1. At a Glance

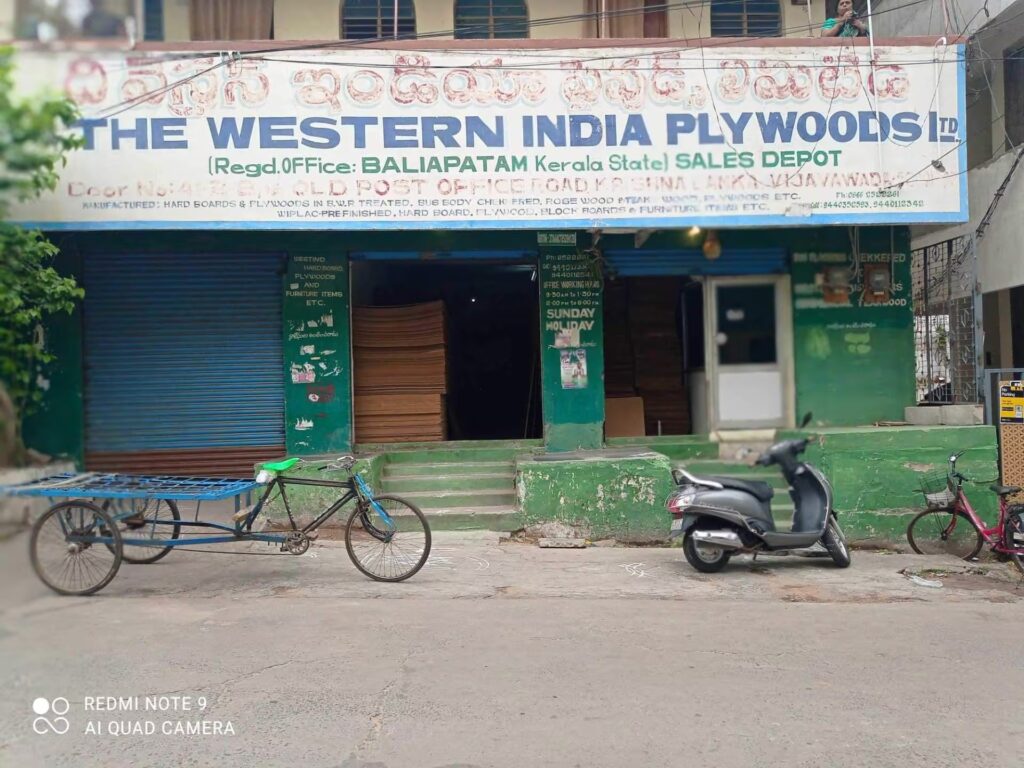

Western India Plywoods Ltd (WIPL) is one of those companies that makes you pause and say, “1945 se listed hai… and still alive?” Respect. Founded before Independence, still cutting wood, still selling boards, and somehow still paying dividends.

Market cap sits around ₹127 Cr, with the stock trading near ₹150, down ~13% in 3 months and ~29% over 1 year. Despite this, the valuation refuses to behave like a sleepy old plywood mill — P/E is ~60, EV/EBITDA ~20.6, and Price to Book ~2.8×. For context, this is a business doing ₹119 Cr annual sales, ₹2.1 Cr PAT, and ROCE of 8.5%. Yes, you read that correctly.

Latest Q3 FY26 (Dec 2025) numbers show ₹31.45 Cr revenue and ₹0.83 Cr PAT, with EPS of ₹0.98. Nothing explosive, nothing disastrous — just steady, boring plywood life. But the stock price behaves like it’s secretly an AI startup hiding behind marine plywood.

This is a classic “heritage company with confused valuation” case. Let’s open the plywood stack layer by layer.

2. Introduction

Western India Plywoods is not trying to be flashy. It doesn’t do investor day PowerPoints with buzzwords like “platform”, “synergy”, or “optionalities”. It cuts wood, presses it, densifies it, and sells it to industries that actually need boring, strong stuff.

The company operates an integrated wood complex, meaning the same raw material — timber logs, firewood, veneer — can be diverted into different end products depending on demand. This flexibility is the core moat. If plywood demand slows, densified wood or hardboard steps up. If furniture demand picks up, they pivot.

Sounds great in theory. In practice, margins remain thin, working capital is heavy, and returns on capital hover in single digits. This is not a scale monster. This is a process discipline business.

The puzzle

is not the business. The puzzle is the valuation.

Why is a ₹2–3 Cr profit company trading like a mid-cap FMCG brand? Is the market pricing in optionality, real estate, patents, or just scarcity value of an 80-year-old listed entity? Let’s find out.

3. Business Model – WTF Do They Even Do?

Imagine a giant factory where wood enters and 12 different avatars exit.

WIPL manufactures:

- Plywood (marine, shuttering, BWR, fire-retardant)

- Hardboard

- Densified wood (Compreg) — high-strength engineered wood used in railways, transformers, buses

- Pre-compressed boards

- Furniture & flooring

- Insulation boards

The real crown jewel is densified wood / Compreg. This is not your carpenter-wala plywood. This stuff goes into railways, power equipment, pharma packaging, automobile interiors, and industrial applications where replacement is painful and certification is long.

The company also has patents related to radiation-induced polymerization, which sounds very fancy until you realize it hasn’t translated into supernormal margins yet.

Raw material sourcing is semi-controlled:

- Firewood & timber locally

- Veneer imported from Malaysian subsidiary

This gives some insulation but also exposes them to import volatility.

In short:

Business = technically sound, operationally complex, financially low-return.

Would you explain this to a lazy investor?

“Yes, they make plywood… but the kind that goes into trains, not wardrobes.”