1. At a Glance

Sangam Finserv Ltd is that small NBFC which quietly sits in the corner of the market, occasionally coughing up profits, occasionally scaring shareholders, and always reminding you that size matters in lending. With a market cap of ₹176 crore, a current price of ₹37.6, and a P/E of ~30.6, this is not a cheap stock pretending to be boring — it is an expensive stock pretending to be disciplined.

Latest quarter (Q3 FY26, Dec 2025) revenue came in at ₹4.41 crore, down 36.5% YoY, while PAT slipped to ₹1.29 crore, a sharp 64% YoY drop. Yet the operating margin continues to hover at an eyebrow-raising ~60%, because when you lend money, the product margin looks fabulous… until credit cycles remind you who’s boss.

Debt is modest at ₹29.8 crore, promoter holding is a steady 63.1%, and the balance sheet is liquid enough to survive a minor financial apocalypse. But with ROE stuck around 5%, the company is basically telling investors: “I will not blow up, but I will also not excite you.” Intrigued? Confused? Slightly annoyed? Perfect. Let’s dig in.

2. Introduction

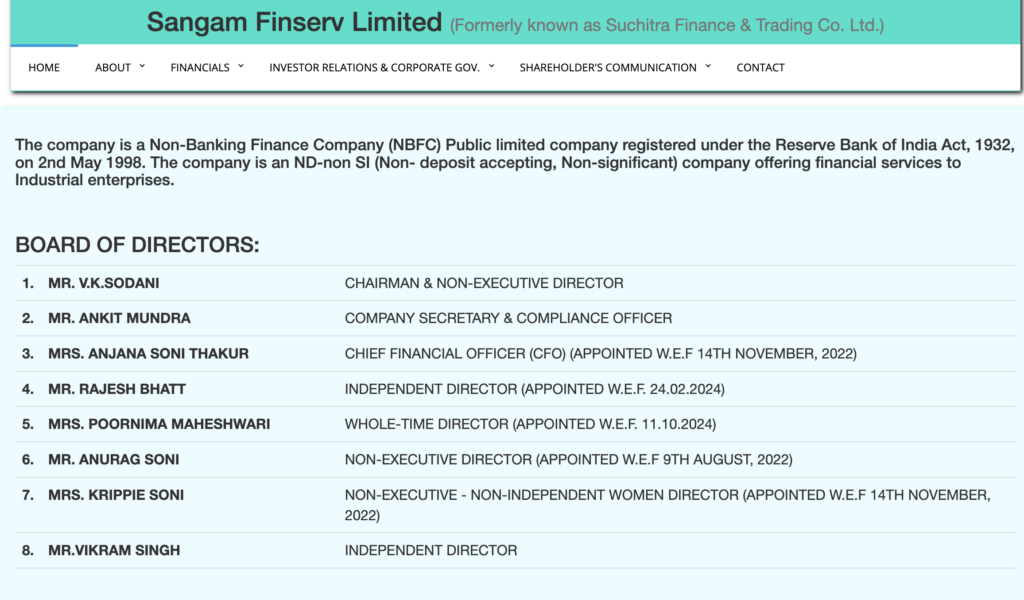

Sangam Finserv (formerly Suchitra Finance & Trading) is a non-deposit-taking NBFC incorporated in 1981 — which means it has survived multiple economic cycles, liberalisation, scams, reforms, and SEBI mood swings. Longevity is impressive, but longevity alone doesn’t make returns.

The company lends to pretty much everyone who can sign a document — individuals, SMEs, corporates, mortgage borrowers, and project finance clients. The strategy is broad, flexible, and slightly old-school. Think of it as a local money manager wearing a corporate tie.

Revenue is entirely interest income, no fancy fee businesses, no fintech razzle-dazzle. This keeps accounting clean but also caps upside. The last few years show flat to negative growth, volatile quarterly profits, and a return profile

that looks more like a fixed deposit with mood swings than a compounding machine.

So the big question: is Sangam Finserv a hidden gem… or just a well-dressed balance sheet doing cardio instead of lifting weights?

3. Business Model – WTF Do They Even Do?

At its core, Sangam Finserv borrows modestly and lends carefully. No deposits, no CASA, no app downloads. Just classic NBFC stuff.

Loan Products

- Personal Loans – Salaried and self-employed borrowers, minimal paperwork, maximum trust.

- Business Loans – Term loans (with or without collateral) up to ₹20 crore, tenure up to 15 years.

- Mortgage Loans – Loan-to-value up to 85%, tenure stretching to 25 years.

- Project Finance – Long-term funding for infrastructure and industrial projects, based on projected cash flows (read: Excel optimism).

- Takeover Loans – Porting loans from other lenders at lower interest rates.

This diversified book reduces concentration risk, but it also means no sharp niche advantage. There’s no gold loan moat, no vehicle finance ecosystem, no consumer brand recall. It’s a generalist lender in a specialist world.

Does it work? Yes. Does it scale aggressively? Not really.

4. Financials Overview

Quarterly Comparison (₹ crore)

| Metric | Latest Qtr (Dec-25) | YoY Qtr (Dec-24) | Prev Qtr (Sep-25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 4.41 | 6.94 | 4.76 | -36.5% | -7.4% |

| Financing Profit | 2.01 | 4.75 | 2.01 | -57.7% | 0.0% |

| PAT | 1.29 | 3.62 | 1.89 | -64.4% | -31.7% |

| EPS (₹) | 0.28 | 0.78 | 0.41 | -64.1% | -31.7% |