✅ At a Glance

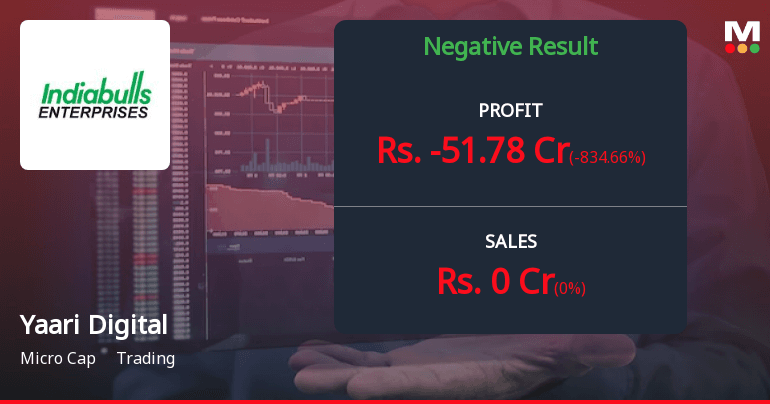

| Metric | FY25 (Consolidated) | FY24 (Est.) |

|---|---|---|

| 🧾 Revenue from Ops | ₹0 Cr | Minimal |

| 💸 Other Income | ₹5.1 Cr | NA |

| 💥 Net Loss | ₹(68.2) Cr | ₹(19.4) Cr est. |

| 📉 EPS | ₹-6.79 | ₹-1.94 est. |

| 💰 CMP (May 20, 2025) | ₹15 | — |

| 🧮 FV Estimate | NA (EPS negative) | — |

The only thing growing here is the loss. And maybe the investor patience.

🧾 About the Company

Yaari Digital Integrated Services Ltd. (formerly part of Indiabulls) claims to operate in:

- 💬 Digital platforms (social + e-commerce)

- 🏢 Real estate–related services (historically)

- 📉 Whatever’s left after demergers

But in FY25, there’s no operating revenue, no products sold, and only other income (likely from investments, cash interest, or asset sales).

📊 FY25 Financial Breakdown

| Line Item | Amount (₹ Cr) |

|---|---|

| 📊 Revenue (Operations) | 0.00 |

| 💸 Other Income | 5.1 |

| 🧍♂️ Employee Cost | 1.16 |

| 💣 Finance Costs | 60.4 |

| 🧾 Other Expenses | 7.05 |

| 📉 Total Expenses | 68.7 |

| 🔻 Net Loss | (68.2) |

| 🧮 EPS | ₹-6.79 |

Finance costs of ₹60 Cr with ₹0 revenue = business model in reverse gear.

🏦 Balance Sheet Snapshot

| Metric | Value (₹ Cr) |

|---|---|

| 💰 Cash & Equivalents | ₹188 Cr |

| 📉 Net Worth | ₹-2,764 Cr |

| 📉 Reserves | ₹-2,961 Cr |

| 📊 Equity Capital | ₹197.4 Cr |

| 📉 Total Liabilities | ₹3,002 Cr |

| ⚖️ D/E Ratio | NA (net negative equity) |

Technically bankrupt — except for the ₹188 Cr cash. Aka: “Bhookhe hain, lekin

To Read Full 16 Point ArticleBecome a member

To Read Full 16 Point ArticleBecome a member