1. At a Glance – The Colourful Business Nobody Is Excited About (Yet)

If food colours were as exciting as they sound, Vidhi Specialty Food Ingredients Ltd would be trading like a hot startup instead of behaving like a sleepy chemistry professor. Market cap stands at ₹1,598 crore, current price ₹320, and the stock is down ~33% over one year, which means the market has clearly decided that red, yellow, and blue pigments are not sexy enough right now.

Operationally though, Vidhi is doing just fine. Q3 FY26 revenue came in at ₹94.4 crore, PAT at ₹12.4 crore, and operating margins stayed healthy at ~20%, despite global demand volatility. ROCE sits at 18.7%, ROE at 14.9%, debt-to-equity is a comfortable 0.19, and the company keeps paying dividends like a disciplined uncle who believes in fixed deposits.

Exports dominate the story, with ~70%+ revenue from overseas markets, and the company quietly holds a top-3 global position in synthetic food-grade colours. Yet, the stock trades at ~33x P/E, higher than the industry median, while growth has slowed.

So the big question: Is Vidhi a boring compounder temporarily ignored, or a structurally slow chemical business wearing a premium valuation mask? Let’s break it down.

2. Introduction – The Most Global Indian Company You’ve Never Bragged About

Vidhi Specialty Food Ingredients was incorporated in 1994, long before “specialty chemicals” became a buzzword on Twitter and LinkedIn. While everyone was busy hyping pharma APIs, fluorochemicals, and niche intermediates, Vidhi quietly built a global food colour business supplying to Nestlé, Mars, Pedigree, Sanofi, and dozens of distributors across Americas, Europe, Asia, Africa, and the Middle East.

This is not a startup story. This is a process chemistry, compliance-heavy, regulation-loving business where trust matters more than marketing. Food colours are regulated, audited, FDA-checked, and reputation-driven. Once a client approves you, they don’t change vendors casually—unless you mess up quality, compliance, or delivery.

Vidhi’s problem

isn’t operations. It’s perception.

Revenue growth over the last 3 years is negative, five-year growth is ~11% CAGR, and while margins are respectable, they’re not explosive. The market today wants either hyper-growth or deep value. Vidhi sits awkwardly in between—steady, global, boring, and profitable.

But boring businesses have a habit of surprising people once capacity kicks in.

Before we jump to conclusions, let’s first answer the most basic question.

3. Business Model – WTF Do They Even Do?

Vidhi makes food-grade synthetic and natural colours. Not the Instagram filter kind. The kind that goes into:

- Biscuits 🍪

- Soft drinks 🥤

- Chocolates 🍫

- Medicines 💊

- Pet food 🐶

- Cosmetics 💄

- Even inkjet inks (yes, printers again ruining lives)

How the business works:

- Chemical synthesis + blending of approved dyes

- Regulatory compliance with US FDA, EU, and other agencies

- Custom blends based on client needs (this is where stickiness comes from)

- Export-heavy distribution via global partners

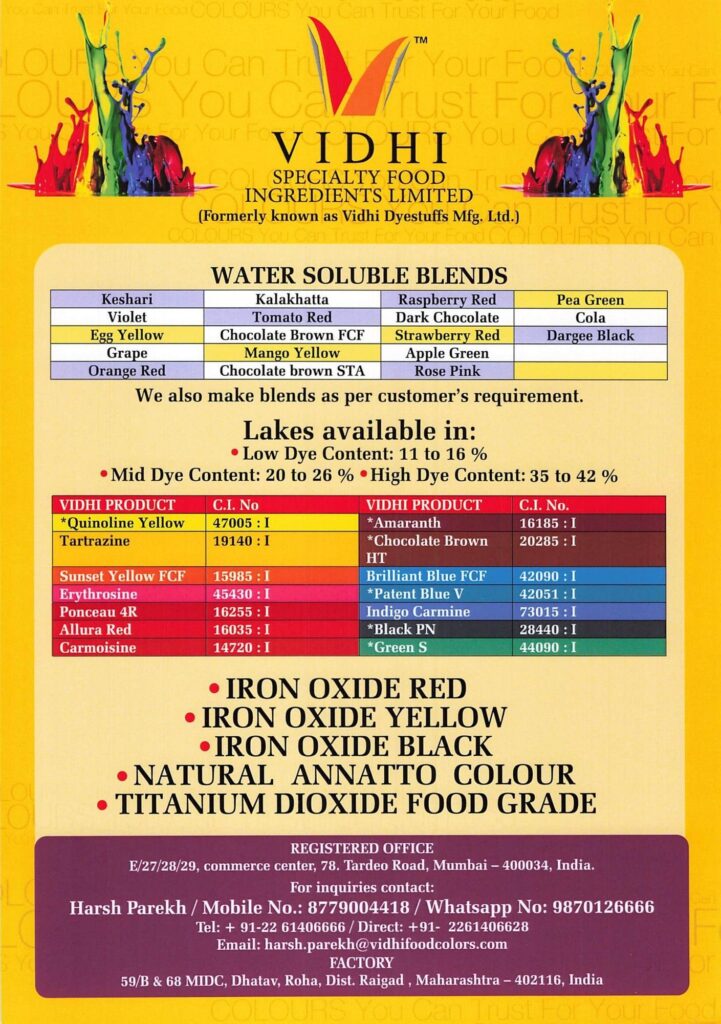

Product buckets:

- Primary water-soluble colours

- FD&C-certified colours & aluminium lakes

- D&C colours for pharma & cosmetics

- Custom blends (high-margin, low-volume, relationship-driven)

This is not a commodity chemical. It’s closer to ingredient branding without the branding. Customers care about consistency, not Instagram ads.

Now ask yourself: How many companies globally can consistently supply FDA-certified food colours across 80+ countries?

Exactly. Not many.