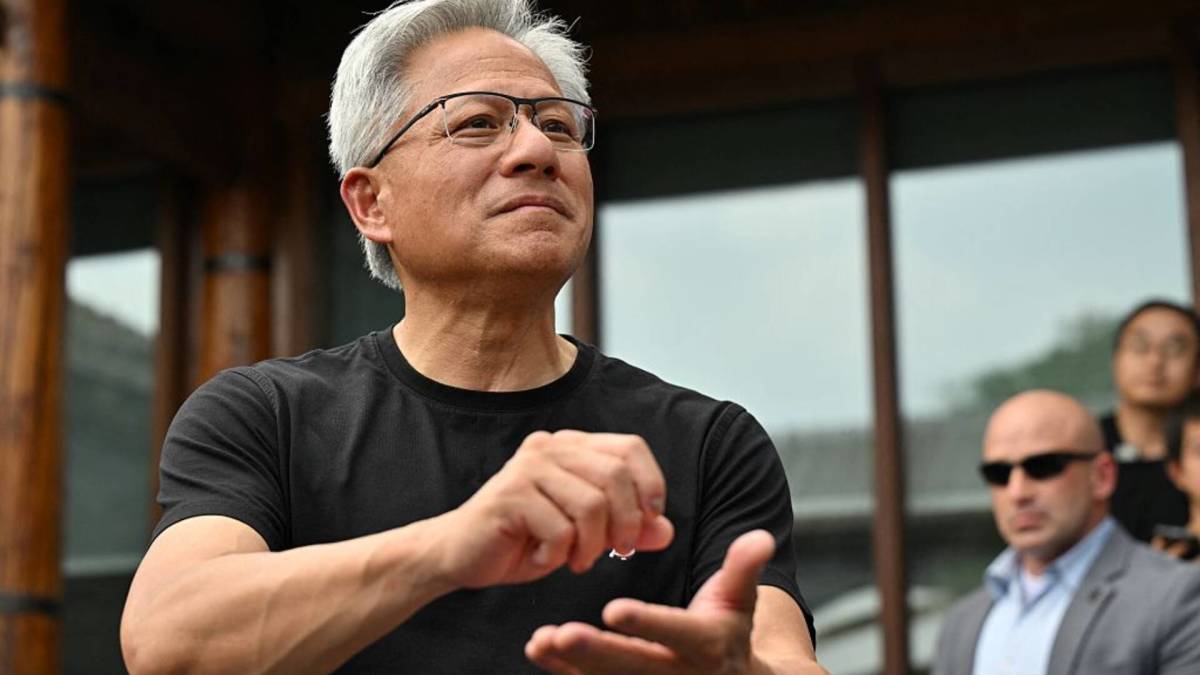

Jensen Huang wants you to work hard — even if you’re family.

Huang may be co-founder and CEO of AI-chip colossus Nvidia (NVDA) , but his children still had to start off as interns.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰💵

Bear in mind that the elder Huang is a strong believer in resilience.

“You have to suffer,” he said in an interview. “You have to struggle, you have to endeavor, you have to do those hard things and work through it in order to really appreciate what you’ve done.

“Therefore, I wish upon you greatness, which by my way of saying, wish upon you plenty of pain and suffering.”

If that’s the case, then siblings Madison and Spencer Huang must have had several serious helpings of pain and suffering in their time at the world’s most valuable company.

Nvidia preps to report for fiscal Q2

Madison operates the Omniverse division’s 3D simulation software operations, and her brother Spencer oversees AI-model development and robotics-perception systems, according to The Information.

And if they stick around, the two siblings could make a lot of dough.

More Nvidia:

- Nvidia quietly buys more stock in AI infrastructure favorite

- Soros supercharges Nvidia stake, loads up on AI plays

- Goldman Sachs revamps Nvidia price target ahead of earnings

“I’ve created more billionaires on my management team than any CEO in the world,” Jensen Huang said during a panel hosted by venture capitalists running the All-In podcast. “They’re doing just fine.”

And if you don’t measure up, Huang probably won’t show you the door — although you might wish he had.

“I very seldom fire people,” he said. “I’d rather torture them to greatness.”

Nvidia will be center stage on Aug. 27 when the Santa Clara, Calif., company is scheduled to report fiscal-second-quarter earnings.

The chipmaking giant had been hit hard by President Donald Trump’s trade war with China, after the White House blocked the export of certain AI chips to China, including Nvidia’s H20 chips and AMD’s MI308 chips.

China is an important market for Nvidia, generating $17.1 billion in fiscal 2025 revenue, or 13.1% of total revenue.

However, Nvidia and AMD (AMD) recently agreed to pay the U.S. government 15% of Chinese revenue as part of a deal to secure export licenses to China.

And analysts expect revenue from the country to begin showing up in Nvidia’s reports soon.

Nvidia’s shares are up 35% this year and have climbed 45% from this time in 2024.

Firm cites insatiable AI chip demand

Morgan Stanley raised its price target on Nvidia to $206 from $200 and affirmed an overweight rating on the shares, according to The Fly.

Expectations have risen ahead of Nvidia’s earnings, and “rightfully so,” said Morgan Stanley, which expects a strong quarter and outlook.

The investment firm, which said its “optimism centers on what lies ahead,” said supply is what matters on the night of the earnings call but demand is what sets the path into 2026.

Morgan Stanley modeled $46.6 billion in revenue for the July quarter, up from its prior forecast of $45.2 billion, and $52.5 billion in revenue for the October quarter, up from a prior view of $51.3 billion.

Related: Nvidia quietly buys more stock in AI infrastructure favorite

Cantor Fitzgerald boosted its price target on Nvidia to $240 from $200 and maintained an overweight rating.

With Nvidia ramping up Blackwell chip production amid seemingly insatiable demand for artificial-intelligence computing, estimates appear poised to reaccelerate in the July quarter and move significantly higher into the October quarter and beyond, the firm said.

Cantor Fitzgerald’s confidence in a path to $200 billion-$300 billion in data-center revenue in 2025-2026 has grown over the past three months, supporting a clear path to $8 in earnings power in calendar 2026.

Computing power is emerging as one of this decade’s most critical resources amid the AI boom, according to consulting firm McKinsey. By 2030, data centers are projected to require $6.7 trillion worldwide to keep pace with the demand for computing power, McKinsey said.

Piper Sandler analyst Harsh Kumar raised the firm’s price target on Nvidia to $225 from $180 and kept an overweight rating on the shares.

The analyst is expecting another positive quarter from Nvidia and sees upside to numbers for both the July and October quarters.

While Kumar is modeling largely in line with the analyst consensus for the July quarter and slightly below Wall Street for October, he is calling for upside given the recent positive commentary from U.S. hyperscalers as well as the inclusion of revenue from China.

(The hyperscalers, like Amazon, Alphabet’s Google and other tech giants, are the major providers of cloud-computing services and infrastructure.)

The analyst noted that its estimates and Wall Street estimates do not reflect the inclusion of China business. Piper is expecting revenue from the country to start coming in toward the end of this month.

Related: The stock market is being led by a new group of winners