1. At a Glance

Jaipur’s sparkle factory — Motisons Jewellers Ltd (MJL) — is where gold meets drama and diamond margins fight inflation. As of November 2025, the company shines with a market cap of ₹1,666 crore, a current price of ₹17 per share, and a P/E of 29.8. Not bad for a jeweller that once sold its dreams at ₹55 in the IPO.

The company clocked quarterly revenue of ₹90.5 crore and PAT of ₹21.4 crore, showing a 106% YoY jump in profit, even though sales dipped 17% QoQ. Talk about doing more with less — or as Indian moms say, “beta, paise bacha ke gold le lo.”

With ROE of 11.6%, ROCE of 14.5%, and a debt-to-equity ratio of just 0.12, Motisons doesn’t just glitter — it manages to stay solvent, a rare feat in the gold bazaar. But no dividends yet — apparently, they prefer the shine on the shelves, not in your demat.

So, is Motisons the Titan of tomorrow or just another smallcap sparkle waiting to fade? Let’s dig in, one karat at a time.

2. Introduction

Welcome to Jaipur, the city of pink walls and gold halls — and home to Motisons Jewellers, a brand that turned its Tonk Road showroom into an architectural flex. Since its humble start in 1997, the company has built a kingdom of kundan, polki, and Instagram reels that could blind you with bling before the sunlight does.

With four stores across Jaipur and an online presence since 2018, Motisons plays on both ends — grandma’s necklace nostalgia and Gen Z’s gold-for-content strategy. They claim to have over 3,00,000 designs — that’s more SKUs than Netflix titles in India.

The brand’s IPO in Dec 2023 was one of the more glittering SME success stories — issue price ₹55, now trading at ₹17 (ouch). Post-listing, they’ve issued warrants worth ₹170 crore and even had a 10-for-1 share split, proving that the only thing multiplying faster than their designs is their equity.

Still, behind the shine is a serious business story — Rs. 462 crore in FY25 revenue and Rs. 56 crore profit, making it one of the few jewellers that’s not only surviving but scaling. Whether it’s luck, legacy, or leverage, we’re about to find out.

3. Business Model – WTF Do They Even Do?

Motisons Jewellers sells everything shiny enough to make a bride forget her budget — gold (80%), silver (8%), diamond (11%), and the rest 1% for God knows what. Their product line includes gold, diamond, kundan, temple, and Italian jewellery, plus silver utensils, coins, and artifacts — because why not sell a silver spoon to the baby born with one?

Most of their jewellery is sourced from third-party artisans across India, while diamond and gemstone pieces are made in-house

at Jaipur. This hybrid model keeps them light on capex but heavy on designs.

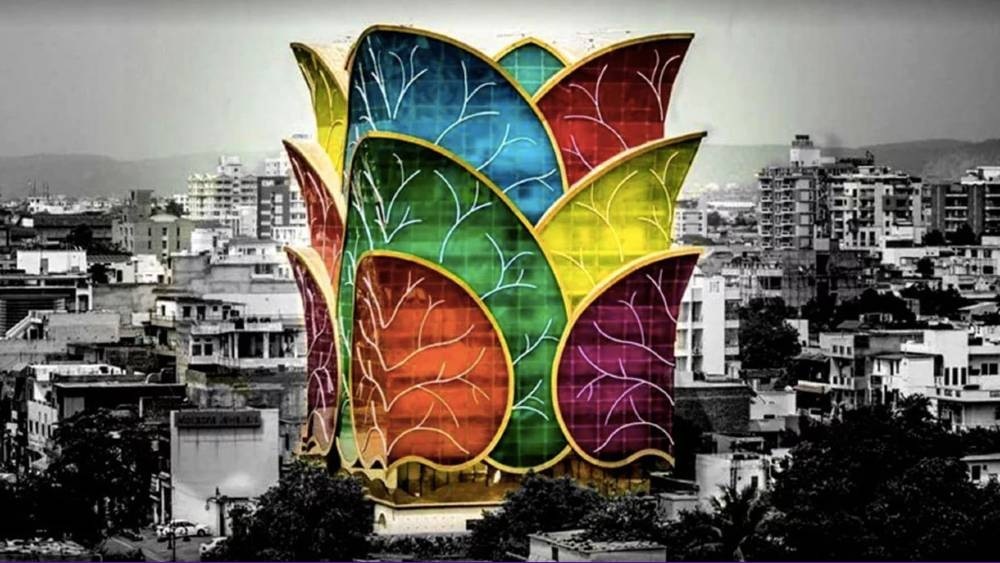

The brand’s flagship showroom, Motisons Tower, is a Jaipur landmark — 16,000 sq ft of pure retail drama spread over three floors. You could get lost between bangles and balance sheets.

And here’s the modern twist — they sell online through motisonsjewellers.com, complete with virtual appointments. In a world where marriages happen on Zoom, at least you can pick your ring online.

If Titan is the Tanishq of the elite, Motisons is the “Tanishq of tier-2 India” — bold designs, smaller bills, and just enough glamour to make you feel rich during EMI payments.

4. Financials Overview

Quarterly Performance (₹ in crores)

| Metric | Latest Qtr (Sep’25) | YoY Qtr (Sep’24) | Prev Qtr (Jun’25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | 90.5 | 109 | 87 | -17.0% | 4.0% |

| EBITDA | 31 | 17 | 13 | 82.4% | 138.0% |

| PAT | 21.4 | 10 | 8 | 114.0% | 168.0% |

| EPS (₹) | 0.22 | 0.11 | 0.08 | 100.0% | 175.0% |

Commentary:

If this quarter were a necklace, it’d be a minimal one — less metal, more margin. Revenue dipped, but EBITDA margin exploded from 15% to 34%, thanks to better product mix and probably fewer discounts. The company’s ability to double profit while cutting sales is either brilliant or black magic.

5. Valuation Discussion – Fair Value Range Only

Let’s polish the numbers before they blind us.

P/E Method:

- Current EPS (TTM): ₹0.57

- Industry P/E: ~29x

- Fair value range = ₹0.57 × (25–35) = ₹14.25 to ₹19.95

EV/EBITDA Method:

- EV = ₹1,705 crore

- EBITDA (TTM): ₹84 crore

- EV/EBITDA = 20.3x

If the sector average is 18–22x, the fair range = ₹1,705 × (18/20.3) to ₹1,705 × (22/20.3)

→ Roughly ₹1,511 crore – ₹1,849 crore

→ Per share: ₹15–₹18

DCF (Simplified, assuming 12% growth, 11% discount):

Fair equity value = ₹1,500–₹1,900 crore range

Educational Range: ₹15–₹19 per share

Disclaimer: This fair value range is for educational purposes only and is not investment advice.

6. What’s Cooking – News, Triggers, Drama

Motisons has been busier than a bride during wedding week:

- Fund Raise of ₹170 crore