1. At a Glance

Timex Group India Ltd is currently that stock which looks like it just ran a marathon but is still wearing a tuxedo. Market cap around ₹3,089 Cr, stock price hovering near ₹306, and a P/E of 52x — all this for a company selling watches that most Indians first bought during board exams or first salaries. Yet here we are.

Q3 FY26 numbers? Revenue ₹151 Cr (+26% YoY), PAT ₹5.13 Cr (+164% YoY). ROE looks like it drank Red Bull — 197%, while ROCE is a respectable 42.6%. Debt is practically non-existent at ₹12.6 Cr, but book value is just ₹11.8, which makes the 25.9x P/B feel like buying a ₹500 roadside watch for ₹13,000 because it says “Swiss Design”.

Promoters just sold 8.93% stake via OFS, bringing holding down to 51%, which adds spice. Stock is up ~70% YoY, but down 17% in 3 months, so momentum traders are confused and long-term investors are sharpening Excel sheets.

Bottom line: this is no longer a sleepy watch assembler. It’s a lifestyle, retail, and distribution play pretending to be a manufacturing company. Curious already?

2. Introduction

Timex is that rare Indian listed company whose brand recall is stronger than its balance sheet history. For nearly two decades, it struggled — losses, negative reserves, awkward cash flows, and the occasional “why is this even listed?” moment.

Then something changed.

From FY22 onwards, revenue started accelerating, margins stopped embarrassing management, and suddenly Timex India discovered something revolutionary: operating leverage + retail expansion + premiumisation. Add e-commerce, Just Watches acquisition, and luxury brand licensing, and voilà — the market woke up.

But don’t get carried away. This is still a company with:

- Thin net margins (~6%)

- Heavy royalty & advertising costs

- And a valuation that assumes

- everything goes right, forever

So is this a genuine turnaround, or just a well-timed fashion cycle wearing a fancy strap?

Let’s open the back case.

3. Business Model – WTF Do They Even Do?

Timex India does four things:

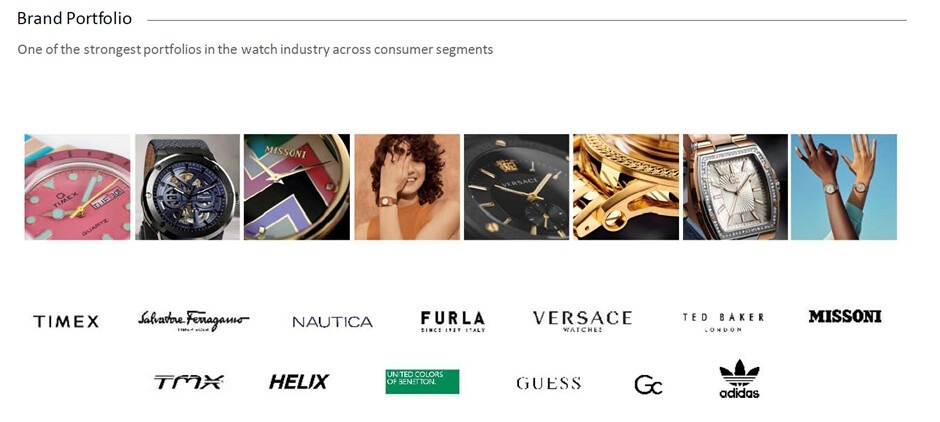

- Manufacture & assemble watches

The Baddi plant in Himachal Pradesh assembles ~3 million watches annually, covering analog, digital, smart, mechanical, and hybrid models. This is assembly-heavy, not hardcore manufacturing. Think Lego, not semiconductor fabs. - Brand licensing & trading

Timex doesn’t own Versace, Guess, Ferragamo, etc. It licenses them, manufactures/outsources, markets, and sells. Which means:- High ASPs

- High marketing

- Royalty expense (3.6% of revenue in Q3 FY25)

- Retail & distribution

This is where the real game is.- 5,500+ multi-brand outlets

- 362 large format stores

- 44 exclusive retail stores

- 149 luxury retail points

- Plus Amazon, Flipkart, Myntra, Nykaa, AJIO

- After-sales & service moat

Watches break. Batteries die. People lose invoices. Timex has 163 authorised service centres pan-India, which quietly builds brand stickiness.

Question for you: how many Indian brands can sell a ₹2,000 watch and a ₹2,00,000 Versace watch under one roof?

4. Financials Overview

Quarterly Performance Table (₹ Cr)

| Metric | Latest Qtr (Q3 FY26) | YoY Qtr | Prev Qtr | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 150.78 | 119.94 | 243.67 | 25.7% | -38.1% |

| EBITDA | 9.55 | 4.21 | 42.54 | 126.8% | -77.6% |

| PAT | 3.20 | 1.94 | 30.23 | 164.4% | -89.4% |

| EPS (₹) | 0.32 | 0.19 | 2.99 | 68.4% | -89.3% |

Yes,