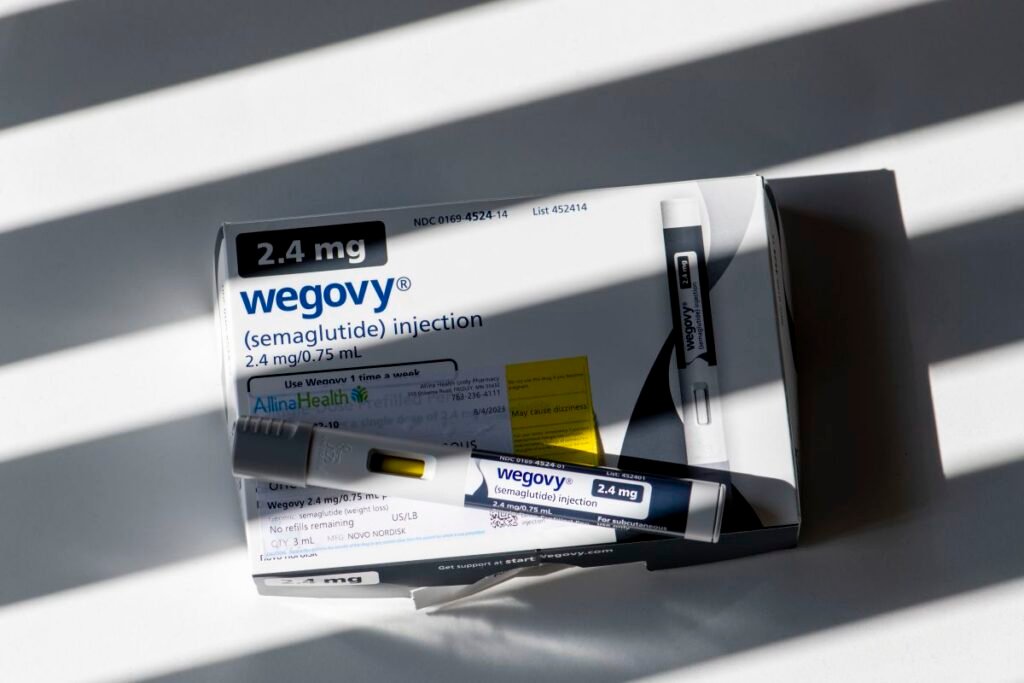

Telemedicine company GoodRx (GDRX) has been helping Americans find the cheapest way to buy drugs for years. Thanks to a new partnership with pharma giant Novo Nordisk (NVO) , the creator of Ozempic and Wegovy, it might soon be the cheapest way to buy branded weight loss drugs too.

On Monday, the two firms announced a partnership which will allow patients with a prescription to get the branded medication for $499/mo, so long as they’re willing to pay out of pocket and present the GoodRx coupon at their local pharmacy.

How Does that Compare to Alternatives?

At $499/mo the branded drug is only a little more expensive than compounded GLP-1 injectables sold by telehealth pharmacies, which have drawn the ire of pharmaceutical giants and the Food and Drug Administration (FDA).

It’s also more expensive than the $349/mo single-dose vial of Zepbound, the competing GLP-1 drug sold by competitor Eli Lilly (LLY) , which is also available through GoodRx. However, Ozempic and Wegovy’s patented pens might be reason enough to pay up, since they’re easier to use.

Still, those with insurance might be eligible to have the cost completely covered, rather than pay the out of pocket cost. For that, patients should check with their prescriber and insurer.

Second Time’s a Charm

This is not Novo’s first ride on the direct-to-consumer wagon. In April, it partnered with Hims & Hers HIMS (-1%) to help them sell Wegovy directly to customers.

Novo ended that effort in July, alleging that the telehealth company intentionally undercut their branded medications through “deceptive promotion and selling of illegitimate, knockoff versions” of its drug, which “put patient safety at risk.” A lawsuit has been filed against Hims & Hers.

The failed “collaboration” between the companies spurred the departure of its chief executive, as well as a reduction to the company’s annual guidance ahead of its quarterly earnings. Worst of all, it say Novo Nordisk lose market share to competitor Eli Lilly, which represents over half of the GLP-1 market.

Novo’s leadership have indicated a desire to expand its direct-to-consumer offerings and cut prices, looking to undercut both branded and compounded GLP-1 drugs.