

💸 2. EBITDA Growth & Margin Expansion

| Year | EBITDA (₹ Cr) | EBITDA Margin |

|---|---|---|

| FY21 | 4 | 2.4% |

| FY22 | 5 | 3.0% |

| FY23 | 12 | 6.2% |

| FY24 | 37 | 9.0% |

| FY25 | 125 | 16.0% |

📊 Margin expansion powered by:

- Operating leverage

- In-house aluminium frames & junction boxes

- Reduction in raw material dependence

🧠 3. Profit Explosion

| Year | PAT (₹ Cr) |

|---|---|

| FY21 | 0 |

| FY22 | 0 |

| FY23 | 4 |

| FY24 | 27 |

| FY25 | 83 |

💥 Net profit grew 20x in 2 years

From almost breakeven to ₹83 Cr — and it’s not a one-off. Alpex is printing profits, not promises.

🚀 4. Return Ratios

| Year | ROCE (%) |

|---|---|

| FY21 | 2.1% |

| FY22 | 7.0% |

| FY23 | 14.0% |

| FY24 | 27.0% |

| FY25 | 51.8% |

🎯 ROCE doubling every year = capital is being used ruthlessly well.

📌 Takeaway:

Alpex isn’t just growing — it’s growing efficiently. And in solar manufacturing, margin + return ratios are your moat. The numbers suggest it’s starting to build one.

📄 Page 5: Competitive Positioning – Who’s the Real Waaree Killer?

Alpex isn’t just trying to build solar panels. It’s trying to build a moat — in a segment where most players are stuck in assembly-line mediocrity.

So… how does it stack up?

🥊 1. Peer Comparison – Valuation & Scale

| Company | P/E | ROCE (%) | Revenue (₹ Cr) | Segment Focus |

|---|---|---|---|---|

| Waaree Energies | 45.9x | 35.1% | 4,003 Cr | PV Modules (GW-scale) |

| Premier Energies | 49.5x | 41.5% | 1,620 Cr | PV + Cells |

| Genus Power | 36.3x | 19.2% | 937 Cr | Smart Meters |

| Shilchar Tech | 41.1x | 71.1% | 232 Cr | Transformers |

| Alpex Solar | 29.3x | 51.8% | 780 Cr | PV, Pumps, EPC |

🧠 Alpex has better ROCE than Waaree & Premier — but trades at a ~35% discount on P/E.

🏭 2. What’s Alpex’s Edge?

| Category | Alpex Positioning |

|---|---|

| 🛠️ Manufacturing Base | In-house frames, junction boxes, 2.4 GW PV target |

| 📦 Integration | EPC + OEM + Contract Manufacturing |

| 🔌 Approvals | Listed with Tata Power, NTPC, NHDC, CREDA, PEDA |

| 📈 Order Visibility | ₹349 Cr from Coal India, ₹44 Cr from Haryana |

| 📉 Working Capital | Moderate – improving post FY24 IPO |

| 🔬 R&D / Innovation | Early Green H2 entry via GH2 subsidiary |

| 🧃 Brand Recognition | Limited — no strong D2C brand yet |

📊 SWOT Matrix

| Strengths | Weaknesses |

|---|---|

| ✔ High ROCE / ROE | ❌ No dividend track record |

| ✔ EPC + Manufacturing dual play | ❌ Thin brand identity (retail) |

| ✔ Cost advantage via backward integration | ❌ SME segment perception |

| Opportunities | Threats |

|---|---|

| 🌞 Govt. tenders & solar push | 🧨 Policy delays / margin squeeze |

| 🌱 Green hydrogen vertical | 🥷 EPC execution risk |

| 🌍 Exports / new geographies | 🏦 Interest rate volatility |

🥇 So Who Wins?

| Category | Winner |

|---|---|

| Scale & Capacity | Waaree Energies |

| Margin Leadership | Shilchar Tech |

| Growth Rate | Alpex Solar ✅ |

| Risk-Reward Balance | Alpex Solar ✅ |

📌 Alpex isn’t the biggest player yet — but it’s the fastest-growing one with the cleanest runway.

