1. At a Glance

Shrem InvIT is currently trading at ₹102 with a market cap of roughly ₹6,231 crore, which is almost poetic considering its latest declared NAV is ₹94.33 per unit and book NAV is even lower at ₹70.21. Translation: the market is pricing in hope, distributions, and a prayer.

In the last three months, returns are negative (-2.63%), six months are also negative (-3.77%), and one year returns sit at a sad -10.7%. Meanwhile, the trust proudly announced its 18th distribution of ₹5.418 per unit, which is basically the only reason most unitholders are still emotionally invested.

Operationally, this is a 39-road asset InvIT across 9 states, mostly HAM-heavy, with ₹8,080 crore of debt, ~54% leverage, 1.97x DSCR, and a 7.35% weighted average cost of debt.

Revenue is growing (14.3% TTM), profits are falling (-20.9% TTM), and promoter units are 70% held with ~48% pledged, which is… let’s say “energetic governance”.

If you came here for price momentum, you’re lost.

If you came for yield stability with debt drama on the side, welcome home.

2. Introduction

Infrastructure Investment Trusts are sold to retail investors like fixed deposits with highways. Smooth annuities, predictable cash flows, inflation protection, and quarterly hugs in the form of distributions.

Shrem InvIT looked like exactly that story — until you actually read the numbers instead of the brochure.

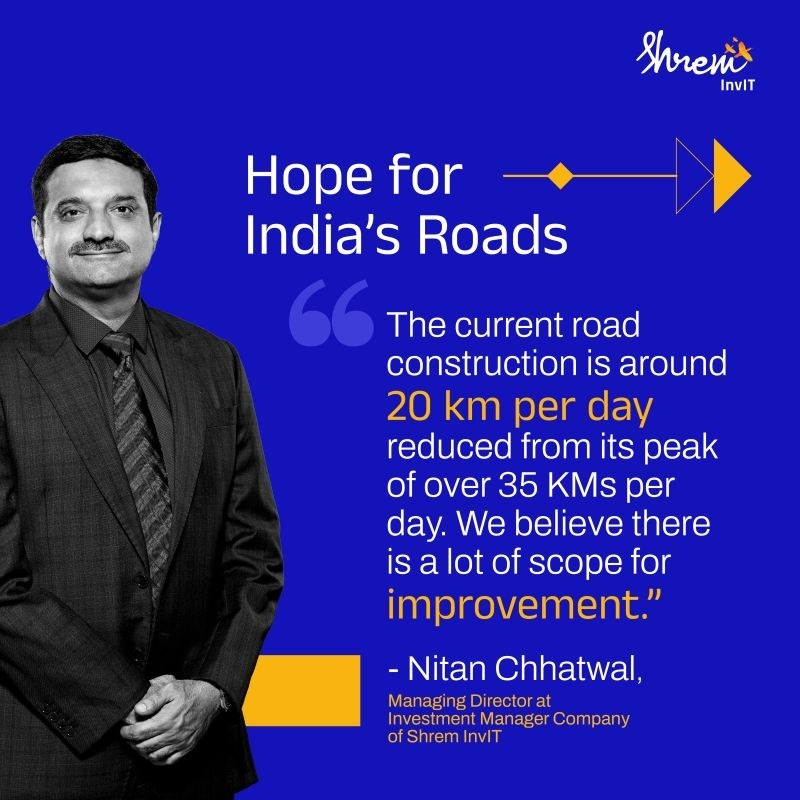

Set up by the Shrem Group (founded in 2010 by Nitan Chhatwal), this InvIT owns a diversified portfolio of road assets across Madhya Pradesh, Maharashtra, Karnataka, UP, Andhra Pradesh, Odisha, Jharkhand, Gujarat, and Chhattisgarh. On paper, that’s diversification. In reality, it’s HAM-heavy leverage with annuity seasoning and toll exposure sprinkled on top.

The trust has been extremely active in acquisitions, issuing fresh units, raising debt, and pushing leverage dangerously close to the regulatory ceiling of 60% net debt to EV. Management insists they’ll stay below the cap. Technically, they have. Emotionally, this is white-knuckle finance.

And then there’s the tax rate. Or rather, the lack of it. Negative tax percentages popping up quarter after

quarter make profits look healthier than they feel — like gym selfies with perfect lighting.

So the question is simple:

Is Shrem InvIT a misunderstood yield machine, or a leveraged highway toll booth waiting for traffic to disappoint?

Let’s dig.

3. Business Model – WTF Do They Even Do?

Shrem InvIT does exactly one thing: collect money from roads.

It owns, operates, and maintains road assets through SPVs. Cash flows come from:

- HAM annuities paid by NHAI

- Annuity projects with fixed payments

- Annuity-cum-toll hybrids

- Pure toll roads (the spicy but risky ones)

Out of 39 assets:

- Majority are HAM projects

- A smaller chunk are annuity-based

- A minority depend on toll traffic and economic mood swings

HAM is supposed to be low-risk. Government pays annuities, inflation-linked, long tenor. Sounds boring — which is perfect for InvITs. But here’s the catch: HAM projects are debt-hungry during construction and still carry refinancing and interest rate risk post-COD.

Shrem’s model has been aggressive acquisition-led growth. Buy roads, load SPVs with debt, upstream cash flows to the trust, distribute aggressively, and hope interest rates behave.

This works beautifully when:

- Traffic assumptions hold

- Refinancing remains cheap

- Government payments don’t get delayed

- Capital markets remain friendly

Ask yourself: how many of these are permanently guaranteed?

4. Financials Overview

Quarterly Comparison Table (₹ crore unless stated)

| Metric | Latest Quarter (Dec FY26) | YoY (Dec FY25) | QoQ (Sep FY26) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 471 | 574 | 570 | -18.1% | -17.4% |

| EBITDA | 238 | 362 | 315 | -34.3% | -24.4% |

| PAT | 132 | 237 | 206 | -43.1% | -35.9% |

| EPS (₹) | 2.18 | 3.84 | 3.35 | -43.2% | -34.9% |