🟢 At a Glance:

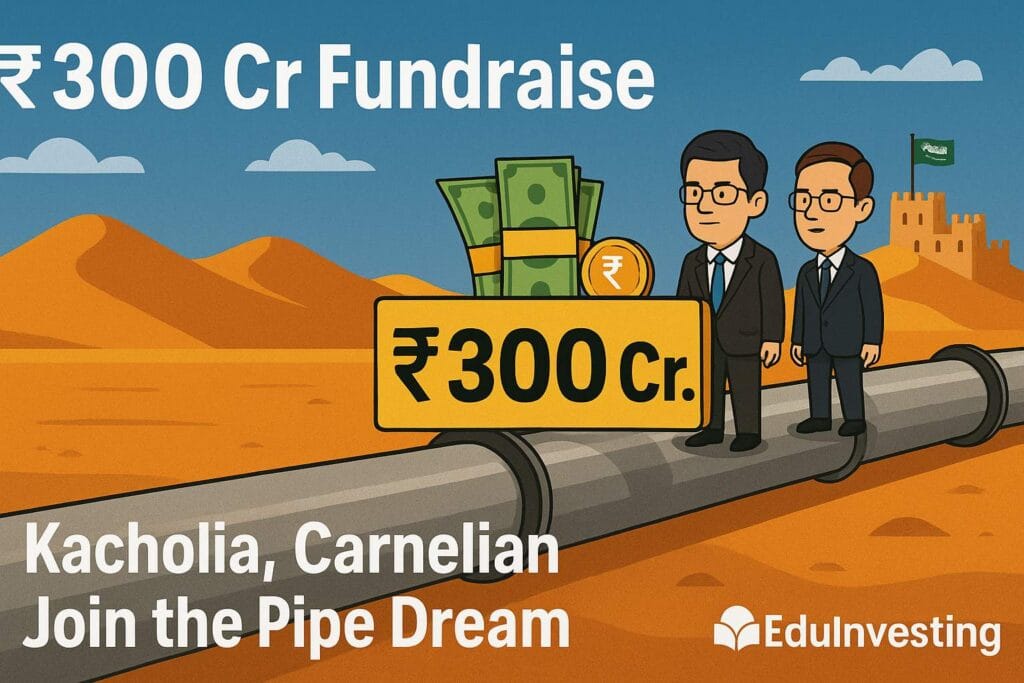

MAN Industries (India) Ltd has just announced a major fundraise of ₹300 crore via preferential allotment. The move includes convertible warrants to promoters and fresh equity to marquee non-promoter investors like Ashish Kacholia, Carnelian Structural Shift Fund, Capri Global, and others. The money? To power expansion in Jammu and Saudi Arabia, and also flex some balance sheet muscle. 🚀

💼 What’s the Deal?

The board of directors met on May 31, 2025, and approved:

- ✅ ₹300 Cr fundraise through preferential allotment

- ✅ Convertible warrants worth ₹39.99 Cr to Man Finance Pvt Ltd (Promoter group)

- ✅ Equity shares worth ₹259.99 Cr to a who’s who of Indian investing circles

👥 Who’s Getting What?

| 🏦 Investor Name | 🧾 Category | 📊 Shares Allotted | 💸 Investment (₹ Cr) |

|---|---|---|---|

| B Arunkumar Capital & Credit | Non-Promoter | 9.45 lakh | ₹31.00 |

| Ashish Kacholia | Non-Promoter | 9.14 lakh | ₹30.00 |

| RBA & Finance Inv. Co. | Non-Promoter | 9.14 lakh | ₹30.00 |

| Carnelian Shift Fund | CAT III AIF | 7.62 lakh | ₹25.00 |

| Capri Global Holdings | Non-Promoter | 4.57 lakh | ₹15.00 |

| Others (20+ entities incl. family trusts, LLPs, FIIs) | Mixed | 39.3 lakh | ₹128.99 |

| Total | — | 79.26 lakh | ₹259.99 Cr |

💥 Warrants to Promoter Group:

- 12.19 lakh warrants to Man Finance Pvt Ltd at ₹328 each

- Convertible within 18 months

🧾 Price per share/warrant: ₹328

- Face value: ₹5

- Premium: ₹323

🏗️ Where’s the Money Going?

MAN Industries has dropped clear hints:

- 🏭 Jammu and Saudi Arabia capex — setting up a new ₹600 Cr plant in Dammam, Saudi

- 💰 Working capital & balance sheet boost

- 📈

To Read Full 16 Point ArticleBecome a member

To Read Full 16 Point ArticleBecome a member