1. At a Glance

₹397 stock price. ₹1,033 Cr market cap. ROCE screaming at 53%, ROE flexing 40%, and Q3 FY26 revenue casually exploding +401% YoY like someone discovered a hidden turbo button in the EPC engine. Sathlokhar Synergys E&C Global Ltd has gone from “regional EPC player” to “why is this SME showing up in large-cap-style spreadsheets?” in less than a year post listing.

But pause the victory music. Returns over the last 3 months are -27%, debtor days have ballooned to 123, and working capital days crossed 100 like it’s training for a marathon. The company is executing faster than Zomato delivery, but cash is arriving like Indian Railways — eventually.

Latest quarter numbers are loud, order book is obese, balance sheet is still light on debt, and promoters are mostly holding the fort. The question is simple: is this a disciplined EPC scaling story… or an aggressive growth sprint where cash flow is still tying its shoelaces?

Curious already? Good. Let’s open the site office container.

2. Introduction

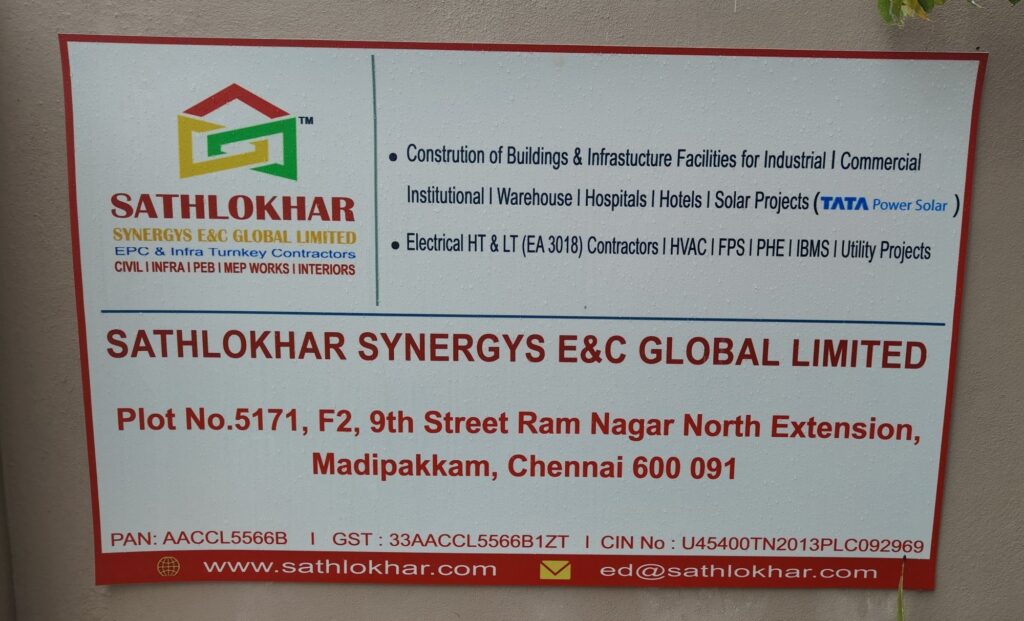

Founded in 2013, Sathlokhar Synergys operates in the Engineering, Procurement & Construction (EPC) space — the kind of business where execution speed matters more than PowerPoint skills. The company handles industrial, warehousing, pharma, commercial, institutional buildings, and has politely added solar EPC to the menu because renewables are the new mandatory garnish.

What changed recently?

Two words: Scale + Listing.

Post IPO (August 2024), revenue growth has gone ballistic. FY25 revenue hit ₹399 Cr, and just 9M FY26 revenue is already ₹250 Cr, with Q3 alone doing ₹189 Cr. That’s not growth — that’s a plot twist.

But EPC businesses don’t just grow on Excel sheets. They grow by:

- Taking large orders

- Executing faster than peers

- And surviving the working-capital hunger games

Sathlokhar is clearly doing the first two. The third one? We’ll audit that shortly.

3. Business Model – WTF

Do They Even Do?

Think of Sathlokhar as a one-stop construction juggernaut.

They don’t just build. They:

- Design

- Engineer

- Procure

- Execute

- Install MEP systems

- Hand over keys

Basically, from blueprint to “sir inauguration kab hai?”

Their sweet spot:

- Industrial buildings

- Warehouses

- Pharma facilities

- Hospitals, hotels, villas

- Solar EPC (via Tata Power Solar dealership)

98.6% of revenue comes from private clients, which is both good and risky. Good because margins are better. Risky because one angry client can delay ₹50 Cr payments and suddenly your CFO needs meditation.

Client concentration is high:

- Top 10 clients = 90% of FY24 revenue

Execution footprint:

- Tamil Nadu

- Karnataka

- Uttar Pradesh

- West Bengal

This is not a pan-India monster yet. It’s a southern + selective expansion story.

4. Financials Overview

📊 Quarterly Performance (Q3 FY26)

| Metric | Latest Qtr (Dec FY26) | YoY Qtr (Dec FY25) | Prev Qtr (Sep FY26) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue (₹ Cr) | 189 | 38 | 195 | +403% | -3% |

| EBITDA (₹ Cr) | 28 | 6 | 30 | +366% | -7% |

| PAT (₹ Cr) | 19.7 | 4 | 22 | +340% | -10% |

| EPS (₹) | 7.59 | 1.86 | 9.11 | +308% | -17% |

Annualised EPS (Q3 rule):

Average of Q1, Q2, Q3 EPS × 4 ≈ ₹30–31 range

Witty takeaway:

Revenue went vertical. Margins stayed steady at ~15% OPM. Profit scaled nicely. But QoQ softness hints that execution is lumpy — classic EPC behaviour.

Does this worry you, or is this just project timing noise?