1. 🧬 At a Glance

Acutaas Chemicals (FKA Ami Organics) is a specialty chemicals company focused on pharma intermediates, agrochemicals, and now… semiconductor chemicals. With a ₹9,200 Cr market cap, 41% 5Y PAT CAGR, and zero serious debt, it’s got the ingredients of a compounder. But a P/E of 58x and recent promoter stake cuts mean you better look closer before sipping the Kool-Aid.

2. 🧠 Introduction with Hook

- Pharma + semiconductors in one company? Sounds like a LinkedIn overachiever.

- Acutaas started as a humble pharma intermediates maker and now wants to supply chemicals to chip fabs in South Korea.

- ROCE of ~20%, profits up 3x in 3 years, cash flows finally kicking in.

So… is this the new Neuland Labs x Tata Elxsi combo? Or just high-multiple hype?

3. 🏭 WTF Do They Even Do? – Business Model

Acutaas operates in 3 verticals:

- Pharmaceutical Intermediates (core biz)

- Advanced intermediates for regulated APIs and New Chemical Entities (NCEs)

- Products for oncology, neuro, anti-psychotic APIs

- Agro & Fine Chemicals

- Custom intermediates for global crop protection majors

- Includes key starting materials (KSMs)

- New Bet – Semiconductor Chemicals 🧪

- JV with Korean partner (KRW 30B) to make chip-grade fine chemicals

- Strategic: High-margin, import substitution play, but early stage

Clients include 8 of the top 10 global pharma companies, but now diversifying hard.

4. 📈 Financials – Profit, Margins, ROE, Growth

| Metric | FY21 | FY22 | FY23 | FY24 | FY25E |

|---|---|---|---|---|---|

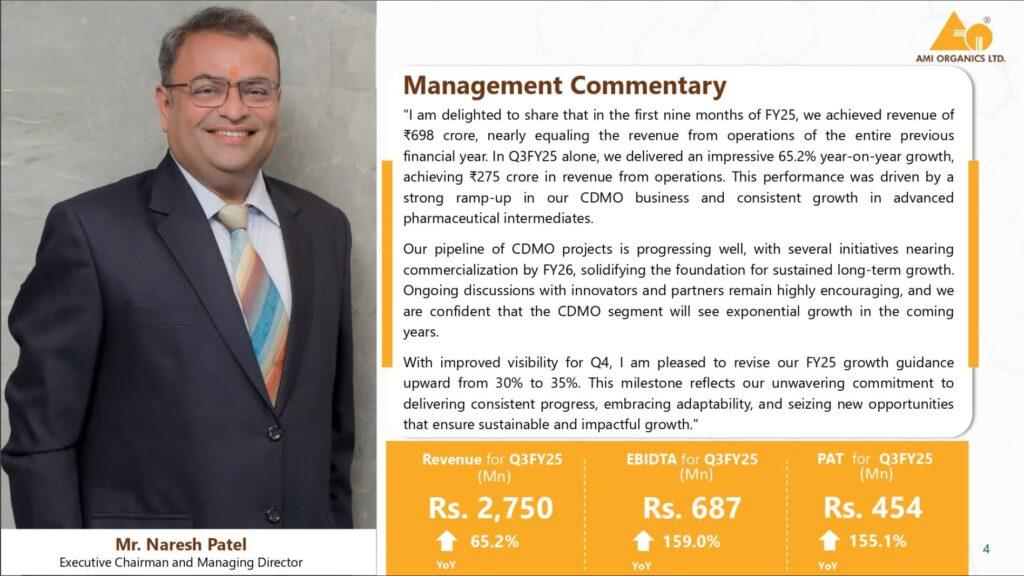

| Revenue (₹ Cr) | 341 | 520 | 617 | 717 | 1,007 |

| Net Profit (₹ Cr) | 54 | 72 | 83 | 49 | 160 |

| OPM (%) | 24% | 20% | 20% | 18% | 23% |

| ROE (%) | 13% | 10% | 13% | 16% | 16% |

| EPS (₹) | 8.57 | 9.87 | 11.43 | 5.80 | 19.38 |

🎯 FY25 TTM looks strong:

→ ₹308 Cr Q4 sales, ₹63 Cr PAT (EPS ₹7.63)

→ OPM surged to 28% in March 2025 Qtr

5. 📊 Valuation – Cheap, Meh, or Crack?