Unlike capital-guzzlers, Alpex is funding expansion through IPO cash + internal accruals. No perpetual dilution. No death-by-debt.

📄 Page 6: What’s Changed Recently – Orders, Capex & Execution Pipeline

📦 Massive Orders Secured (April–May 2025)

Between April 24 and May 12, Alpex Solar bagged ₹1,069 Cr in fresh orders across solar EPC and B2B supply.

| 📅 Date | 💼 Order Details | 💰 Value (₹ Cr) | 🕒 Timeline |

|---|---|---|---|

| 24 Apr 2025 | Leading Manufacturer (B2B module supply) | 380.52 | By Mar 2026 |

| 25 Apr 2025 | Haryana Renewable Energy Dev. Agency (HAREDA) | 65.33 | Within 120 days |

| 8 May 2025 | Leading Industry Player (likely EPC + modules) | 378.00 | By Mar 2026 |

| 12 May 2025 | CMPDI (Coal India subsidiary) – Solar Pump EPC | 349.99 (244.99 Cr share) | 540 days |

🔥 Total Fresh Orders: ₹1,068.84 Cr

That’s 1.37x of FY25 Revenue booked in just 19 days.

🏗️ Capacity Update

- Existing: 850 MW functional (PV modules)

- Under Expansion:

- 1.2 GW at existing Noida plant

- New 1.2 GW plant coming up in Mathura (UPSIDA) – land acquired

- Target by FY26: 2.4 GW module capacity

- Also expanding into cell manufacturing (1.6 GW) in planning phase

📍 Total ₹642 Cr capex underway, fully funded via IPO proceeds + internal accruals

🔄 Management Update

- 🧾 CFO Change:

- Amit Ghai resigned

- Udaya Sehgal appointed CFO on June 4, 2025

- Possible reason: aligning finance strategy with aggressive expansion pipeline

🏁 Execution Visibility = 📈 Revenue Predictability

Alpex now has:

- Orders stretching into FY26 (Mar deadlines)

- EPC and module mix = diversified revenue stream

- State + PSU + Private = reduced client concentration risk

📌 Key Takeaway:

Alpex isn’t just “riding solar tailwinds” — it’s building a multi-segment solar backlog that gives 12–18 months of revenue visibility. Most SME-listed peers? Still living quarter-to-quarter.

📄 Page 7: Risk Factors – What Can Go Wrong?

Yes, Alpex is riding high on orders, margin expansion, and a sectoral boom.

But we’re EduInvesting — not fanboys.

Here’s what could throw a spanner in the solar frame:

⚠️ 1. Execution Risk on ₹1,069 Cr Orders

- EPC is a landmine if timelines slip or costs overrun.

- 540-day timelines (CMPDI order) → cash flows are back-ended.

- HAREDA 120-day delivery? One monsoon delay, and it’s a compliance headache.

🔁 Execution delays = delayed revenue recognition = PAT shock.

🧾 2. Working Capital Stress

- Alpex has improved cash cycles (53 days now vs 101 in FY23)

- But: ₹349 Cr from Coal India-type tenders usually comes with heavy receivables lag

- If advance payments aren’t structured right, we could see temporary debt spike again

💸 Cashflow ≠ Profit. Especially in EPC.

🏭 3. Expansion Overload

- 2.4 GW module + 1.6 GW cell capex = ₹600–700 Cr over 2 years

- Can current internal accruals + IPO funds support both?

- If margins slip or demand slows, we risk a debt-funded spiral

📉 ROCE can collapse quickly if assets come up before orders.

🧠 4. Green Hydrogen = Buzzword Risk

- GH2 subsidiary exists — but has zero traction as of now

- No policy clarity, no subsidy defined, no orders yet

- Including this in core valuation would be speculative

☠️ If they start raising debt “for GH2 scale-up”, that’s a red flag.

