🧵 At a Glance

Marine Electricals (India) Ltd just announced three new orders worth ₹14.33 Cr, spanning naval defense, infrastructure, and renewables. While it’s not a massive number in absolute terms, it confirms one thing: Marine is hustling across sectors and riding the multi-theme India growth wave. The contracts may be small individually — but together, they signal serious momentum.

1️⃣ What’s the News?

Marine Electricals received three supply orders totaling ₹14.33 Cr (excl. taxes):

| Client | Project | Product Supplied | Timeline |

|---|---|---|---|

| Garden Reach Shipbuilders & Engineers (GRSE) | Indian Navy’s Multi-purpose Vessel | Remote-Controlled Valves with actuators | 12 months |

| Afcons Infrastructure Ltd | Infra Project | Power Distribution System | 6 months |

| Core GreenTech LLP | Green Energy Project | Power Distribution System | 6 months |

✅ Not related-party

✅ Promoters not involved

✅ Clean corporate disclosure under SEBI Reg. 30

2️⃣ Why This Matters

💡 Multi-sector Diversification

This order mix proves Marine Electricals isn’t dependent on any one industry. In just one update, they’re supplying to:

- 🚢 Naval defense (GRSE)

- 🏗️ Urban infra/transportation (Afcons Infra)

- 🌱 Renewables/green tech (Core GreenTech)

It’s like a small-scale L&T – only with more wires and less noise.

3️⃣ Order Value – Small but Consistent

- While ₹14.33 Cr is not massive, Marine has a history of booking regular small-to-mid size orders.

- The company has done ₹500+ Cr revenue in FY24 → this update = ~2.9% of annual revenue

- Delivery time spread = 6–12 months = revenue visibility over next 2–4 quarters

4️⃣ Marine Electricals: Business Snapshot ⚙️

| Metric (FY24) | Value |

|---|---|

| Revenue | ₹537 Cr |

| Net Profit | ₹20 Cr |

| EBITDA Margin | ~12% |

| ROCE | ~13% |

| Promoter Holding | ~64% |

| Debt:Equity | < 0.4x |

| Current Market Cap | ~₹900 Cr+ |

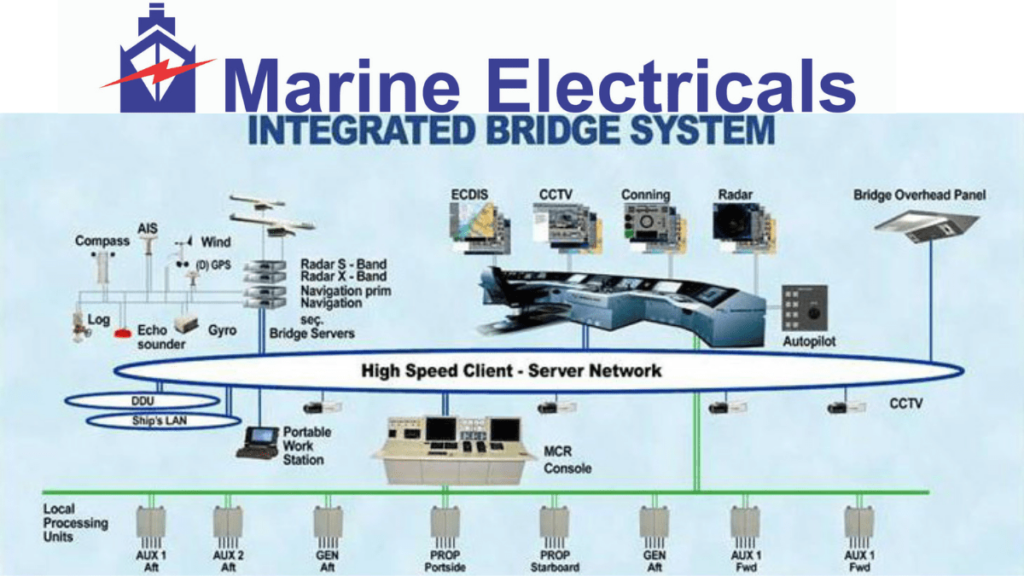

- Marine is one of the largest integrated electrical automation solution providers for marine, infra, and industrial clients

- Growing presence in EV charging infra, solar panels, defense supplies, and smart electrification

5️⃣ Strategic Signals

🟢 GRSE order → continuing defense exposure. Marine’s earlier work with Indian Navy, submarines, and patrol vessels is being extended.

🟢 Afcons → big name in infrastructure (bridges, tunnels, metros). Good entry or continuation.

🟢 Core GreenTech → renewables exposure intact. Could be battery/smart infra integration project.

⚠️ None of these are mega EPC contracts, but they add recurring revenue and strengthen Marine’s book and reputation.

6️⃣ Stock Performance Check 📈

| Period | Price Gain |

|---|---|

| 1 Month | +9% |

| 3 Months | +45% |

| 1 Year | +240% 🚀 |

- Stock has quietly turned into a multibagger, aided by FY24 delivery, improving margins, and visible order book

- P/E ~45x – but growth trajectory supports it (so far)

🧑⚖️ EduInvesting Verdict™

Marine Electricals isn’t giving you huge order numbers to flex on Twitter. But what they are doing is methodically building a diversified, resilient, order-backed business.

- This update reaffirms three things:

- Orders are flowing

- Sectors are expanding

- Marine Electricals is staying visible on every radar from defense to decarbonization

Keep an eye on their Q1FY26 earnings – the execution on these orders will start reflecting there.

🧮 No FV change for now, but momentum is strong.

✍️ Written by Prashant | 📅 7 July 2025

Tags: Marine Electricals, Defense Orders, Afcons Infra, GRSE, Core GreenTech, Smart Electrification, Power Distribution, NSE SME, EduInvesting, Order Win, Automation Stocks