1. At a Glance

Move over Bangalore coders—Hyderabad just dropped a silicon bomb. MosChip Technologies, the ₹5,075 crore cap semiconductor hopeful, just reported Q2FY26 numbers that read like the trailer of India’s chip revolution: revenue ₹146.9 crore (+17% YoY), PAT ₹12.2 crore (+25%), and an operating margin holding near 11%. The stock sits pretty at ₹264, up 57% in three months, yet priced like a luxury watch—P/E at a dizzying 119 and P/BV at 13.8.

If semiconductor dreams were cricket matches, MosChip just survived the powerplay with no wickets down. Debt is mild at ₹48 crore (D/E = 0.13), ROE is 11.2%, and promoter holding at 44.3% is slightly thinned but stable. The firm’s pivot from design services to full-blown turnkey ASICs and RISC-V platforms is both brave and risky. But hey, this is the same country that made Chandrayaan land on the moon—dreams are meant to be over-engineered.

2. Introduction

Semiconductors are the new gold rush, and MosChip is the guy showing up with both a shovelanda YouTube channel explaining how to use it.

This Hyderabad-based design house isn’t just drawing circuits anymore—it’s drawing attention. From its modest start as a fabless chip design firm to bagging a ₹509 crore contract for a 5nm HPC SoC (yes, that’s “High-Performance Computing System-on-Chip” for the jargon crowd), MosChip has gone from obscurity to semiconductor startup poster child.

The numbers are spicy. Over the last five years, sales have compounded at 36% annually, profits at 26%, and stock price at a ridiculous 88%. The company even acquired US-based Softnautics for ₹142 crore, half cash, half stock—because why not buy your way into Silicon Valley when you’re on a roll?

And yet, behind the memes of “India’s Nvidia in making,” lies a small-cap balancing on a wafer-thin edge: high valuations, erratic cash flows, and a big promise of “Design-Linked Incentives” that might age like a government file.

But let’s not ruin the fun. The story deserves a good look—one circuit at a time.

3. Business Model – WTF Do They Even Do?

Imagine a hybrid between Infosys, Tata Elxsi, and a NASA intern. That’s MosChip.

Their core gig:designing and delivering Application-Specific Integrated Circuits (ASICs)—custom chips made for specific devices like defense systems, smart meters, wearables, or automotive controls.

They run three verticals:

- Semiconductor Design (≈80% of revenue)– They design chips for clients who either don’t have their own R&D muscle or want to outsource it cheaply to India.

- Embedded & IoT Systems (≈20%)– They make the hardware+software ecosystems that connect these chips to actual devices.

- Turnkey ASIC Solutions– The holy grail: not just designing, but owning the whole value chain from architecture to tape-out. That’s where the real margin—and the real risk—lives.

The company boasts partnerships with AMD, Microchip, Siemens, and Tenstorrent (Canada’s RISC-V star). So while Nvidia sells GPUs, MosChip sells the brains that design the GPUs.

Still, let’s keep it real. This is not TSMC. It’s a design house with big brains, not big fabs. They’re the architects, not the bricklayers of the semiconductor mansion.

4. Financials Overview

| Metric | Latest Qtr (Sep’25) | YoY Qtr (Sep’24) | Prev Qtr (Jun’25) | YoY % | QoQ % |

|---|---|---|---|---|---|

| Revenue | ₹146.9 Cr | ₹125.7 Cr | ₹136.0 Cr | +17.0% | +8.0% |

| EBITDA | ₹17.0 Cr | ₹14.9 Cr | ₹17.0 Cr | +14.1% | 0.0% |

| PAT | ₹12.15 Cr | ₹9.73 Cr | ₹11.0 Cr | +24.9% | +10.4% |

| EPS (₹) | 0.63 | 0.51 | 0.57 | +23.5% | +10.5% |

Annualised EPS = ₹0.63 × 4 = ₹2.52At CMP ₹264 →P/E = 104x(P/E not for the faint-hearted).

Commentary:If this valuation were a Bollywood hero, it would be Ranveer Singh—loud, energetic, but slightly over-priced for the role.