💥 5. Valuation is No Longer Dirt Cheap

- CMP ₹999

- EduFair™ FV: ₹875–₹1,025

- Stock now trades near upper bound of valuation

This is not a ₹5 stock going to ₹50 story. It’s a ₹1,000 stock that needs delivery + consistency.

⚠️ Other Minor Risks

- 👨👩👧👦 Family-run firm — succession, CFO churn risk

- 🏢 SME-listed — liquidity issues for large investors

- 🇨🇳 Module cell sourcing still partially China-linked

- 😓 No dividend = no cushion in flat years

📌 Takeaway:

Alpex has execution mojo — but it must now prove it can scale without slipping.

Margins are up, orders are in. Now comes the hard part: delivering on promises.

📄 Page 8: Management Lens

👔 Management: Who’s Steering This Solar Ship?

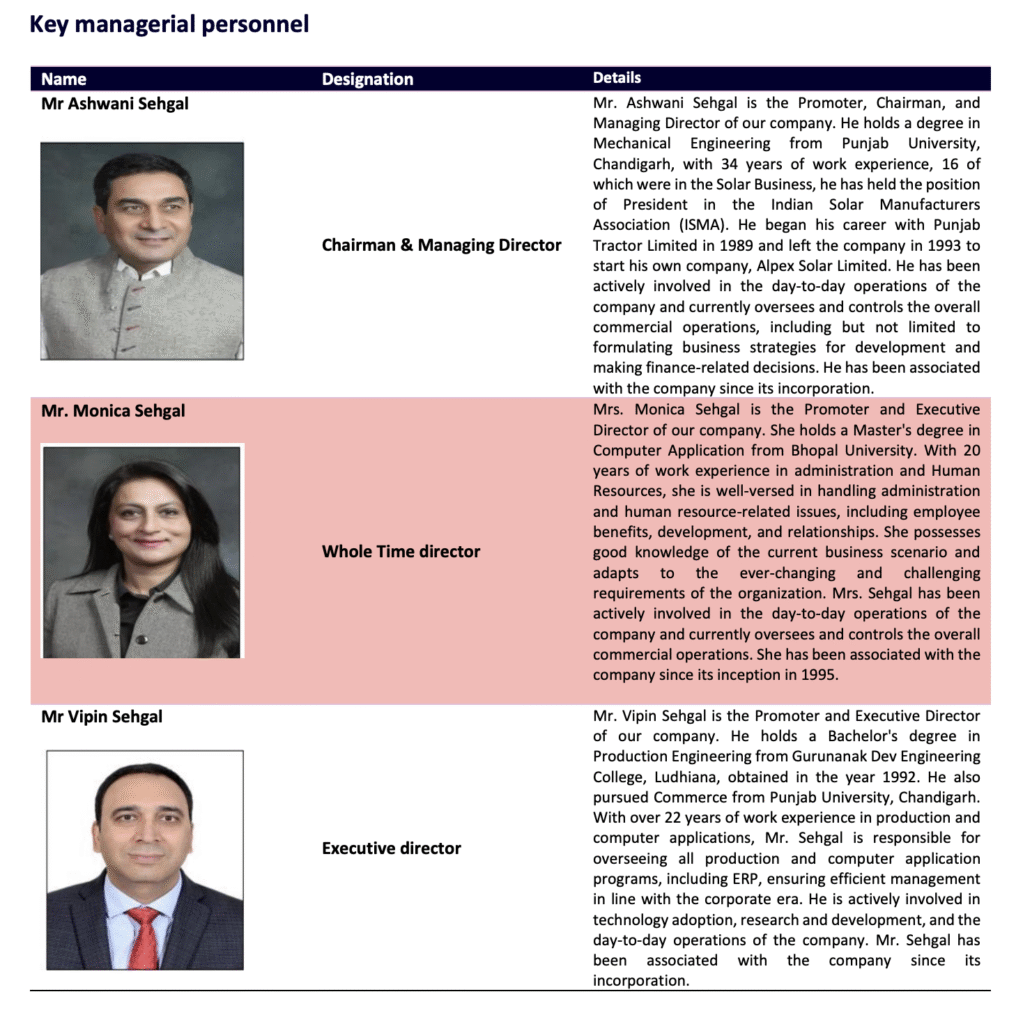

🧔♂️ Ashwani Sehgal (CMD & Promoter)

