Opening Hook

While auto component peers were busy complaining about raw material prices, Craftsman Automation came in like a turbocharged lathe – spitting out revenue growth and EBITDA margins that made analysts rub their eyes. The company flexed its metal (literally) with record numbers, acquisitions, and a global footprint that screams: “Made in Coimbatore, ruling the world.”

Here’s what we decoded from their machine-oiled earnings call.

At a Glance

- Revenue zoomed 55% YoY to ₹1,784 crore – CNC machines not the only things running hot.

- EBITDA up 34% YoY to ₹270 crore – CFO calls it “operational efficiency,” we call it “ka-ching.”

- PAT up 19% to ₹70 crore – profit that’s not alloyed with excuses.

- EBITDA margin steady at 15% – not flashy, but solid like their castings.

- Market cap at ₹11,635 crore – from ₹3,000 crore IPO days, this stock’s been in beast mode.

- 26 plants in India + 2 in Germany – global expansion with a German twist.

- Guidance? More growth, more metal, fewer headaches.

The Story So Far

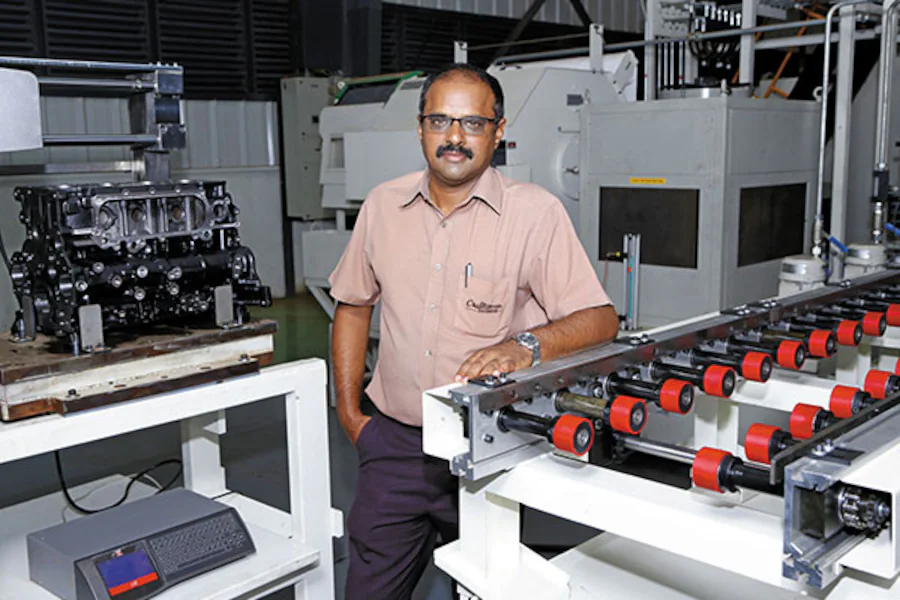

Craftsman started in 1986 as a humble precision engineering shop. Fast forward to FY25, it became a ₹5,690 crore revenue giant, gobbling up DR Axion, Sunbeam Lightweighting, and German foundries. The company pivoted from just powertrain components to aluminium lightweighting, EV parts, and industrial storage solutions.

Q1FY26 is the first full quarter reflecting these acquisitions, hence the 55% YoY revenue jump. Management proudly showcased their “end-to-end” capabilities – from casting to machining to assembly – because why outsource when you can own the supply chain?

Management’s Key Commentary

- On Growth:

“Acquisitions are driving scale, and we’re integrating well.”

– Translation: We bought growth, but it’s working. - On Margins:

“EBITDA margin stable at 15%.”

– Translation: Don’t expect miracles, but no disasters either. - On Aluminium Products:

“EV parts and lightweighting solutions are gaining traction.”

– Translation: Future-proofing with shiny metal. - On Industrial Engineering:

“Storage solutions remain steady; contract manufacturing is improving.”

– Translation: Not a cash cow, but it pays the bills. - On Global Footprint:

“Germany acquisition opens new markets.”

– Translation: Ja, wir expandieren! - On Outlook:

“Expect high double-digit growth this year.”

– Translation: Buy more shares? Your call.

Numbers Decoded – What the Financials Whisper

| Metric | Q1FY26 | Meme Take |

|---|---|---|

| Revenue – The Cash Conveyor | ₹1,784 cr | Growth like a perfectly machined gear. |

| EBITDA – The Margin Muscle | ₹270 cr | Solid, no cracks in this casting. |

| PAT – The Final Polish | ₹70 cr | Profitable and shiny. |

| EBITDA Margin – The Balancer | 15% | Not luxury margins, but rock steady. |

| Net Profit Margin – The Quiet One | 4% | Could use some lubrication. |

Analyst Questions That Spilled the Tea

- Analyst: “How much of growth is organic vs. acquisitions?”

Management: “Acquisitions helped, but organic is strong too.”

Translation: Acquisitions are carrying the weight. - Analyst: “Any risks from German operations?”

Management: “Integration is smooth.”

Translation: Fingers crossed, no engineering hiccups. - Analyst: “How’s EV exposure shaping up?”

Management: “EV parts growing fast.”

Translation: We want that Tesla supplier tag. - Analyst: “Margins stable?”

Management: “Yes, around 15%.”

Translation: Don’t expect fireworks here.

Guidance & Outlook – Crystal Ball Section

Craftsman expects:

- Revenue to keep growing at high double digits, thanks to acquisitions and EV boom.

- Margins to stay in the 14–15% range – no overpromises.

- Germany to contribute more in FY26 as plants stabilize.

- Capex focus on Hosur Greenfield to boost capacity.

The future? Looks forged, cast, and machined to perfection.

Risks & Red Flags

- Raw material prices – aluminium isn’t cheap.

- Integration risk – German operations could surprise (and not in a good way).

- Auto sector slowdown – dependency on OEM cycles is real.

- Debt levels – acquisitions cost money; keep an eye on leverage.

Market Reaction & Investor Sentiment

Investors cheered the growth but stayed cautious on margins. The stock held steady, with bulls betting on EV and export growth, while bears whispered about integration risks. Traders? They just love the revenue spike.

EduInvesting Take – Our No-BS Analysis

Craftsman Automation is firing on all cylinders (literally). The growth story is strong, acquisitions have turbocharged revenue, and EV exposure is the future play.

But margins are stuck in the mid-teens, and debt plus integration risks could drag if not managed well. This is a classic growth with caution stock – worth holding if you like precision engineering with a side of global ambition.

Conclusion – The Final Roast

The call was as smooth as their machined components – numbers strong, management confident, and analysts mildly impressed. Craftsman Automation isn’t just tightening bolts; it’s tightening its grip on global markets.

Q2FY26? Expect more of the same – unless Germany sneezes.

Written by EduInvesting Team

Data sourced from: Company concall transcripts, investor presentations, and filings.

SEO Tags: Craftsman Automation, Craftsman Automation Q1FY26 concall decoded, earnings call analysis, EduInvesting humour finance, Craftsman results insights