1. At a Glance

₹519 crore market cap. ₹43 stock price. One quarter where profits suddenly woke up like they drank five cups of cutting chai. Q3 FY26 PAT up 241% YoY, sales up 26% YoY, and EPS quietly climbed to ₹0.37 for the quarter. Sounds exciting, right?

Now zoom out. ROCE is still 6.17%, ROE a sleepy 3.54%, and inventory days are doing yoga at 387 days. So yes, the quarter slapped — but the balance sheet still needs cardio.

Orient Ceratech sits in that classic Indian mid-cap industrial zone: boring products, essential demand, cyclical customers, and a share price that refuses to behave. Steel plants can’t live without refractories, but shareholders also can’t live on one good quarter.

Three-month return: +17.3%. One-year return: -8.3%.

This stock doesn’t run marathons. It does short sprints and then disappears.

So the real question: Is this a genuine turnaround or just a quarterly sugar rush?

2. Introduction

Orient Ceratech is what happens when a 50-year-old industrial company tries to modernise without changing its soul. Founded in 1974, rebranded in 2023, still very much dependent on steel, bauxite, and heavy industry cycles.

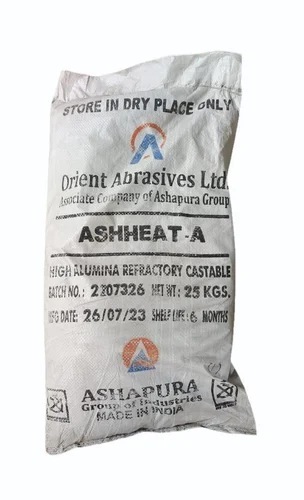

Earlier known as Orient Abrasives, the name change to Ceratech was not just cosmetic. It was management telling the market, “Boss, we’re more than grinding stones now.” The product mix expanded, value-added refractories came in, ceramic proppants joined the party, and power generation stayed in the background like a quiet uncle at weddings.

But here’s the catch. This is not a high-ROE compounder. This is a volume-driven, working-capital-heavy, asset-intensive business that lives and dies with steel demand and raw material prices.

And yet, it refuses to die.

Sales keep inching up. PAT just exploded this quarter. Promoters hold 63.9% with zero pledge. FIIs are chilling at ~13%.

So why does the market still treat it like a third-row

benchwarmer?

Because Orient Ceratech has always promised more than it delivered. And now, investors want proof — not PowerPoint optimism.

3. Business Model – WTF Do They Even Do?

Let’s simplify this like explaining to your cousin who thinks steel is just iron with attitude.

Orient Ceratech does three things:

First: It digs bauxite out of the ground.

Second: It cooks that bauxite into high-alumina refractory products.

Third: It supplies those products to steel plants that melt iron at temperatures hotter than Indian Twitter debates.

Core Segment: Alumina Refractories & Monolithics

This is 98% of FY23 revenue. Everything else is background noise.

Products include:

- Calcined bauxite

- Fused alumina (brown, white, pink — no Holi jokes here)

- Low-cement castables

- High-alumina refractory cement

- Specialty mortars

These materials line furnaces, ladles, and kilns inside steel plants. Without them, steel plants shut down faster than a laptop with 1% battery.

Ceramic Proppants – The “Fancy” Part

This is where management gets excited. Ceramic proppants are used in oil & gas fracking, especially in shale extraction. High margin, niche, export-oriented, and sexy sounding.

Reality check:

- Still a small contributor

- Cyclical

- Dependent on global oil prices

Good optionality. Not a saviour.

Power Generation – The Side Hustle

Captive power plants:

- 18 MW thermal (coal +