1. At a Glance

Dr. Reddy’s is the pharma equivalent of Virat Kohli—built for consistency, with occasional fireworks and the odd duck-out thanks to the FDA umpire. With₹33,520 crore FY25 revenue, ₹5,681 crore PAT, and a P/E of just 18.6x, it looks like a value bet in a sector where Sun and Torrent charge “Bollywood star” multiples. But don’t mistake cheap for weak—this Hyderabad-based powerhouse has400+ generics, 23 plants, 36 subsidiaries, and products across 165 countries. Still, with 83% revenues from generics, two customers contributing ~15% revenue, and R&D spend tapering down, the question is: is Dr. Reddy’s building a resilient long game or just playing IPL with budget cuts?

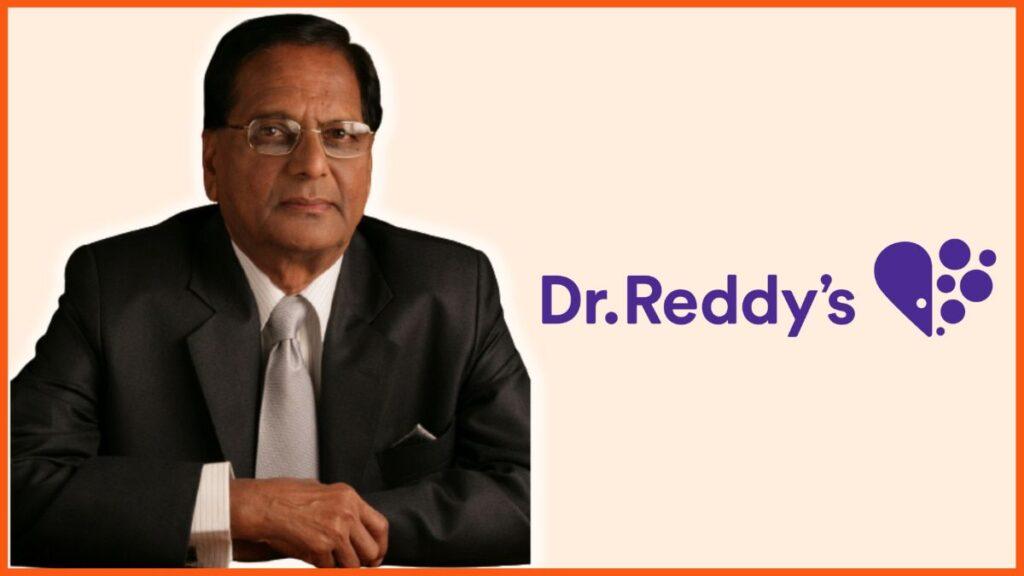

2. Introduction

Dr. Reddy’s Laboratories (DRL) was born in 1984 in Hyderabad with a clear mission: affordable drugs for the world. Fast forward four decades, and it’s one of India’s top 3 pharma majors with footprints acrossthe U.S. (37% revenue), India (22%), Russia (9%), and a sprinkling across 32% “rest of world.”

What makes DRL fascinating is itsdouble life:

- On one hand, it’s a cost warrior—churning out APIs, filing ANDAs, making generics cheaper than a Mumbai vada pav.

- On the other, it’s quietly hedging its bets withbiosimilars, injectables, oncology research (via Aurgene Discovery), and even proprietary products.

They even tried their hand at Covid medicine roulette—Remdesivir, Molnupiravir, Baricitinib, and even Sputnik-V. Basically, if you were sick between 2020–2022, there’s a chance Dr. Reddy’s had a medicine (or ten) with your name on it.

But unlike Cipla (king of inhalers) or Sun (king of margins), Dr. Reddy’s is a grinder. Its growth comes from niche, limited-competition generics, occasional product acquisitions (like Eton’s injectables), and a careful API strategy that gives both revenue and backward integration.

3. Business Model (WTF Do They Even Do?)

Revenue Split (FY22):

- Global Generics (~83%)→ 400+ generics, top categories: nervous system (14%), GI (13%), anti-infectives (10%). Filed 7 ANDAs in FY22.

- PSAI (~14%)→ APIs powerhouse (filed 139 DMFs globally in FY22). Cardiovascular, anti-infectives, pain management dominate.

- Proprietary Products & Others (~2%)→ Differentiated formulations, biosimilars, and Aurgene’s oncology research.

Geography:

- U.S. – 37%

- India – 22%

- Russia – 9%

- Others – 32%

Assets:23 plants (14 formulations, 9 APIs) spread from India to Mexico, UK, U.S., China.

R&D:9 facilities, spend dropped from 13% (FY18) → 8% (FY22). They’re still filing DMFs like engineers file resumes, but R&D thriftiness raises eyebrows.

Verdict: 83% generics is both strength (scale, cost) and weakness (pricing pressure, FDA risk). DRL is like Reliance Fresh—huge presence, but margins depend on how well suppliers (and regulators) behave.

4. Financials Overview

| Metric | Latest Qtr (Jun ’25) | YoY Qtr (Jun ’24) | Prev Qtr (Mar ’25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | ₹8,572 Cr | ₹7,696 Cr | ₹8,528 Cr | 11.4% | 0.5% |

| EBITDA | ₹2,174 Cr | ₹2,130 Cr | ₹1,998 Cr | 2.1% | 8.8% |

| PAT | ₹1,410 Cr | ₹1,392 Cr | ₹1,587 Cr | 1.3% | -11.2% |

| EPS (₹) | 17.0 | 16.7 | 19.1 | 1.8% | -11.0% |

Commentary:YoY growth looks healthy, but QoQ PAT dip shows pharma volatility. Annualized EPS ~₹68 → P/E 18.6x, making it the “value kid” of pharma compared to Torrent’s nosebleed 61x.

5. Valuation (Fair Value Range Only)

- P/E Method:EPS ~₹68. Fair multiple = 17–24x (pharma peer band). FV =₹1,150–₹1,630.

- EV/EBITDA Method:EV ~₹1,07,695 Cr. EBITDA ~₹8,500 Cr. EV/EBITDA = ~12.6x. Peer band 11–16x. FV =₹1,200–₹1,700.

- DCF Method:Assume 10% CAGR, WACC 9%, terminal 3% → FV =₹1,300–₹1,800.

👉Consolidated FV Range: ₹1,150–₹1,800Disclaimer: This FV range is for educational purposes only and not investment advice.

6. What’s Cooking – News, Triggers, Drama

- FDA Updates:Aug 2025 – Miryalaguda plant inspection closed as VAI (manageable). Investors sighed in relief.

- Acquisitions:Snapped up Eton’s injectable portfolio (₹5M upfront + contingent). Building