1. At a Glance

Vikran Engineering wants ₹1,000 Cr from the market — ₹900 Cr fresh issue (yay, expansion!) and ₹100 Cr OFS (promoters encashing a bit). Promoter stake pre-issue:81.8%, post-issue (TBD, but likely ~60%). The business? EPC contracts inpower, water, railways, solar. Think underground water pipelines, 400kV substations, solar projects, and tanks in Tier-II towns. FY24 revenue = ₹791 Cr, PAT = ₹75 Cr, margins ~9.5%. Healthy growth, but IPO pricing is still a black box (price band “TBD”).

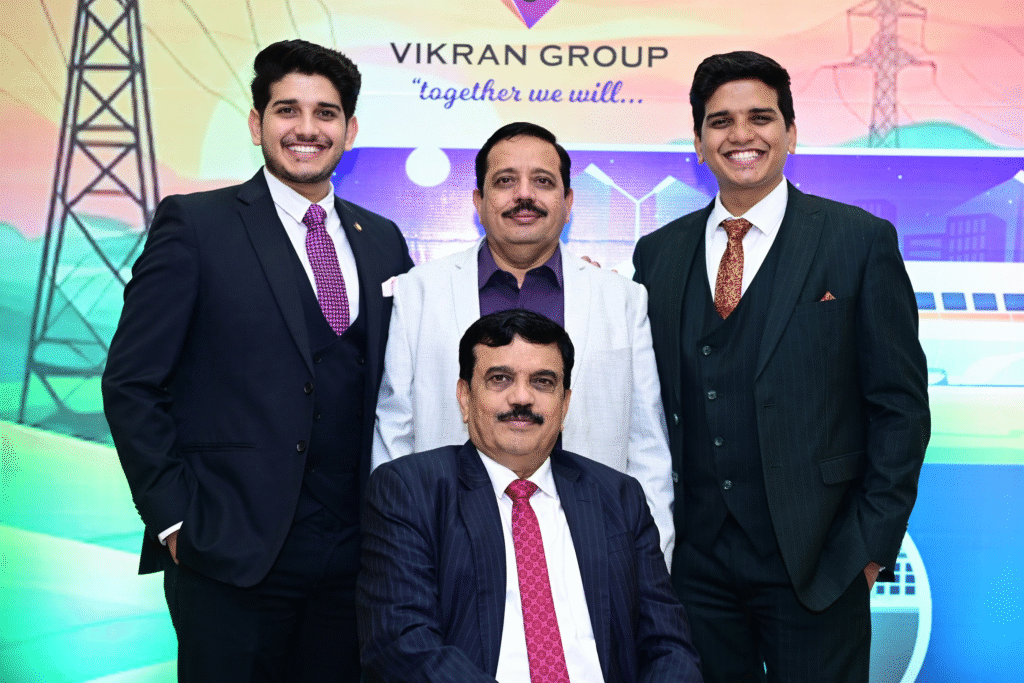

2. Introduction

Every infrastructure company wants to look like L&T but usually ends up looking like “local contractor uncle.” Vikran Engineering, incorporated in 2008, is now trying to scale up from regional EPC player to listed company glory. Their claim: executed 44 projects worth nearly ₹1,900 Cr and sitting on anorder book of ₹1,955 Cras of Aug 2024.

The story has all ingredients:

- Power distribution contracts with NTPC & PGCIL.

- Water infra projects in Bihar, Telangana.

- Railway infra touches.

- Solar EPC experiments.

Basically, they build the boring but necessary stuff governments love to announce in rallies.

IPO funds are primarily forworking capital(~₹625 Cr!). That’s a big ask. Translation: “We have orders but no cash to execute, so please fund our projects.”

3. Business Model (WTF Do They Even Do?)

Vikran is an EPC company (Engineering, Procurement & Construction). Which means:

- Bid for infra projects (water, power, solar, railways).

- Win tenders → borrow/raise working capital → build → pray for timely payments.

Core sectors:

- Power: Substations up to 400kV, T&D projects.

- Water Infra: Underground pipelines, extraction, storage, distribution.

- Railways: Infra contracts.

- Solar: EPC for large solar parks.

They claim “pan-India presence” with 195 site locations. Reality: heavily dependent on government contracts (translation: “payment aayega… kab aayega?”).

4. Financials Overview

| Metric | FY24 | FY23 | FY22 | YoY % | 2Y CAGR % |

|---|---|---|---|---|---|

| Revenue | ₹791 Cr | ₹529 Cr | ₹480 Cr | +50% | +29% |

| EBITDA | ₹133 Cr | ₹80 Cr | ₹25 Cr | +67% | +105% |

| PAT | ₹75 Cr | ₹43 Cr | ₹7 Cr | +75% | +215% |

| Net Worth | ₹291 Cr | ₹131 Cr | ₹89 Cr | +122% | — |

👉Commentary: Revenues growing nicely, PAT jumped 11x in 2 years. Margins ~9.5%, ROE ~26%. Solid optics. But infra businesses are cyclical — one delayed project or government change and numbers collapse.

5. Valuation (Fair Value Range Only)

(Price band TBD, but let’s assume mid-cap infra multiples 18–22x earnings)

- EPS FY24 = ₹75 Cr / ~29.1 Cr shares (post-IPO guess) = ~₹2.6.If IPO is ₹250–₹300/share (speculative), implied P/E = 95–115x. That would be insane.If IPO is ₹80–₹100/share, P/E = ~30–38x → still premium.

🎯Fair Value Range (Educational only): 15–20x earnings → ₹40–₹60/share(based on FY24 EPS). IPO band will decide if this is a reasonable infra play or just overcooked.

6. What’s Cooking – News, Triggers, Drama

- Big Order Book: ₹1,955 Cr order book → ~2.5x FY24 revenue. Visibility is good.

- Working Capital Monster: ₹625 Cr of IPO is for WC. This screams: “clients aren’t paying on time.”

- Sector Push: