🟢 At a Glance:

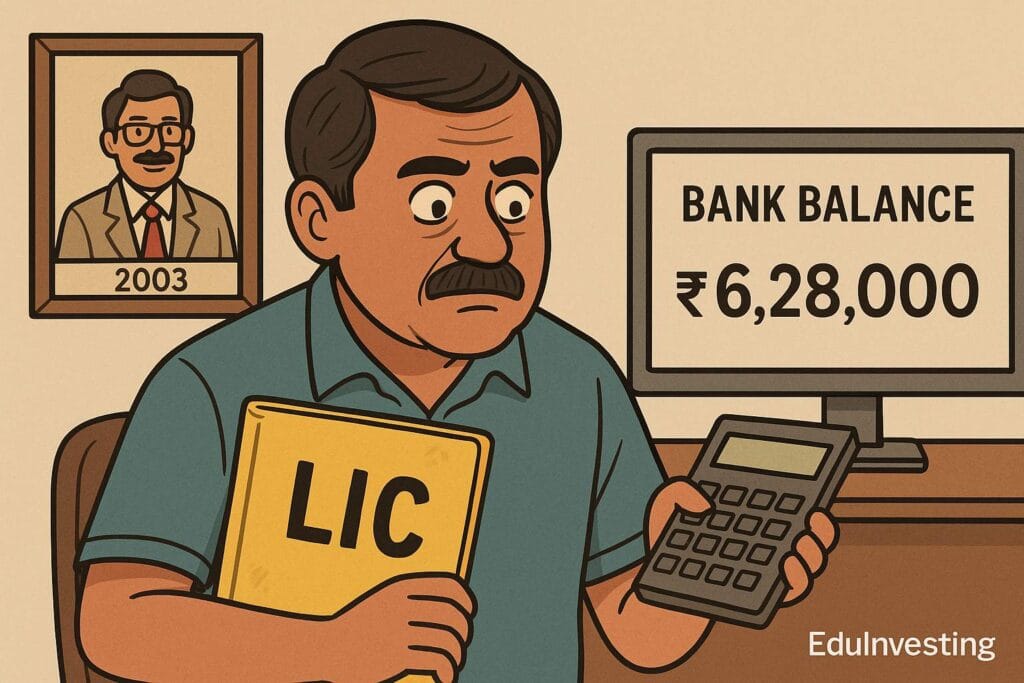

Millions of LIC endowment policies bought in the early 2000s are maturing in 2025. And every Indian dad who once said “Stock market is gambling” is now refreshing his SMS inbox for that one magic payout. But is it really the jackpot they were promised?

📜 The Great LIC Dream: A Flashback

Remember when the LIC agent came home in the early 2000s?

- He had a calculator, a smile, and a plan that made your dad believe he’d be a crorepati by 2025.

- The plan? Pay Rs. 5,000 quarterly for 20 years, and get Rs. 10 lakh on maturity.

- The reality? Your dad paid Rs. 4 lakh in premiums and might receive just Rs. 6.2 lakh after 20 years.

Because:

It wasn’t an investment. It was a “savings with life cover” — the most boring product ever made to look

exciting.

💸 Maturity Time = Harsh Reality Check

Here’s what most policies are maturing into:

| Policy Type | Typical Term | Premium Paid | Maturity Amount (Est.) | Returns (IRR) |

|---|---|---|---|---|

| Endowment | 20 yrs | Rs. 4,00,000 | Rs. 6.2–6.8 lakh | 4%–5.5% |

| Money-back | 20 yrs | Rs. 5,00,000 | Rs. 6.5 lakh (incl. bonus) | 3.8%–5.2% |

Now compare with:

- Nifty 50 CAGR (2005–2025): ~11.5%

- PPF: ~7.1% compounded

- Even a boring FD: ~6.5% average

So why does your dad still swear by LIC?

Because “guaranteed” feels better than “volatile” — even if it’s 40% less money.

🧠 Why So Many Policies Are MaturingNow

Let’s connect the dots:

- 2003–2005: LIC’s peak selling phase post-Unit Linked Plan (ULIP) crackdown.

- Over 3 crore policies were sold annually.

- Most were20-year endowment plans, set to mature in 2023–2026.

- That’slakhs of Indians

To Read Full 16 Point ArticleBecome a member

To Read Full 16 Point ArticleBecome a member