- CMP: ₹1,130

- TTM EPS: ₹19.38 → P/E = 58x

- Book Value: ₹160 → P/B = 7.06x

- Dividend Yield: 0.13%

🧠 This is NOT cheap — but specialty chem never is when it’s on the upcycle.

High valuations are riding on:

- Semiconductor chemicals upside

- Pharma & agrochem order book

- Clean balance sheet + cash flows

6. 🔥 What’s Cooking – News, Triggers, Drama

🧪 Korean JV (June 2025):

- KRW 30B (~₹180 Cr) investment

- Target: chemicals for chipmaking fabs

- Big optionality, but will take 2–3 years to show up in revenues

📉 Promoter stake cut:

- Down from 41% to 35.96% over 2 years

- Offloaded to FIIs/DIIs – not ideal, but no red flags yet

💼 DII holding at 18.3%, FII at 16.5% – institutional buildup strong

🧾 Cash flow reinvestment:

- ₹130 Cr capex underway

- ₹224 Cr investing outflow in FY25

7. 💳 Balance Sheet – How Much Debt, How Many Dreams?

📊 Debt: ₹13 Cr – almost nothing

💰 Reserves: ₹1,269 Cr

🏗️ Assets: ₹1,549 Cr

🏭 Fixed + CWIP: ₹700 Cr+

This is a net cash company, funding growth internally. Low leverage = high flexibility.

8. 💸 Cash Flow – Sab Number Game Hai

| Year | CFO (₹ Cr) | FCF (Est.) |

|---|---|---|

| FY22 | -12 | Negative |

| FY23 | 66 | 40+ |

| FY24 | 125 | 90+ |

| FY25 | 118 | ~80 |

🧾 Investing cash flow is deeply negative due to expansion

💸 Free cash flow turning positive is a BIG shift in FY24–25

9. 📊 Ratios – Sexy or Stressy?

| Ratio | Value |

|---|---|

| ROE | 16.0% |

| ROCE | 19.9% |

| OPM | 23% (TTM) |

| Debt/Equity | ~0.01 |

| Cash Conversion Cycle | 121 days 😬 |

| Working Capital Days | 126 |

⚠️ High working capital cycle — pharma + chem biz often stuck in receivables

✅ ROCE nearing 20% = efficient operations

10. 💵 P&L Breakdown – Show Me the Money

- FY25 TTM Revenue: ₹1,007 Cr

- EBITDA: ₹232 Cr

- Net Profit: ₹160 Cr

- PAT Margin: ~15.9%

- EPS: ₹19.38

Expect margins to stay above 20% if semi-chemicals gain traction in FY26–27

11. 🧪 Peer Comparison – Who Else in the Game?

| Company | P/E | ROE | OPM | M-Cap (Cr) |

|---|---|---|---|---|

| Divi’s Labs | 83x | 15.3% | 31.7% | ₹1.8L Cr |

| Neuland Labs | 48x | 32% | 27% | ₹11K Cr |

| Anupam Rasayan | 43x | 14.1% | 25% | ₹13K Cr |

| Acutaas | 58x | 16% | 23% | ₹9,250 Cr |

🥼 Positioned as a midcap pharma+chem hybrid, but not a pure CDMO or API maker. That’s niche.

12. 🧩 Misc – Shareholding, Promoter Moves, Red Flags?

- Promoters: 35.96%

- FIIs: 16.48%

- DIIs: 18.31%

- Public: ~29.2%

✅ Promoter pledging: Zero

📉 Stake dilution: Yes, but offset by high DII interest

📢 Investor Meets: June 2025 Singapore & HK roadshows

Management is actively pitching the global growth story.

13. 🧑⚖️ EduInvesting Verdict™

“Acutaas is like that quiet chemistry nerd who suddenly got a K-drama offer and now everyone’s paying attention.”

✅ Pharma + Fine Chemicals + Semi optionality

✅ Asset-light, debt-light, cash-flow positive

⚠️ Rich valuation needs flawless execution

⚠️ Promoter dilution isn’t great, but not fatal

🎯 Fair Value Range

Assume FY26E EPS = ₹27–30

Assigning P/E of 40–45 (premium for niche + clean balance sheet)

🧮 Fair Value Range: ₹1,080 – ₹1,350

(Current price ₹1,130 → near mid-point. No margin of safety, but no froth either.)

Tags: Acutaas Chemicals, Ami Organics, Semiconductor Chemicals, Pharma Intermediates, Specialty Chemicals, Korean JV, EduInvesting

✍️ Written by Prashant | 📅 July 8, 2025