1. At a Glance

A company that can’t decide if it wants to build houses or bling them up. Dual business model—real estate projects in Ahmedabad and gold jewelry manufacturing. Stock trades at a nosebleed P/E of 159 because why not?

2. Introduction with Hook

Think of a jeweler who suddenly moonlights as a property tycoon – that’s Laxmi Goldorna. One moment they’re selling gold chains, the next they’re selling commercial blocks. With a stock price rising 173% YoY, the market’s clearly wearing rose-tinted glasses studded with diamonds.

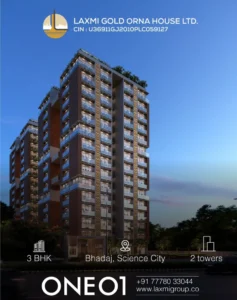

3. Business Model (WTF Do They Even Do?)

- Real Estate – develops commercial & residential properties.

- Jewelry – manufactures, processes, wholesales, and retails gold jewelry.

- Other Ventures – precious stones trading.

Basically, they’re trying to be Titan + Lodha in one corporate body.

4. Financials Overview

- Revenue FY25: ₹88 Cr (down from ₹202 Cr FY24)

- Net Profit FY25: ₹11 Cr

- OPM: 26% (jewelry margins shining)

- ROCE: 16.9%

- ROE: 19%

Sales fell, margins glittered.

5. Valuation

- P/E: 159

- P/B: 25.6x

Fair Value Range: ₹400–₹550 unless they magically double earnings.

6. What’s Cooking – News, Triggers, Drama

- Approved amalgamation with Laxmi Infraspace (real estate play).

- Q1 FY26 profit jumped 115% YoY.

- Inventory days ballooned to 682 (gold hoarding?)

- High working capital lock-up = cash flow headache.

7. Balance Sheet

| Particulars | FY24 | FY25 |

|---|---|---|

| Assets | ₹108Cr | ₹181Cr |

| Liabilities | ₹33Cr | ₹56Cr |

| Borrowings | ₹53Cr | ₹102Cr |

| Net Worth | ₹46Cr | ₹65Cr |

Debt doubled, reserves grew.

8. Cash Flow – Sab Number Game Hai

| Particulars | FY24 | FY25 |

|---|---|---|

| Operating CF | -₹9Cr | -₹45Cr |

| Investing CF | -₹8Cr | ₹3Cr |

| Financing CF | ₹17Cr | ₹41Cr |

Operating cash flow bleeds while financing plugs the gap.

9. Ratios – Sexy or Stressy?

| Ratio | Value |

|---|---|

| ROE | 19% |

| ROCE | 16.9% |

| PAT Margin | 12% |

| D/E | 1.6x |

| P/E | 159 |

Sexy profitability, stressy leverage and valuation.

10. P&L Breakdown – Show Me the Money

| Year | Revenue | EBITDA | PAT |

|---|---|---|---|

| FY24 | ₹202Cr | ₹17Cr | ₹9Cr |

| FY25 | ₹88Cr | ₹22Cr | ₹11Cr |

Revenue tanked, profits edged up.

11. Peer Comparison

| Company | Revenue | PAT | P/E |

|---|---|---|---|

| Titan | ₹60,456Cr | ₹3,336Cr | 92 |

| Kalyan | ₹25,045Cr | ₹714Cr | 86 |

| Laxmi Goldorna | ₹88Cr | ₹11Cr | 159 |

Smallest kid on the block with the biggest valuation tantrum.

12. Miscellaneous – Shareholding, Promoters

- Promoters: 74.97%

- Public: 25%

- No. of shareholders: ~1,660

Tightly held, low float fuels price rallies.

13. EduInvesting Verdict™

Laxmi Goldorna is a mix of gold, real estate, and high drama. Valuation is shinier than its balance sheet. Execution in real estate + jewelry growth will decide if this is a Titan in making or just gold-plated hype.

Written by EduInvesting Team | 27 July 2025

Tags: Laxmi Goldorna, Jewelry, Real Estate, High P/E, EduInvesting Premium