- Founder, solar veteran, ex-ISMA President

- Started Alpex back when “solar” meant water heaters on Delhi roofs

- Runs the commercial + vision side

- Has kept promoter stake high at 68.76% — ✅ skin in the game

🎯 Verdict: He’s not just a figurehead — he’s been in the trenches, inverters, and tender rooms.

🧑💼 Monica Sehgal (Executive Director)

- Heads admin, HR, and ops

- MCA postgrad from Bhopal University

- Keeps the organisation ship tight — especially during scale-up

- Been with the firm since day zero (1995 incorporation)

📦 Your classic family-run, tight-control SME DNA — but efficient, not bloated.

👨💻 Vipin Sehgal (Executive Director)

- Production engineering + commerce dual background

- Leads ERP systems, tech adoption, and manufacturing ops

- Also handles R&D direction (frames, junction boxes, etc.)

🧠 He’s the “techie Sehgal” — critical for backward integration roadmap.

🔄 CFO Update

- Amit Ghai resigned in June 2025

- Replaced by Uday Sehgal (new-gen promoter family?)

- May indicate tighter financial alignment as capex intensifies

⚠️ Needs monitoring — CFO transitions during expansion are a known risk area

📌 EduInvesting View:

This isn’t a hype-fueled startup or a PSU handholder.

Alpex’s management is operator-first, promoter-heavy, and sector-experienced.

A good mix — as long as they don’t over-leverage for vanity projects like green hydrogen.

📄 Page 9: Investment Checklist – Does Alpex Pass the EduInvesting Filter?

Time to check if Alpex is just another “solar hope story” or a real business with bite.

We ran it through our EduInvesting 7-Point Framework™ 👇

| ✅ Checklist Item | 📊 Status | 🧠 Commentary |

|---|---|---|

| Strong Revenue Growth (20%+ CAGR) | ✅ | 49% CAGR over 5 years — check 🔥 |

| Improving Margins | ✅ | EBITDA 9% → 16% in 1 year |

| Consistent PAT Growth | ✅ | PAT up 546% in FY24; FY25 at ₹83 Cr |

| Promoter Skin in the Game (>50%) | ✅ | 68.76% stake – no dilution spree |

| Reasonable Valuation (vs peers) | ✅ | Trades at 29x vs peer median of 44x |

| Low-to-moderate leverage | ✅ | Debt/Equity = 0.3 and falling |

| Moat / Competitive Edge | ✅⚠️ | Cost control + EPC access = moat forming, not finished |

🎯 Edu Score: 6.5 / 7

🧪 Verdict: This isn’t just another panel peddler.

Alpex is building a real business — with real cash, real orders, and real margins.

Not perfect. But damn promising.

📄 Page 10: Final Thoughts + Meme Zone

🎯 Final Take – Alpex Solar in One Line:

An underhyped, overdelivering solar stock that’s scaling like a startup but profiting like a PSU.

✅ Orders booked.

✅ Margins rising.

✅ Moat forming.

❌ Not a tip. Just research.

😂 Meme Zone

“Woh uncle jinhone abhi solar lagwaya hai…”

🌞☀️⚡

“Beta, din bhar AC chalao, koi tension nahi hai — ab toh light free hai!”

Meanwhile Alpex Solar: Thanks uncle marketing ka cheque ghar pe bhej denge

🙌 That’s a wrap on EduInvesting Premium Report

June 2025 | Stock Covered: Alpex Solar Ltd

Tagline reminder:

“1 stock. No tips. Just research.”