1. At a Glance

MeetBizotic Commercial Ltd— the Jaipur-based fast-fashion dream that seems to have swapped tailoring threads for rocket fuel. In Q2FY26 (half year ending September 2025), the company reported revenue of ₹73.78 crore and a net profit of ₹8.38 crore — a sizzling39.6% jump in salesand521% surge in profityear-on-year. The market, clearly impressed, dressed up the stock price to ₹899 (as of November 25, 2025), making it a ₹723 crore SME fashion powerhouse.

But wait — the P/E sits at66.7x, nearly double the industry median (29.4x). That’s like wearing Gucci prices on a Pantaloons product. And yet, the 803% one-year return laughs at all critics, proving that this small-cap tailors’ tale has turned into a multibagger wardrobe essential.

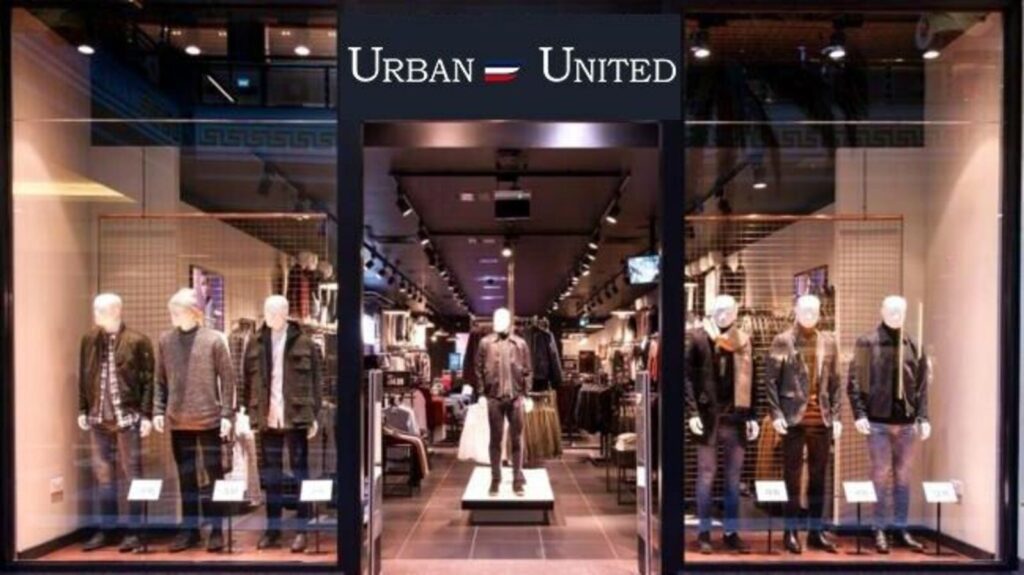

Bizotic runs under the men’s fashion labelUrban United, with 21 stores across India (mostly in Rajasthan) and plans to keep opening new ones faster than Indian weddings happen in November. WithROCE at 11.4%,ROE at 7.6%, andDebt to Equity at just 0.13, the financial stitching looks tight — though the margins need better ironing.

If you blinked during FY24–FY25, you probably missed this company’s Cinderella transformation from ₹8 crore sales in FY19 to ₹132 crore TTM — afashion startup to listed entityleap that even Shark Tank would find overdressed.

2. Introduction

What happens when you mix Rajasthan’s textile DNA with startup-era Instagram energy? You getBizotic Commercial Ltd, a company that manufactures, trades, and sells men’s garments but markets them with the flair of a Bollywood stylist on a sugar rush.

Founded in 2016, Bizotic started as a small trading business, quietly dealing in fabrics and wholesale garments. Fast-forward to FY25, and it’s become a ₹132 crore sales story with its brandUrban Unitedplastered across city malls and e-commerce listings.

The company designs, markets, and retails menswear across every mood swing: formal, casual, party, ethnic, fit, comfort, and even “winter wear” (for people who still believe Rajasthan gets cold). The brand currently operates20 stores in Rajasthan and one in Bihar, mostly on franchisee models — a smart way to expand without bleeding cash like most apparel startups.

But here’s the twist — despite all this glamour, Bizotic isn’t shy about its humble structure. It outsources manufacturing to third-party job workers, handling design, quality, and packaging in-house. In short, it’s a fashion orchestrator, not a factory-heavy behemoth.

And investors love the melody — because while competitors like Lux, Arvind, and Gokaldas are grinding through global headwinds, this ₹723 crore SME just pulled off a 520% profit jump. Who knew a Jaipur fashion brand could outpace even influencer growth rates?

