1. At a Glance

Syschem (India) Ltd is that classic “numbers look hot, ratios look confused” pharma smallcap that suddenly woke up from a decade-long coma. At a market cap of ₹216 crore, trading around ₹49.6, the stock has delivered a mixed cocktail: +10% in 1 year, -17% in 3 months, and a sleepy 2% return over 3 years—basically the chart equivalent of jet lag.

Now here’s the plot twist. Q3 FY26 revenue came in at ₹141.5 crore, up 82% YoY, while PAT jumped 734% YoY to ₹4.17 crore. Sounds like a multibagger origin story, right? Except… ROCE is 1.47% and ROE is 0.62%. That’s not low—that’s “why are you even listed” low.

The company is debt-free, promoter holding sits at 56.7%, and EPS (TTM) is ₹1.88, putting the stock at a P/E of ~26x, slightly below industry average. Syschem is clearly selling more, growing faster, and commissioning new capacity—but profitability is still running in chappals while revenue is riding a Bullet.

So the big question: Is this a genuine pharma turnaround or just one great quarter with good PR? Let’s dissect this molecule slowly.

2. Introduction – From ICU to General Ward

Syschem (India) Ltd was incorporated in 1993, and for most of its life, it behaved exactly like a forgotten API manufacturer—low margins, erratic profits, negative reserves, and balance sheets that looked like they survived multiple chemical spills.

Between FY14 and FY21, Syschem’s financials read like a crime novel:

- Negative profits

- Negative reserves

- ROCE dipping to -29% in FY21

- Operating margins flirting with zero

Then something changed.

From FY22 onwards, sales started climbing. From ₹59 crore in FY22 to ₹332 crore in FY25, and now ₹473 crore TTM. That’s not incremental growth—that’s a structural jump. And Q3 FY26 confirms this isn’t a fluke quarter: three consecutive quarters above ₹100 crore revenue.

But before you start lighting diyas, remember—

profitability is still thin, working capital is stretched, and margins are lower than generic paracetamol pricing.

This is not a clean story. This is a messy, improving, high-operating-leverage API story. And those are the most dangerous and interesting ones.

So let’s ask the uncomfortable question early:

👉 If revenues have exploded, why is ROCE still stuck at 1–2%?

3. Business Model – WTF Do They Even Do?

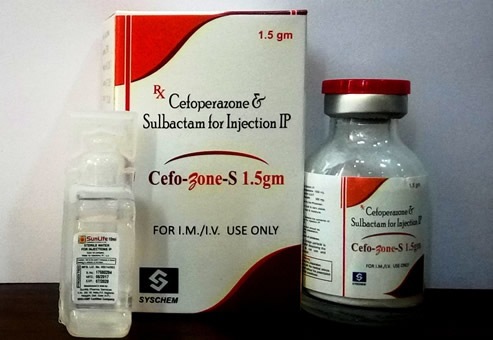

Syschem manufactures beta-lactam antibiotics APIs—the most commoditised, price-sensitive, China-dominated part of the pharma universe.

Core Products:

- Amoxycillin Trihydrate

- Ampicillin Trihydrate

- Cloxacillin / Dicloxacillin / Flucloxacillin

- Cephalexin, Cefixime, Cefadroxil

- Plus solvent distillation (DMF, Acetonitrile, Ethyl Acetate, THF)

In simple terms:

Syschem sells “volume antibiotics” where pricing power is weak, compliance is expensive, and margins depend on scale + utilisation.

In FY21, 74% of revenue came from Amoxycillin & preparations, while 26% came from solvents & others. This hasn’t materially changed—the company is still heavily dependent on one antibiotic family.

The good news?

- India is aggressively pushing China+1 sourcing for APIs

- Government incentives + import substitution

- Syschem has expanded capacity aggressively

The bad news?

- These are low-margin molecules

- One pricing cycle can wipe out profitability

- No specialty or patented APIs here

Think of Syschem as a factory with machines finally running at high speed, but still selling