5. Valuation Discussion – Fair Value Range

Let’s crunch the three-way math:

A. P/E Method:Industry P/E = 26xAnnualised EPS = ₹2.52→ Fair Value =

₹2.52 × (25–35) =₹63 – ₹88

B. EV/EBITDA Method:EV/EBITDA (industry median) ≈ 25xEBITDA (TTM) = ₹65 Cr→ EV = 25 × 65 = ₹1,625 Cr → EV/EBITDA-based fair value ≈₹80 – ₹100

C. Simplified DCF:Assume:

- Cash flow CAGR 25% for 5 yrs

- WACC = 12%

- Terminal growth = 4%→ Implied range ≈₹90 – ₹120

🟣Fair Value Range (Educational only):₹65 – ₹120 per share

📜Disclaimer:This range is for educational purposes only. Not investment advice.

6. What’s Cooking – News, Triggers, Drama

Oh, plenty. MosChip has been dropping announcements like Diwali crackers:

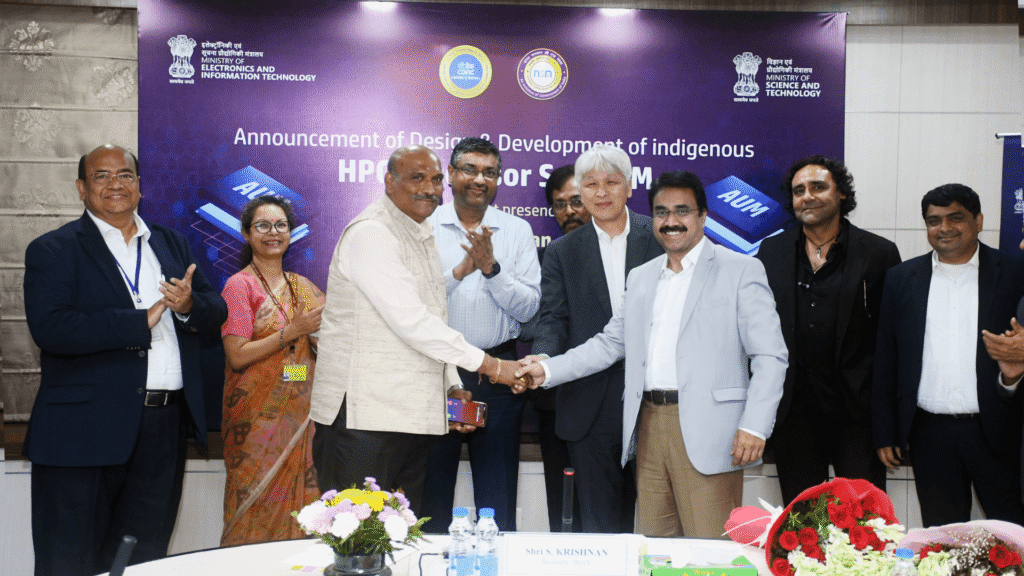

- ₹509 crore 5nm HPC SoC Contract:Signed in June 2024—a major validation for India’s semiconductor R&D. Think of it as their “moon mission” moment.

- Design-Linked Incentive (DLI) Approval:Got a MeitY nod for developing a Smart Energy Meter IC—basically, India’s own chip for power grids.

- Partnership with Tenstorrent (Mar’24):A high-end RISC-V collaboration that could put MosChip on global radar if executed well.

- Softnautics Amalgamation:Ongoing merger of their U.S. subsidiary to simplify structure and increase IP control.

- Expansion:1 lakh+ sq. ft. of new leased office space across India and the U.S.—because engineers need bean bags too.

- New Leadership:CEO Srinivasa Rao Kakumanu, a semiconductor veteran, joined in 2023. The man’s LinkedIn reads like a TSMC wish list.

If these projects convert on schedule, MosChip might actually justify half its valuation. If not, it risks becoming another PowerPoint tiger.

7. Balance Sheet Snapshot (₹ Cr)

| Metric | Mar’23 | Mar’24 | Mar’25 | Sep’25 |

|---|---|---|---|---|

| Total Assets | 215 | 382 | 444 | 538 |

| Net Worth (Equity + Reserves) | 113 | 270 | 328 | 367 |

| Borrowings | 72 | 69 | 21 | 48 |

| Other Liabilities | 30 | 44 | 94 | 122 |

| Total Liabilities | 215 | 382 | 444 | 538 |

Validation:367 + 48 + 122 = 537 ≈ 538 ✅

Quick Roast:

- They’re expanding like a tech startup on a caffeine IV.

- Debt fell, but other liabilities ballooned 3x—vendors clearly not paid in smiles.

- Net worth rising fast,