3. Business Model – WTF Do They Even Do?

Bizotic’s playbook is simple but stylish:design locally, outsource efficiently, sell aggressively. Under its flagship brandUrban United, it curates a full wardrobe for men — from formal shirts to party jackets, from “ethnic wear for shaadis” to “comfort wear for hangovers.”

The process works like this: Bizotic finalizes the design and fabric specs, sends them to third-party job workers for production, and handles quality inspection, finishing, and distribution in-house. Think of it asZara’s fast-fashion model, but executed in Jaipur’s industrial bylanes with desi cost control.

Here’s where it gets smarter — 17 out of 21 stores arefranchisee-owned. That means the company takes asecurity deposit, supplies merchandise, and gets brand reach without the headache of rent and staff costs. This keeps capital expenditure light and scalability high.

It’s also a fabric trader, selling cloth material wholesale and retail. So even if apparel demand slows, the company’s trading leg cushions the P&L.

Revenue mix (FY24):

- 94%from product sales (the core business)

- 3%from sundry write-offs

- 2%from capital gains

- 1%from interest income

A neat structure, though one wonders — when 94% comes from selling shirts, is the 6% “extra income” their version of accessorizing?

4. Financials Overview

| Metric | Latest Qtr (Sep 2025) | YoY Qtr (Sep 2024) | Prev Qtr (Mar 2025) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue (₹ Cr) | 73.8 | 52.9 | 58.0 | 39.6% | 27.2% |

| EBITDA (₹ Cr) | 12.0 | 2.0 | 4.0 | 500% | 200% |

| PAT (₹ Cr) | 8.38 | 1.35 | 2.06 | 521% | 306% |

| EPS (₹) | 10.42 | 1.68 | 3.05 | 520% | 242% |

Annualised EPS = ₹10.42 × 2 = ₹20.84 (since these are half-yearly numbers).

At ₹899 per share, the P/E =899 / 20.84 = 43.1x

(annualised)— though the screener quotes 66.7x on trailing earnings, which suggests FY25 was still warming up.

Commentary:From ₹1 crore profit in FY22 to ₹8 crore in H1FY26 — that’s a glow-up Bollywood makeup artists would envy. The EBITDA margin has climbed from a patchy 2–6% range to a solid 16%, hinting that Urban United’s pricing power is finally kicking in.

5. Valuation Discussion – Fair Value Range Only

Let’s decode whether this ₹723 crore market cap makes sense or if the stock’s just modeling runway prices.

Method 1: P/E Approach

- EPS (annualised): ₹20.84

- Industry P/E: 29.4

- Bizotic premium justified for growth: 1.2–1.6x range

→Fair Value = ₹20.84 × (29.4 × 1.2 to 1.6)→ ₹20.84 × (35 to 47) =₹730 – ₹980 range

Method 2: EV/EBITDA

- EV = ₹730 Cr

- EBITDA (TTM) = ₹16 Cr→ EV/EBITDA = 45.6xIndustry average ≈ 20x→ Educational fair range = 20–35x → implies EV between ₹320–₹560 Cr →Fair Value range ₹600–₹850/share

Method 3: DCF (Simplified)Assume PAT growth 25% next 3 years, discount rate 12%, terminal growth 4%.DCF fair range works out around₹750–₹950/share.

✅Fair Value Range (Educational Only): ₹700–₹950/share

Disclaimer:This range is purely for educational purposes and not investment advice.

6. What’s Cooking – News, Triggers, Drama

The most delicious gossip comes straight from Bizotic’s BSE filings:

- Sep 30, 2025:Company bagged₹72.25 crore purchase ordersfrom Osia Hyper Retail, DDTC Exim, and Qmin Industries for fabrics, apparel, trousers, and bags. That’s almost an entire year’s FY24 revenue — in one swoop.

- Sep 12, 2024:Opened a new1600 sq. ft. showroom in Ahmedabad, marking its first big move outside Rajasthan. Maybe next — Mumbai malls and influencer tie-ups?

- Oct 2025:Board approvedpreferential issue of ₹22.27 Cr equity + ₹71.11 Cr warrants, signalling expansion firepower.

- Feb 2025:Resignation of Company Secretary (again) — because what’s fashion without a little HR drama?

- Nov 2024:Appointment ofJ. Singh & Associatesas new auditors, post resignation of the previous firm. Because every SME needs a fresh auditor before a fresh rally.

Clearly, this is a